According to the latest report from VIS Rating on the corporate bond market, credit prospects in 2024 are expected to improve. Economic activities will be more robust and the low interest rate environment will support the ability to repay debt and mobilize capital for businesses.

The overall market sentiment will improve along with stricter regulations for market participants, which will support bond issuance activities, enhance market liquidity and develop the depth of the domestic bond market.

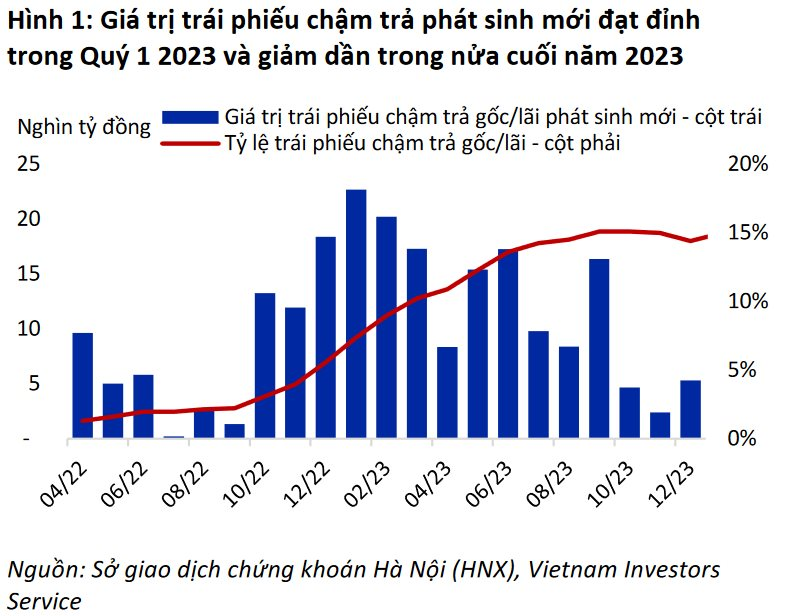

In 2023, the overall market delinquency rate for principal/interest payments peaked at 15% in October and gradually declined to 14.7% by the end of December. Many issuers have negotiated with bond holders to extend bonds to 2024 or 2025, with a total of 175 bonds with a nominal value of VND 59,000 billion having their maturity dates extended, accounting for 14% of the total value of bonds maturing in 2023.

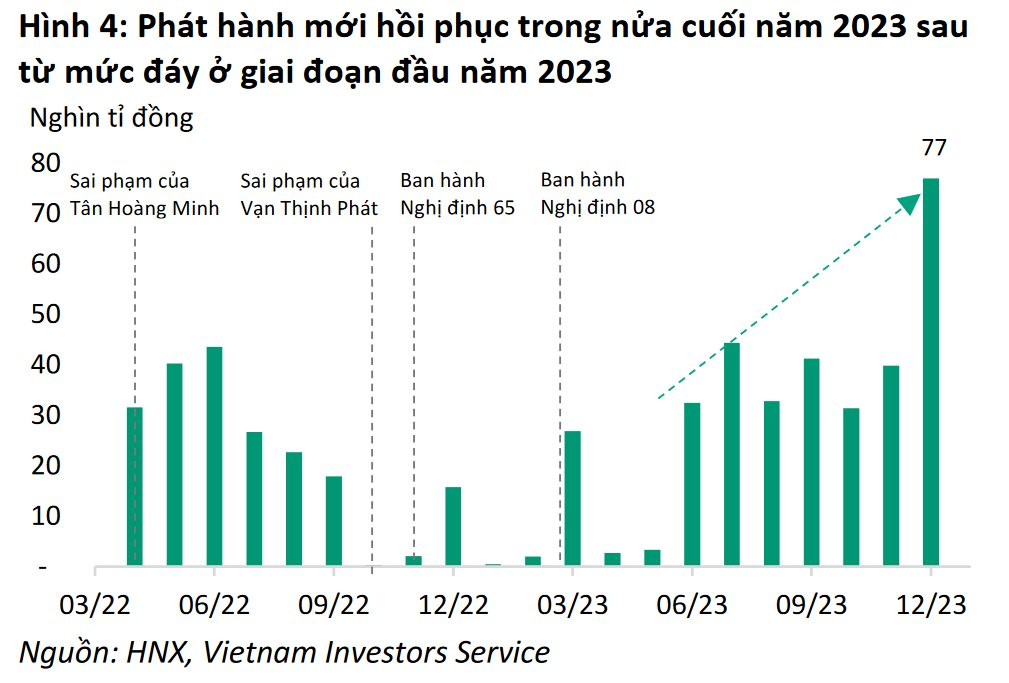

Along with the resumption of new issuances in the second half of 2023 after the issuance of Decree 08 in March 2023. The total value of new corporate bonds issued in 2023 reached VND 336,000 billion, a 22% increase compared to 2022.

VIS Rating believes that the market is at a turning point for a new development stage as stricter regulations on bond issuance and investment begin to take effect from 2024.

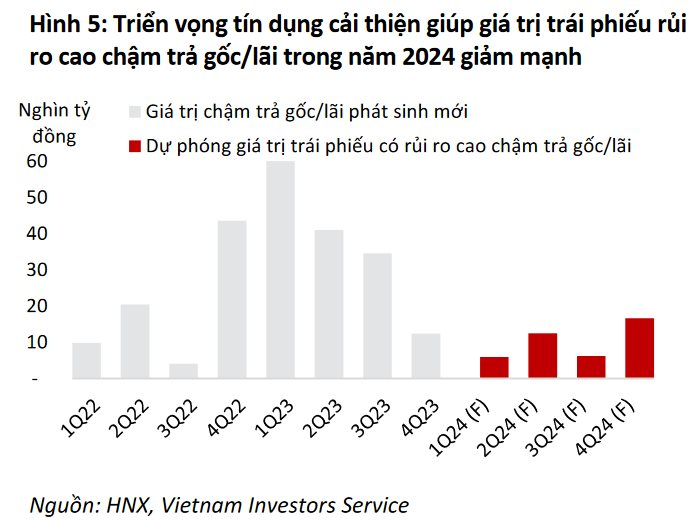

VIS Rating estimates that the amount of high-risk bonds in 2024 is VND 40,000 billion, significantly lower than the VND 147,000 billion of delinquent principal/interest bonds that occurred in 2023. The majority of high-risk bonds belong to real estate or construction companies with weak cash flow, high debt-to-equity ratios, and limited cash to meet debt obligations.

In addition, VIS Rating noted that over 60% of the value of high-risk bonds in 2024 comes from Special Purpose Entities (SPEs) that have been established solely for capital mobilization, have no business operations, very weak debt repayment capacity, and are associated with groups of struggling companies that have been delinquent in principal/interest payments.

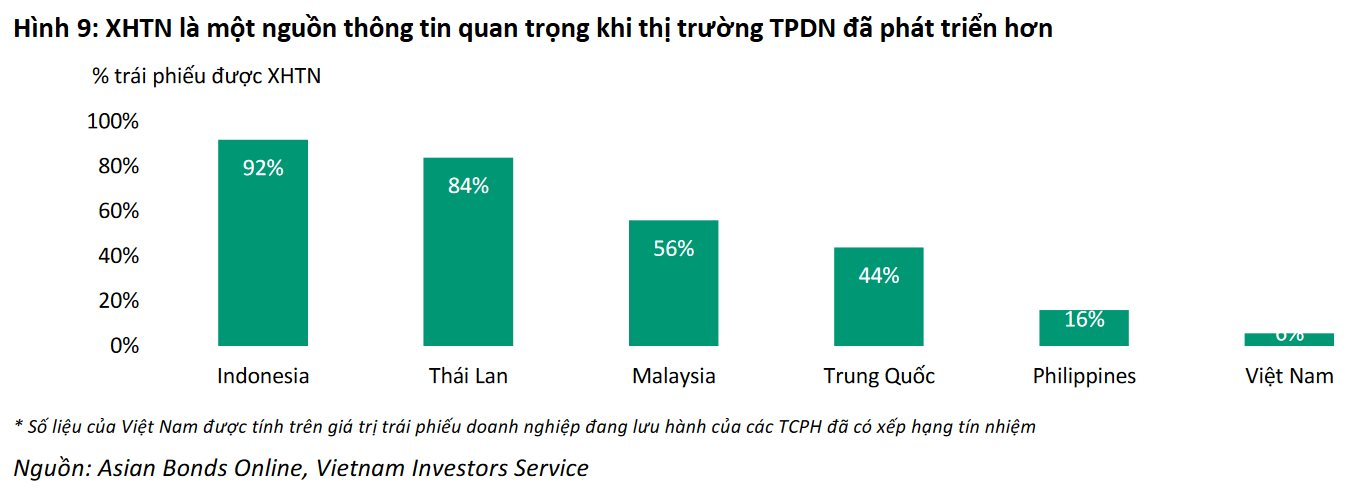

In 2024, VIS Rating expects market discipline to improve due to stricter regulations on new issuances, detailed and timely information disclosure, and increased participation of institutional investors.

Under the provisions of Decree 65, private bond issuances must disclose timely information about the use of funds, principal/interest payment status, and financial situation of the issuing organization (IO). Bondholders will also have more channels to assess bond risks, including bond credit ratings or IO credit ratings, and secondary market transaction information.

Retail investors will be better protected due to stricter regulations on the new bond issuance process, while professional individual investors and institutions will have more reliable information to evaluate IOs, especially IOs that are not listed on the stock exchange and have limited information.

VIS Rating believes that the value of new bond issuances will continue to recover in 2024 as the TPDN market enters a new development cycle.

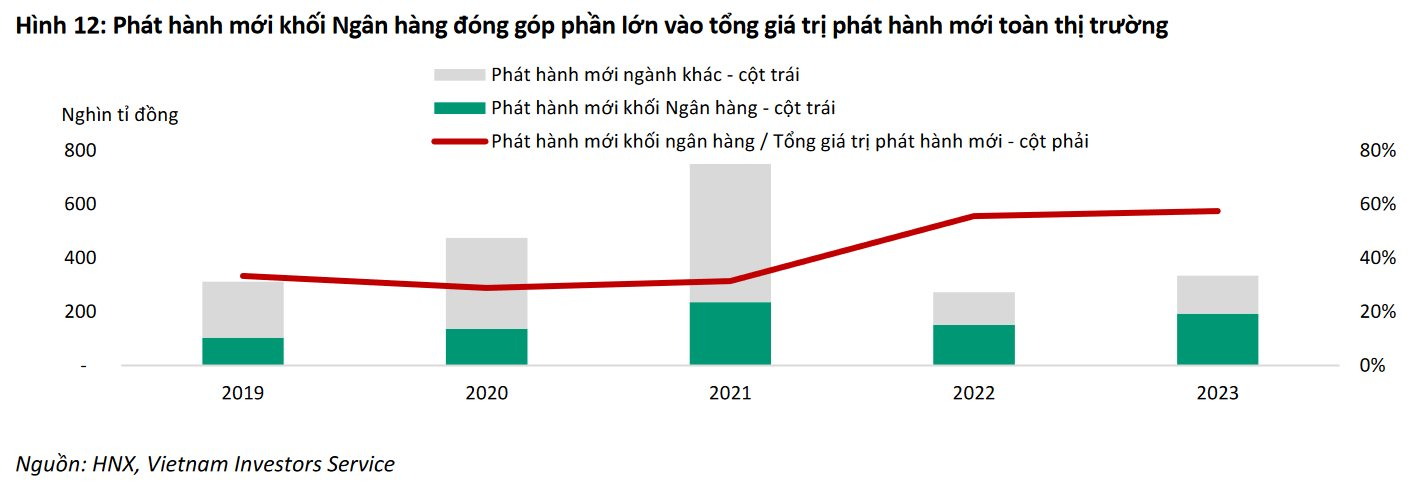

Significant new issuances will continue to come from the banking sector in 2024. Tighter regulations on short-term to long-term capital ratios will encourage banks to issue more bonds to supplement their long-term capital structure.

In addition, banks usually make new issuances annually to offset the amount of bonds repurchased and that mature in the year. Therefore, according to VIS Rating, in a low interest rate environment, banks will have the motivation to repurchase and issue bonds with more attractive interest rates.

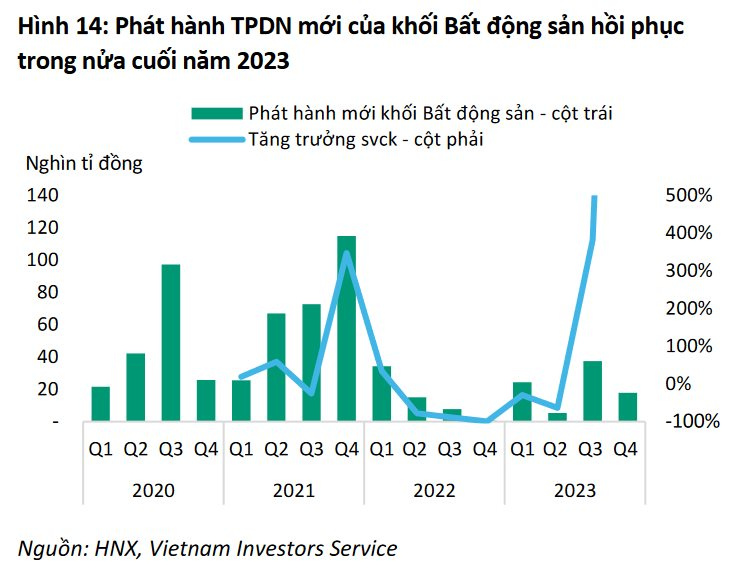

The recovery of TPND issuances from the Real Estate sector will also contribute to the recovery of new TPND issuances in 2024. VIS Rating expects the capital needs of Real Estate companies to be higher in 2024 as the legal barriers are reduced and project licenses are restored, with real estate laws becoming effective from 2024. This can be seen through the recovery of the value of Real Estate bond issuances in the second half of 2023.

In addition, improved market liquidity will support investor confidence and stimulate TPND investment demand in 2024. After the operation of the separate TPND trading system in July 2023, the value of separate TPND transactions gradually increased to VND 98,000 billion by December 2023 (~8% of the circulating value of TPND). The value of public TPND issuances also recovered in the second half of 2023, showing the recovery of market liquidity in the TPND market. As of January 2024, nearly 40% of the 2,700 outstanding bonds have been registered on the VSD and can be traded on the separate TPND trading system. VIS Rating predicts that market liquidity will continue to improve as the remaining 60% of outstanding bonds register on the VSD in 2024.

On March 21, 2024, VIS Rating will organize an online workshop with the theme “Credit Environment Outlook 2024: After the rain, the sky clears”. This workshop will provide in-depth insights from experts on the credit environment prospects in 2024, along with in-depth analysis of industries.