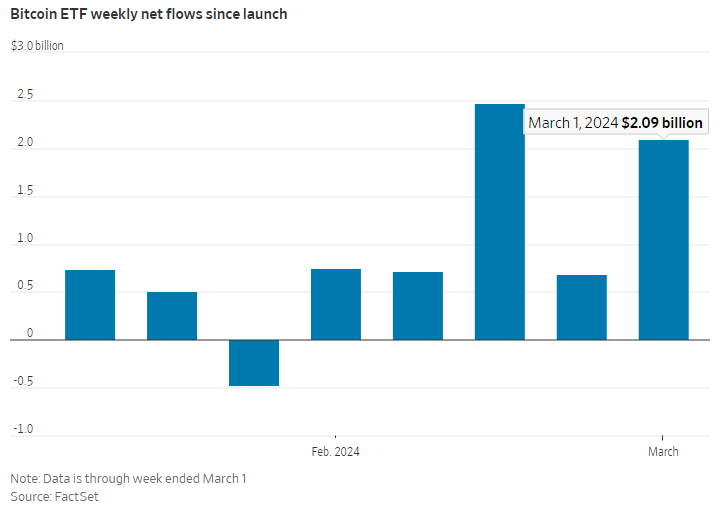

Investors have poured capital into Bitcoin exchange-traded funds (ETFs) at an unprecedented rate since their launch on January 11, 2024. The total assets of the 10 Bitcoin ETFs have risen to nearly $50 billion.

Net capital flows into Bitcoin ETFs since approval date

|

BlackRock’s iShares Bitcoin Trust has surpassed $10 billion in assets on February 29. This is the fastest capital inflow rate for a newly established ETF.

Fidelity’s Bitcoin fund currently manages over $6 billion in assets. With its remarkable capital inflow rate, it has become Fidelity’s third-largest ETF and accounts for the majority of the net capital inflow since the beginning of 2024.

“The demand is growing rapidly. These products have been well received,” shared Todd Rosenbluth, Head of Research at VettaFi.

Bitcoin ETFs allow investors to purchase Bitcoin through their brokerage accounts without having to go through cryptocurrency exchanges or Bitcoin futures contracts.

Some analysts previously predicted that the capital would pour in heavily during the initial phase and then slow down. However, the capital inflow rate has been even faster in recent weeks as Bitcoin approached its all-time high. Bitcoin surpassed $68,000 on March 5 before cooling off. The previous all-time high was set at $68,990 in November 2021.

Many analysts believe that Bitcoin’s upward trend in the second half of 2023 was driven by expectations through Bitcoin ETFs. Currently, they believe that investor enthusiasm for these ETFs is the key factor driving the upward trend.

“This is one of the rare cases where the price of Bitcoin depends on ETFs,” Rosenbluth shared.

BlackRock’s Bitcoin ETF has become the most eagerly embraced fund by investors: Only 4% of the 3,000 listed ETFs in the US have assets over $10 billion, according to Bloomberg Intelligence.

Among them, 9 Bitcoin ETFs were recently launched in January 2024, while the Grayscale Bitcoin Trust was converted to an ETF with nearly $30 billion in assets. All of them have experienced capital inflows, except for the Grayscale Bitcoin ETF. In 2024, investors withdrew $8 billion from this fund.

Of course, not all asset management companies consider Bitcoin ETFs to be suitable products for retail investors when considering the volatile history of Bitcoin. For example, Vanguard has no plans to launch Bitcoin ETFs and will not offer any products related to cryptocurrency on its platform. This asset management giant sees Bitcoin as “more speculative than an investment” in a recent post.