According to a recent market report by KBSV Securities, VN-Index has had a series of consecutive increases in the fourth month, making a strong recovery from the support level of 1,020 points established at the beginning of November.

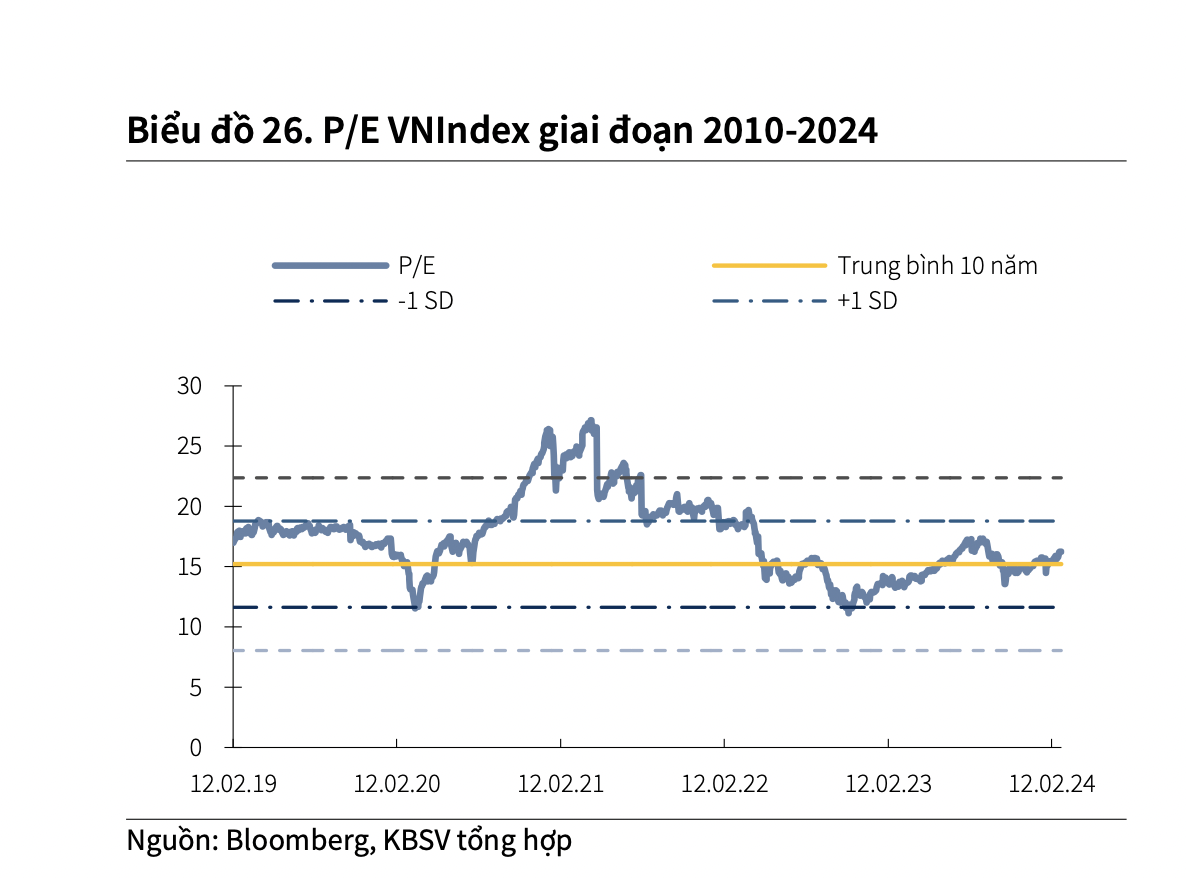

In terms of valuation, the current P/E ratio of VN-Index is around 16.2x (according to Bloomberg data – this P/E ratio has excluded extraordinary profits of companies, so it may differ from calculations of other organizations). This valuation level is currently approaching the average of the past 2 years but still slightly lower than the 10-year average of VN-Index.

Based on expectations of economic recovery throughout 2024 and the low interest rate environment, KBSV believes that the market valuation is still appropriate for long-term investors to accumulate stocks. However, opportunities with attractive profit margins will gradually decrease as more stocks approach high valuation levels.

In terms of market movement in March, the analysis team believes that VN-Index will remain at a high level with maintained recovery momentum, but it is not expected to have a strong breakout as in the first two months of the year due to short-term adjustment risks that are increasing.

Regarding the domestic situation, low interest rates and expectations of business recovery in the first quarter of 2024 will stimulate the stock market. In particular, some sectors such as industrial real estate parks will have positive signals from newly registered FDI data, which is more than twice the same period last year thanks to a 55% increase in the number of projects, including large-scale projects. In addition, the profitability of export-oriented sectors can be improved as Vietnam’s import-export data in the first two months of the year shows some positive signs.

KBSV also notes that March is the time when businesses’ quarterly business performance is clear, and the market can react accordingly to the Q1 financial reports. Accordingly, business performance will vary by industry group, and stock prices will have similar reactions. Investor psychology is still supported when looking at other markets around the world.

In the US, key indices are still performing positively at historical levels. Market attention will focus on the Fed meeting at the end of March. According to the CME FedWatch Tool, the market is currently predicting a 3% chance of a Fed rate cut in March and a 77.6% chance of a rate cut in May. In the Asian market, indices in China, South Korea, and other countries are maintaining recovery trends.

On the daily chart, VN-Index is still maintaining a short-term upward trend with higher highs/lows compared to the previous highs/lows. The trading volume is forming at a value of over 20 trillion VND per session, supporting the increasingly consolidated trend and persuasive recovery after technical corrections.

In addition, the ADX indicator – an average directional indicator, has strengthened from the 24 support level since early February to around 41 at the end of the month, indicating the strength of the trend and showing the potential for short-term upward movement to continue.

However, on the weekly and monthly timeframes, risk factors are more pronounced as the index approaches the notable resistance zone of 1,300-1,350, which is the corresponding area to the peak of the short-term recovery in August 2022. At the same time, the ADX indicator in both timeframes is below the 25 level during the recovery from the October 2023 low.

Therefore, there is a high possibility that VN-Index will face significant volatility pressure at the 1,300-1,350 resistance zone, and this is also an area to watch for confirming whether the market has returned to an upward trend in the medium term. The trading volume will be a factor to closely monitor in breakouts after the index has approached the resistance zone.

If the index continues to rise with higher highs than the previous highs but the trading volume decreases, it will be a signal for analysts to consider the scenario (70% probability) that VN-Index will enter a significant correction phase afterward with the nearest support zone around 1,220 (+-10) and a deeper support zone around 1,170 (+-10).

The remaining scenario (30% probability) is that VN-Index may maintain a breakthrough above the 1,300-1,350 zone, but the probability for this scenario is not high due to many leading sector groups having experienced overbought signals and technical indicators showing signs of overbought conditions.