The audit organization is Moore IT Audit and Services Joint Stock Company (AISC), which has fully approved the audited financial statements for the year 2023 and the after-tax profit of KDM in 2023 is positive according to the audit.

Based on the audit financial statements 2023, KDM turned a profit of over 1.6 billion dong, from a loss of nearly 3.2 billion dong in the previous year, thanks to the growth of its core business activities that led to a nearly 70% increase in revenue, while reducing financial costs by more than 92%.

Therefore, after nearly 1 year since being put under control by HNX (starting from April 3, 2023), KDM’s stock has returned to normal as the audit organization Moore AISC has given an unqualified opinion on the audited financial statements for the years 2021 and 2022, and the after-tax profit for the two years was negative.

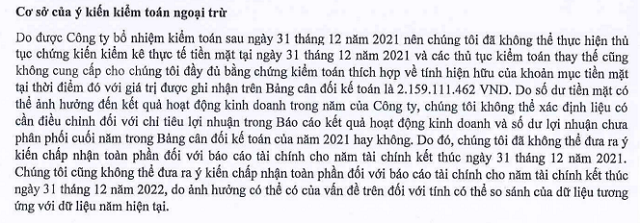

Source: KDM’s audited financial statements for 2022

|

In April 2023, after the decision of HNX, KDM quickly explained the occurrence of the audit’s unqualified opinion. Specifically, KDM stated that in 2021, they signed a contract to perform the interim financial statements review for the first half of 2021 and the audited financial statements for 2021. But after December 31, 2021, ATC Audit and Valuation Joint Stock Company did not continue to register, therefore, it did not meet the conditions for being approved by the State Securities Commission to carry out auditing for public companies in the securities field. Therefore, the 2021 audit contract of KDM could not be continued and had to be terminated after March 31, 2021.

In July 2022, KDM signed a contract with Moore AISC to perform the audit for the audited financial statements for 2021, the review for the first half of 2022, and the audited financial statements for 2022. The audit was carried out after December 31, 2021, so the audit firm could not perform the cash count at that time. Therefore, the audit could not give an unqualified opinion on the audited financial statements for 2021 and the review for the first half of 2022, leading to the inability to give an unqualified opinion on the audited financial statements for 2022.

Regarding the business result, KDM’s after-tax profit in 2022 was a loss of nearly 3.2 billion dong, despite the positive steel business activities, the cost of goods sold did not increase significantly compared to the revenue scale, and the management costs reduced significantly due to restructuring. According to KDM, the impact came from financial costs of over 5 billion dong, while no financial costs were incurred in 2021.

In fact, based on the audit financial statements for 2022, financial costs increased significantly mainly due to KDM’s stock investment losses of over 4.5 billion dong.

Going back another year, KDM turned from a profit of nearly 42 million dong in 2020 to a loss of 252 million dong, mainly due to significant increases in cost of goods sold, management costs, and other costs.

In the stock market, since being put under control, KDM’s stock has surprised investors by increasing nearly 46% to 19,800 dong per share at the end of the session on March 8, 2024.

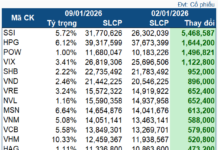

| KDM’s stock performs strongly during the controlled period |

|

GCL Group Joint Stock Company (KDM) was initially Long Thanh Limited Liability Company, established on June 1, 2009, with a charter capital of 16 billion dong. The company operates in 3 main areas: brick and concrete production, transportation services, and construction of civil and industrial projects. On March 29, 2016, KDM’s stock was officially traded on HNX with a reference price of 11,000 dong per share. Since its listing, the company has changed its name 4 times. By the end of July 2022, the latest name was changed to GCL Group Joint Stock Company. |