Currently, the interest rate for savings deposits is being evaluated at a very low level. Specifically, in the Big4 commercial bank group, Vietcombank has the lowest deposit interest rate with only 1.7% per year for deposits with a term of 1-2 months, 2% per year for deposits with a term of 3 months, 3% per year for deposits with a term of 6-9 months, and 4.7% per year for deposits with a term of 12-60 months. The interest rate of 1.7% is considered the lowest in history and is not attractive to some investors.

In addition, the price of gold is currently at a historic high. Specifically, in the session on March 4, at the SJC Hanoi, Danang, and Ho Chi Minh City systems, the buying and selling price of SJC gold was 78.2 – 80.22 million dong/tael, although it has decreased by about 900,000 dong/tael compared to the peak on February 3, but it is still a high level.

Therefore, some investors are turning to other investment channels that offer better profitability, including real estate.

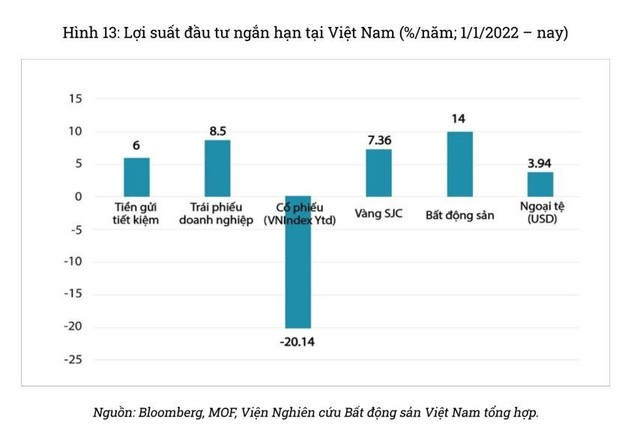

According to a recent report by the Vietnam Real Estate Research Institute, real estate is the investment channel with the highest short-term profitability in the past two years, up to 14% per year.

Ranked second is the corporate bond investment channel (8.5% per year). Next is SJC gold (7.36% per year). Saving deposits are in fourth place with a yield of 6% per year. As for stocks, this is the investment channel that is ranked the lowest as participants can suffer losses of up to 20.14% per year.

The Vietnam Real Estate Research Institute believes that the reason why real estate investment is sought after is due to developers continually offering “huge” discounts. This has made many projects approach their true value.

According to this unit, the market is receiving more positive information. The most prominent one is the “cooling” of lending interest rates, with the current number fluctuating around 8 – 10% per year.

In the context of gradually decreasing interest rates, this unit predicts that the investor sentiment will improve. Therefore, the market may recover from Q2/2024.

For investors who intend to “bottom-fish” real estate, this unit suggests that those with financial capacity may consider using a leverage ratio of 60 – 70% (equity) and 30-35% (borrowed capital).

In addition, this unit notes that the choice of investment channel depends on the risk appetite and financial ability of each investor. In any situation, participants need to maintain the principle of allocating capital to different channels and not “put all their eggs in one basket”.

Real estate “bottom-fishing” investors

Mr. Nguyen Van Tuan, a real estate investor in Hanoi, said that for the past 2 weeks, he has been continuously looking to buy land at a suitable price in the outskirts with the goal of holding for 3 – 5 years.

“Earlier, at the end of last year when deposit interest rates dropped, I withdrew money to buy 2 plots of land in the outskirts. Currently, deposit interest rates continue to bottom out, while gold has increased significantly. I feel that if I buy gold or make a deposit, it will be difficult to make a profit. Therefore, although the real estate market is still quiet, I continue to buy land with the goal of long-term holding for better profits compared to buying gold or making a deposit at this time,” Mr. Tuan shared his point of view.

Currently, with 5 billion VND in hand, Mr. Tuan is targeting 1 – 2 plots of land with a good position and clear legal status.

According to the Consumer Psychology of Real Estate (CSS) report by Batdongsan.com.vn in the first half of 2024 also showed that up to 65% of respondents said they still intend to buy real estate in the next 1 year.

Buyers and sellers of real estate are no longer as cautious as in 2023. The real estate market sentiment index in the first half of 2024 also increased by 3 points compared to the second half of 2023. This index increased thanks to the improvement of consumer satisfaction with the potential for real estate price increases, interest rates for home loans, policies, and market conditions.

Regarding the development of the real estate market in the near future, Dr. Nguyen Van Dinh, Chairman of the Vietnam Association of Realtors (VARS), believes that 2024 will be a challenging year for the real estate industry. However, these challenges also open up great opportunities for the market to accelerate in the future. It can be seen that the release of many projects for sale at the end of 2023 shows that the real estate market is recovering.