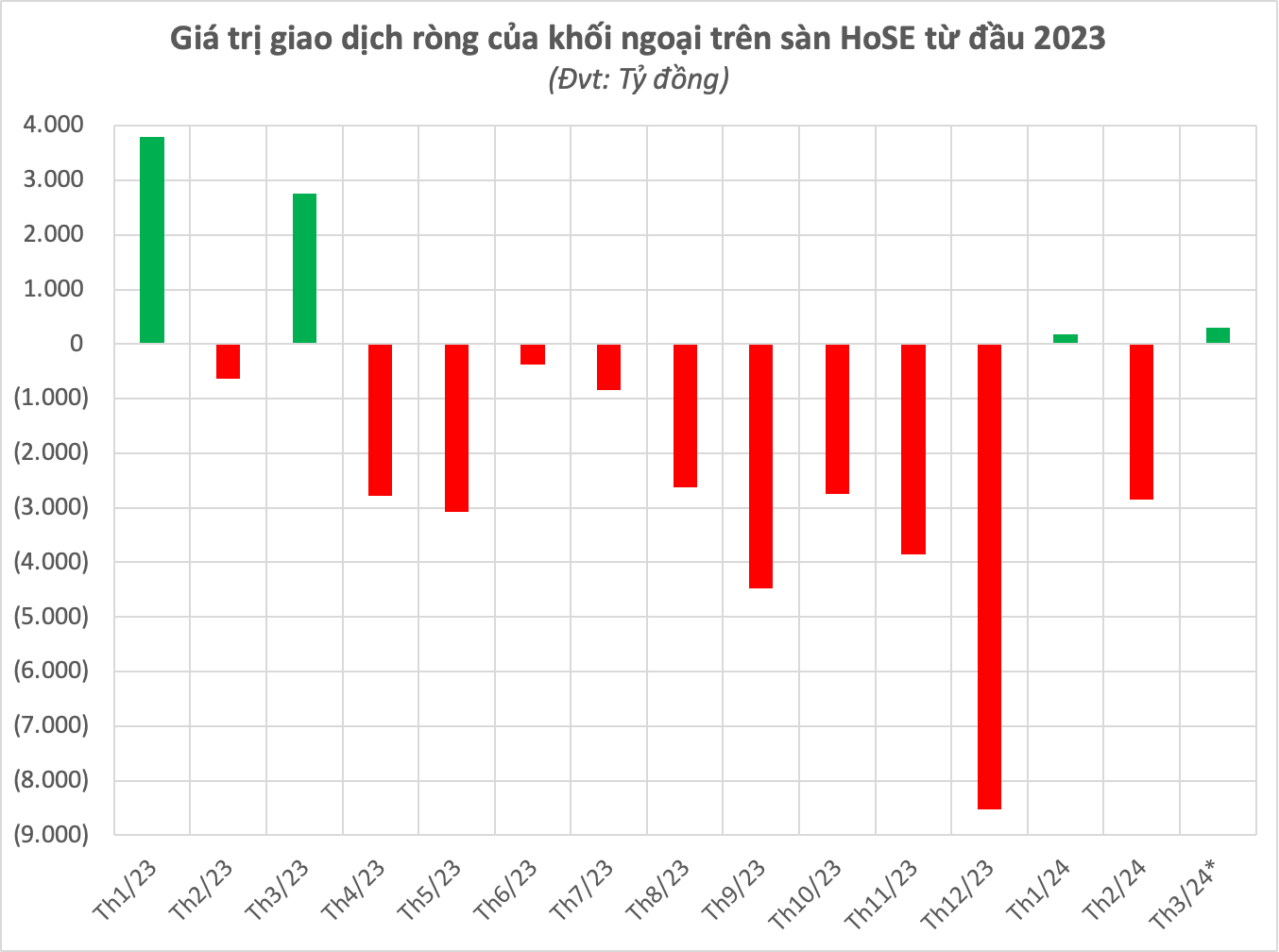

After recording a net sale of billion dollars after 2023, the selling momentum of foreign investors continues into 2024. In just over the first two months, the net selling value of foreign investors on HoSE reached approximately 2,400 billion dong.

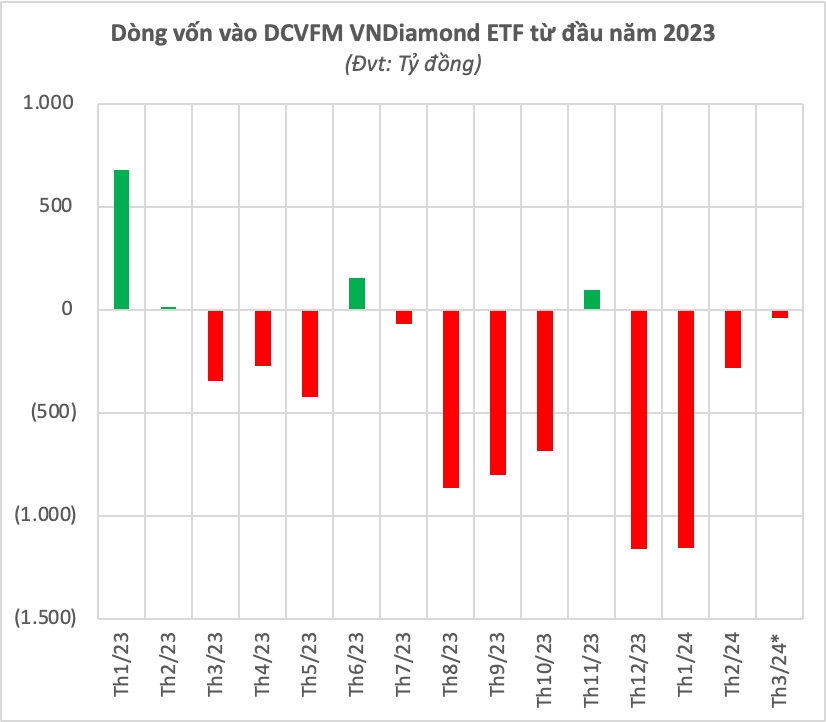

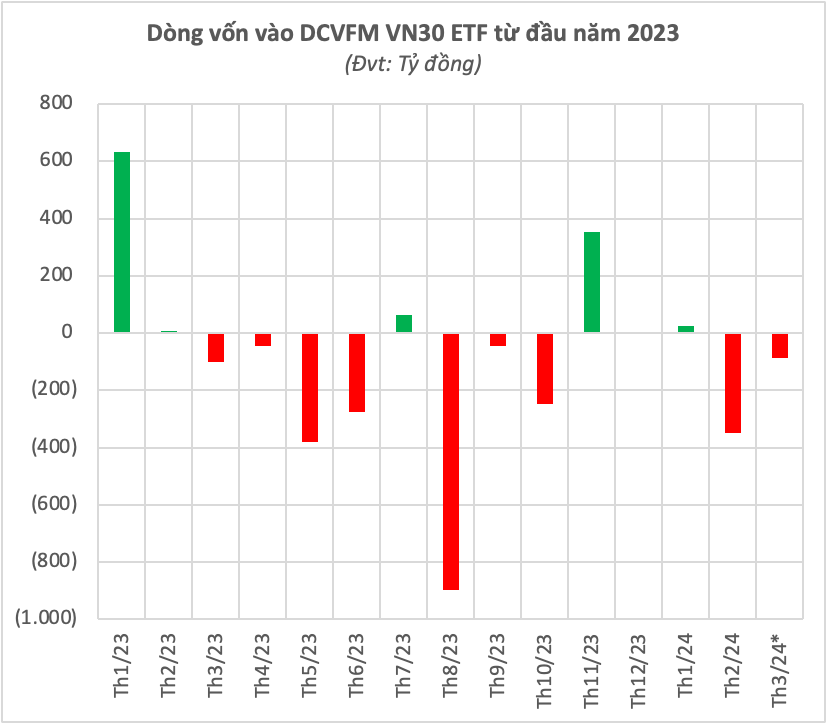

The outflow of foreign capital from the market has been largely due to the strong capital withdrawal of the ETF funds recently. According to statistics, the two largest ETFs managed by Dragon Capital, DCVFM VNDiamond ETF and DCVFM VN30 ETF, have both experienced significant capital withdrawals since the beginning of 2024, with a total net withdrawal value of over 2,000 billion dong.

Specifically, the VNDiamond index-simulating fund saw a net withdrawal of about 1,638 billion dong since the beginning of the year, while the VN30 fund saw a net withdrawal of 409 billion dong. This means that these funds have sold thousands of billions of Vietnam stocks in just over two months.

Prior to 2023, these two funds also experienced significant withdrawals, with DCVFM VNDiamond being withdrawn 3,668 billion dong and DCVFM VN30 ETF being withdrawn 946 billion dong.

The recent heavy capital withdrawal of the two DCVFM ETFs is partly due to the decrease in the flow of funds from Thailand. Thai investors used to be strong buyers of these ETF funds through both direct investment funds and indirect investment through DR (Depositary Receipts).

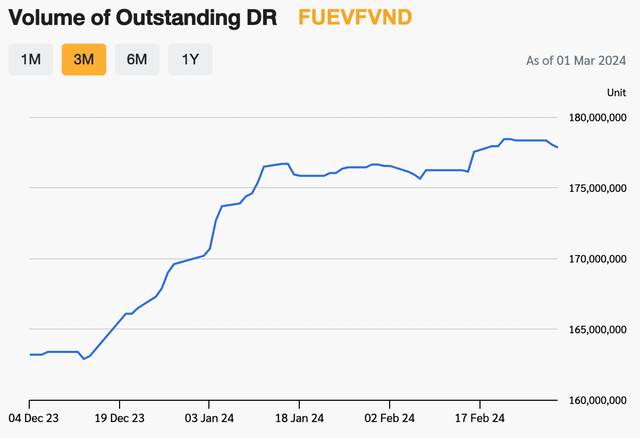

However, in recent times, Thai investors have reduced their holdings through DR. The number of DR based on the E1VFVN30 fund of the DCVFM VN30 ETF has decreased by nearly 4 million units since the beginning of the year and is currently at its lowest level in 3 months, since mid-December of last year. The conversion ratio between DR and underlying fund certificates is 1:1, which means that Thai investors have sold a large amount of Vietnam ETF fund certificates from the beginning of the year until now.

Meanwhile, the number of DR based on the FUEVFVND fund of the DCVFM VNDiamond ETF has slightly increased by about 8,000 units since the beginning of the year.

Under strong selling pressure, although they are still the two largest domestic ETFs in the securities market of Vietnam, with the NAV of more than 18,000 billion dong for the DCVFM VNDiamond ETF and over 8,000 billion dong for the DCVFM VN30 ETF. However, the scale of these two funds has been significantly narrowed due to capital withdrawal and the underperformance of stocks in the portfolio.

In contrast, in the context of strong capital withdrawal from the two largest funds, the DCVFM VNMIDCAP (code FUEDCMID) ETF – the first ETF with a performance that closely simulates the VNMIDCAP index – is against the trend as it attracted net inflows of about 50 billion dong since the beginning of the year, previously it also attracted net inflows of 107 billion dong in 2023. The fund’s performance since the beginning of 2023 has also reached nearly 40%, significantly higher than that of FUEVFVND and E1VFVN30.

Performance of FUEDCMID is superior to the other two ETFs

Foreign capital is expected to return strongly with the prospect of market upgrade

In reality, the recent significant capital withdrawal of ETF funds is in line with the global trend when the Fed maintains a monetary policy of being hawkish. In the January 2024 meeting, the Fed decided to keep interest rates unchanged for the fourth consecutive time. The high USD interest rate has made capital tend to withdraw from markets with large interest rate differentials between local currency and USD, including Vietnam.

It must be said that net selling is still the dominant trend of ETF funds in the first month of the year, although the intensity has cooled compared to December. In a recent report, SSI securities stated that in the medium term, investment capital flowing into the Vietnamese market could benefit from the shift of funds to developing markets, but this usually only occurs after the Fed starts cutting interest rates.

According to SSI, at present, the biggest obstacle for Vietnam to be classified by FTSE Russell as an Emerging Market (EM) is to address the issue of having to pre-fund transactions of institutional investors. To address this issue, SSI can implement two methods. The first is the long-term approach, by applying the Central Counterparty Clearing (CCP) Model. The second is the short-term approach, where securities companies will provide payment support for institutional investors (Non Prefunding Solution – NPS).

SSI predicts that the decision to classify Vietnam as an EM by FTSE Russell may occur as early as September 2024 (positive scenario) or March 2025 (base scenario) and will take effect 6 months later.

With the free float market capitalization of the Vietnamese market currently around USD 35 billion – equivalent to about 1/4 of Indonesia and Thailand. From there, SSI estimates Vietnam’s proportion in the FTSE EM index will be about 0.7% – 1.0% and FTSE Global at 0.1%. This could immediately attract about USD 1.7 – 2.5 billion when the upgrading decision takes effect.

Sharing the same view, Mr. Ketut Ariadi Kusuma, Head of Finance, Competition and Innovation Group at the World Bank in Vietnam, believes that upgrading the stock market will be a significant boost for the Vietnamese capital market, where it will be seen as having reasonable market access for foreign investors with a market capitalization and liquidity comparable to many similarly developed countries.

The World Bank estimates that upgrading the stock market could bring in USD 25 billion in new investment from international investors into the Vietnamese market by 2030.