The VN-Index maintained its upward momentum in the early trading session, thanks to support from the banking and real estate stocks. The index closed at 1,261 on March 4, up 3.13 points. Trading volume was strong, with total matched orders on HOSE reaching over 26,000 billion dong.

Foreign investors were net buyers with a total value of 60 billion dong across the market.

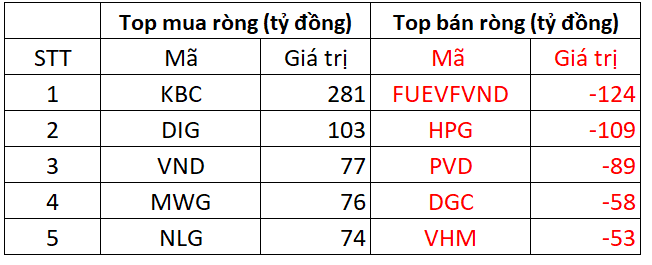

On HOSE, foreign investors were net buyers with an approximate value of 102 billion dong.

In terms of buying, the focus was on KBC shares with a value of 281 billion dong. Foreign investors accumulated KBC heavily as the real estate stock hit its daily limit and set a record trading volume. Another real estate stock, DIG, also saw net buying by foreign investors with a value of 103 billion dong. Additionally, VND and MWG were net buyers with values of 77 and 76 billion dong on HOSE, respectively.

On the other hand, FUEVFVND faced the strongest selling pressure from foreign investors with a value of 124 billion dong, followed by HPG and PVD with selling values of 109 and 89 billion dong per stock, respectively.

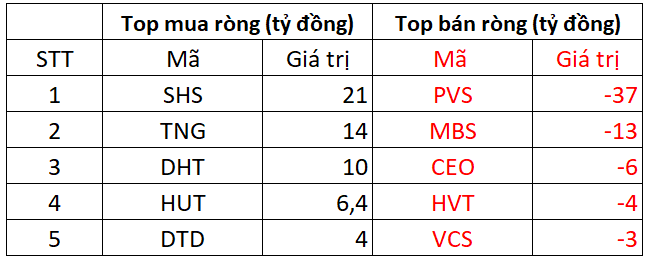

On HNX, foreign investors were net sellers with a value of 13 billion dong

In terms of buying, SHS was the most heavily bought stock with a value of 21 billion dong. TNG ranked second in the list of net buyers on HNX with 14 billion dong. In addition, foreign investors also had net buying positions on DHT, HUT, and DTD with relatively small values.

On the flip side, PVS was the stock facing net selling by foreign investors with a value of 37 billion dong; MBS followed with net selling of approximately 13 billion dong.

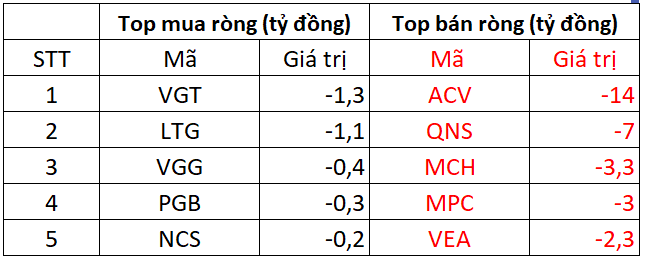

On UPCOM, foreign investors were net sellers with a value of 29 billion dong

In the buying session, VGT shares were bought by foreign investors with a value of 1.3 billion dong. LTG and VGG also saw net buying by foreign investors with values of a few billion dong per stock.

On the other hand, ACV experienced net selling by foreign investors with a value of approximately 14 billion dong today; in addition, they also net sold QNS, MCH, MPC, and other stocks.