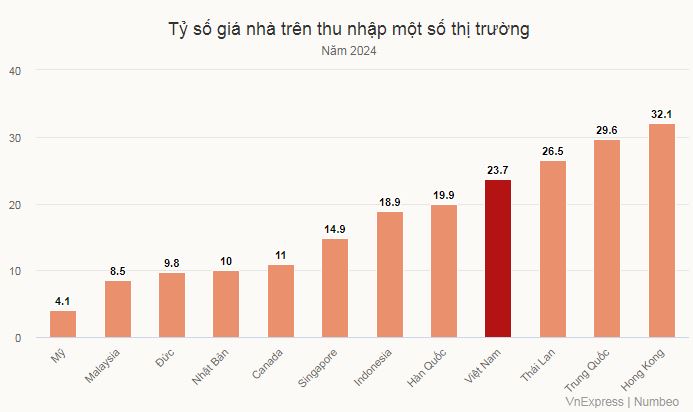

This is the updated 2024 “House Price to Income Ratio” (HPR) from Numbeo, the cost of living database based in Serbia.

The HPR is calculated by dividing the average house price by the average annual household income. This result means that the average house price in Vietnam is nearly 24 times the average annual income of Vietnamese households. According to experts, the ideal ratio should be between 5-7 times.

The HPR is the most popular and widely used method to assess the “affordability” of housing prices, according to the Ministry of Construction. This index is also encouraged by the World Bank and the United Nations.

Numbeo does not disclose the input data used for the calculations. However, recent publicly available data sources can be referenced. For example, the “Survey of living standards in 2022” by the General Statistics Office stated that the average Vietnamese household has 3.6 members, including 2.1 working members who generate an average income of 4.67 million VND per person per month.

Therefore, the estimated average annual income per household in 2022 is 117.6 million VND. According to Numbeo, the HPR in Vietnam in 2022 is 20.5. Combining these two data sources, the average house price at that time is around 2.4 billion VND per unit (considering all types of houses).

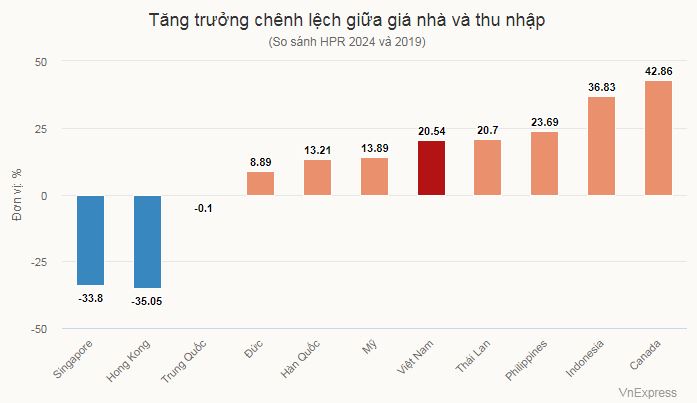

The affordability gap between housing prices and incomes in Vietnam is increasing, as reflected in this year’s HPR increase of 20.54% compared to 2019 (the HPR in 2019 was 19.66). However, Avison Young Vietnam, a real estate service provider, believes that unaffordable housing prices are a common phenomenon in many countries, not just Vietnam.

During the 2019-2024 period, neighboring Asian countries such as the Philippines and Indonesia experienced faster HPR growth than Vietnam, with increases of 23.69% and 36.83% respectively. In contrast, some places had slower HPR growth than Vietnam, such as Thailand (20.76%) and South Korea (13.21%). In fact, some major markets or countries with high property prices have even narrowed the gap between housing prices and incomes.

For example, the housing prices in Singapore are only 14.9 times the annual income this year, compared to 21.56 in 2019. In Hong Kong, the housing prices, which used to be 49.4 times the income 5 years ago, have now dropped to 32.1 times. In mainland China, housing prices are 29 times the income in 2019 and have remained at this level this year.

Similarly, as housing prices become more unaffordable, many young families in Vietnam are considering renting instead of buying. However, the challenge increases as rental costs also continue to rise.

In the two major cities of Ho Chi Minh City and Hanoi, rental prices and related costs have been increasing over the past 3 years. Data from the General Statistics Office for February shows that the index for housing and construction materials prices increased by 0.43%. Specifically, the maintenance materials prices increased by 0.48% and the housing repair service prices increased by 0.71%; the electricity prices for household use increased by 0.78% and the water prices for household use increased by 1.73%.

With the trend of increasing buying, renting, and living costs, they account for an increasingly high proportion of urban residents’ total income, making housing needs – which are essential needs – more “luxurious,” according to Avison Young Vietnam.

Real estate in Trung Hoa – Nhan Chinh area in Hanoi in December 2023. Photo: Ngoc Thanh |

The company believes that expanding urban areas from the core to surrounding areas or even to neighboring localities is a solution that helps make housing prices more accessible. However, with an urbanization rate of about 42.6% and a forecast of reaching 50% by 2030, the housing issue needs a more multi-dimensional approach.

Accordingly, improving housing supply is seen as a sustainable way to stabilize buying and rental prices. Mr. David Jackson, Managing Director of Avison Young Vietnam, believes that housing needs to be viewed as “essential infrastructure for social welfare” like roads and electricity.

“Therefore, housing development policies should be prioritized to address welfare issues, with support from long-term state investment and subsidies for interest rates or credit,” he noted.

At the same time, private developers need to target those with real housing needs. “The housing challenge will become more serious if what is created in the real estate market does not correspond to the true value for the community and society, specifically in terms of meeting housing rental and ownership needs,” said Mr. David Jackson.

Anh Ky