At the end of the trading session on March 5, the stock price of BID, of the Bank for Investment and Development of Vietnam (BIDV), continued to break its own record by increasing 1.68% to VND 54,400/share. The trading volume in the session reached nearly 1.2 million units. Looking further, BID’s market price has increased by nearly 25% since the beginning of the year and by 46.5% since half a year ago – the time this stock started its upward trend.

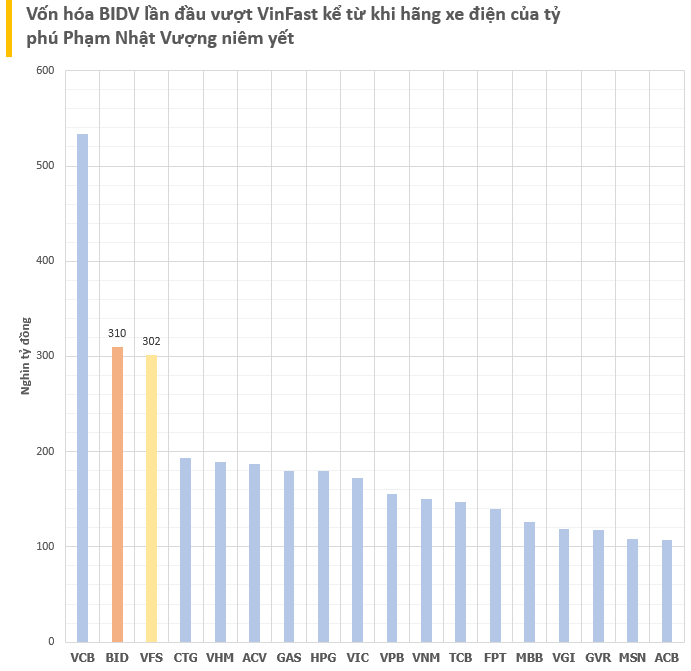

At the price of VND 54,200/share, BIDV’s market capitalization continues to strengthen its second-place position on the Vietnam stock exchange with VND 310,000 billion, an increase of VND 62,500 billion compared to the beginning of the year and an increase of VND 99,000 billion compared to the beginning of October last year.

Especially, in terms of all Vietnamese businesses, the market capitalization of this bank has officially surpassed the electric automobile company VinFast of billionaire Pham Nhat Vuong. At the end of the session on March 4 in the US, VFS shares reached a price of USD 5.28/share, equivalent to more than VND 129,000/share, thereby helping to reduce the market capitalization of this automaker to VND 302,000 billion.

On its debut day, the market capitalization of this electric car company was more than 4.1 times that of Vietcombank (USD 20.7 billion) – the largest market capitalization bank in Vietnam, and 2.3 times that of the total capitalization of the 3 state-owned commercial banks Vietcombank, VietinBank and BIDV (around USD 37 billion).

At the peak of USD 190 billion, even VinFast’s market capitalization is still 2.2 times that of the top 10 companies and banks with the largest market capitalization on the Vietnam stock exchange. Thus, domestically, there are two units that can surpass VinFast, which are BIDV and Vietcombank.

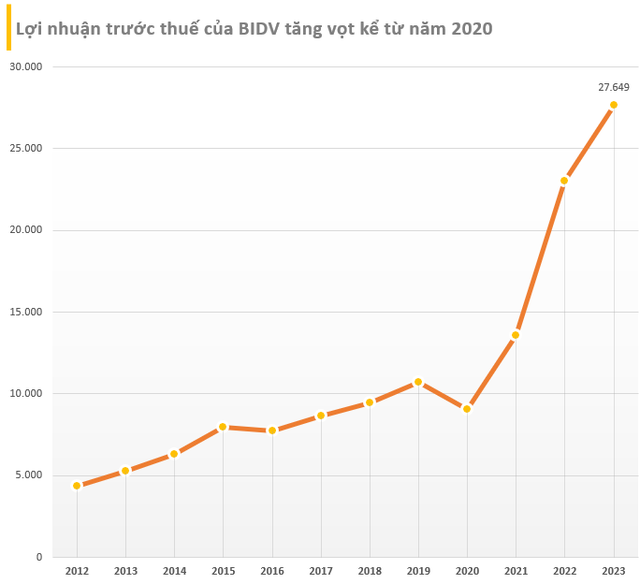

In recent years, BIDV has continued to grow strongly, accompanied by the continuous increase in its stock price. In 2023, the bank recorded consolidated pre-tax profit of VND 27,600 billion, an increase of 20.6% compared to 2022. This is the first time the bank’s profit has exceeded USD 1 billion. With this level of profit, BIDV is the second highest-profit bank among the Big 4, second only to Vietcombank (over VND 41,000 billion).

By the end of 2023, BIDV’s total assets reached VND 2.3 million billion; continues to maintain its position as the largest commercial bank in terms of total assets in Vietnam. Customer deposits reached VND 1.7 million billion, an increase of 15.7%. Customer loans reached VND 1.78 million billion, a growth of 16.8% compared to the beginning of the period. At the end of the year, BIDV’s bad debt stood at VND 22,229 billion, corresponding to a bad debt ratio of 1.25%.

Regarding the business plan for 2024, BIDV said that the credit balance managed according to the credit limit set by the State Bank of Vietnam (SBV) is expected to increase by 14%; Properly mobilize capital in accordance with capital utilization, ensuring liquidity and efficiency; Control the bad debt ratio according to Circular 11 at ≤1.4%…

The BIDV capital increase story

In the analysis report released in December 2023, Phu Hung Securities (PHS) said that the private placement story is still being pursued by BIDV into 2024. The bank plans to privately place 9% for investors. Recently, BIDV has made efforts to implement this plan and has contacted 38 investors. However, unfavorable domestic economic conditions have reduced demand. BIDV will work with SBV and partners to find the most suitable investors.

According to Vietcap Securities, the capital increase deal of this bank will be the bright spot of the banking industry in 2024. Earlier, the annual General Meeting of Shareholders in 2023 approved a plan to issue more than 1 billion shares, including nearly 642 million shares to pay dividends for 2021 and the rest is to issue additional shares through public offering or private placement (455 million shares). At the end of 2023, BIDV issued nearly 642 million shares to pay dividends for 2021.

According to Vietcap, one of the reasons why BIDV could not sell shares in 2023 was that the economic conditions did not allow. With expectations of economic recovery in 2024, coupled with a low interest rate environment, the analysis team expects capital mobilization activities through stock issuance to succeed.

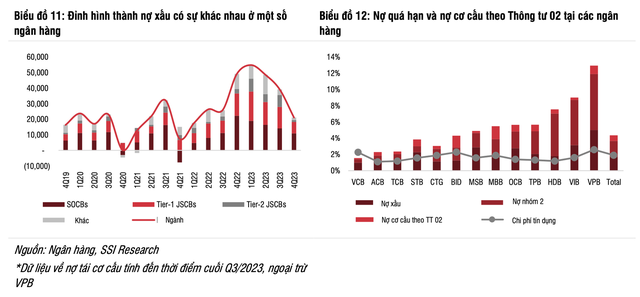

In its 2024 strategic report, SSI Research assessed that the banks with the ability to increase capital earlier will have better conditions to accelerate the debt handling process, gain more market share, and achieve better results than other banks.

Based on SSI Research’s estimate, pre-tax profit (PTP) of banks within the scope of its analysis is expected to grow by 16.5% compared to the same period last year in 2024. This figure is higher than the 5.2% growth in 2023.

In terms of asset quality, SSI Research believes that the overall situation of the banks will improve compared to 2023, mostly due to the reduced capital cost, much lower compared to 2023, and the improved pre-provision profit (PPOP) that helps banks have a better buffer for provisions.

The bad debt ratio may increase again in the first half of 2024 when credit growth slows down and macroeconomic factors have not shown clear signs of improvement. However, the bad debt ratio at the end of 2024 is forecasted to decrease slightly compared to 2023 (1.63% compared to 1.68%), due to expectations that banks will actively write off bad debts and the economy will recover more strongly.

Moreover, problem loans (including Group 2 loans, restructured loans, overdue corporate bonds, and old loans) still need to be closely monitored. In addition, if the draft amendment to Circular 16 is approved, which relaxes the restrictions on bank corporate bond investments, there is a possibility that some credit risks may return to banks that actively repurchase corporate bonds.