The market is engulfed in flames despite the index ending the session with a decrease of only 7 points, much less damage than at certain points. VN-Index fell back to the 1,262 level but the number of declining stocks was 356, nearly 3 times the number of advancing stocks.

Most large and mid-cap sectors saw significant declines. In which, construction decreased by 2.09%; retail returned nearly all of yesterday’s explosive growth with a decrease of 2.05%; chemicals decreased by 1.62%; tech and similar communications decreased by 1.28%; securities also decreased by 1.10%; real estate decreased by 0.89%; banking decreased by 0.31%; oil and gas decreased by 0.43%; construction materials decreased by 0.99%.

Accompanying this are the top stocks dragging down the index today, including GVR with 0.79 points, VPB with 0.68 points, VNM with 0.62 points, along with representatives from sectors such as VHM, HPG, FPT, VRE, MWG.

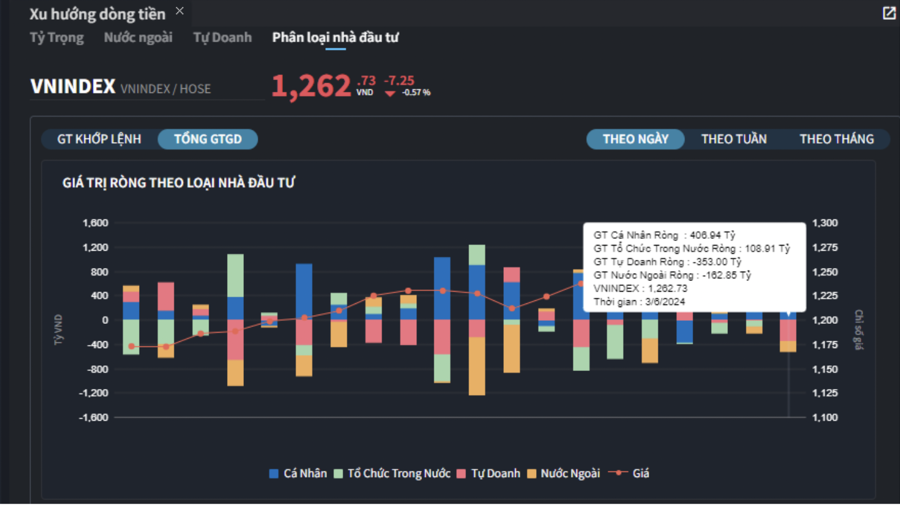

Active selling force persisted throughout the session, with the three exchanges having a combined order matching trading value of 27,900 billion VND, in which foreign investors were net sellers with 237.7 billion VND, and in terms of order matching trades alone, they were net sellers with 147.9 billion VND.

The main net buying groups in order matching trades for foreign investors are the Food and Beverage, and Banking sectors. The top net buying stocks in order matching trades for foreign investors include NLG, SSI, CTG, DGC, KBC, VRE, STB, MSN, KDH, PVT.

The main net selling group in order matching trades for foreign investors is the Financial Services sector. The top net selling stocks in order matching trades for foreign investors include VHM, VIX, FUEVFVND, VCI, GEX, VNM, LCG, VCB, GMD.

Individual investors were net buyers with 406.9 billion VND, in which they were net buyers in order matching trades with 447.7 billion VND. In terms of order matching trades, they were net buyers in 10 out of 18 sectors, mostly in the Real Estate sector. The top net buyers among individual investors are VHM, VIX, NVL, VCI, VSC, VIC, VNM, TCB, VPB, VCB.

The main net selling group in order matching trades for individual investors is the Food and Beverage, and Retail sectors. The top net sellers include NLG, MSN, CTG, MWG, KBC, SAB, PVT, FPT, DGC.

Institutional investors in Vietnam were net buyers with 108.9 billion VND, and in terms of order matching trades, they were net buyers with 89.3 billion VND.

In terms of order matching trades, the main net selling group consists of 9 out of 18 sectors, with the largest value in the Basic Resources sector. The top net sellers include VSC, HPG, ACB, VHM, PC1, SSI, VPB, PVD, DBC, HSG.

The largest net buying value is in the Retail sector. The top net buyers include MWG, FPT, GMD, EVF, SAB, MSN, MBB, CTG, BID, PVT.

Block trading reached 1,914.5 billion VND, a decrease of -17.5% compared to yesterday and contributed 6.9% to the total trading value.

The allocation of capital flows increased in the Real Estate, Banking, Electrical Equipment, Oil and Gas Equipment and Services, Water Transportation, Electricity, and Beer sectors, while decreasing in the Securities, Construction, Steel, Agriculture and Seafood Farming, Food, and Retail sectors.

In terms of order matching trades, the trading value allocation returned to the Large Cap VN30 and Small Cap VNSML groups, while decreasing in the Mid Cap VNMID group.