The market liquidity increased compared to the previous trading session, with the trading volume of VN-Index reaching over 1 billion shares, equivalent to a value of nearly 25 trillion VND; HNX-Index reached nearly 107 million shares, equivalent to a value of nearly 2.2 trillion VND.

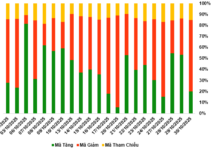

VN-Index opened the afternoon session quite negatively as selling pressure appeared right from the beginning, pulling the index down to its lowest level of the day. Then, buying pressure unexpectedly emerged, pushing the index to recover near the reference level. However, selling pressure still dominated, causing VN-Index to close the session in the red. In terms of impact, GVR, VPB, VNM, VHM, FPT, HPG, VRE, CTG, and MWG were the most negatively affected stocks, taking away more than 5 points from the index. On the contrary, SAB, GAS, TCB, and MSN were the stocks with the most positive impact on VN-Index, contributing more than 2.6 points of increase.

| Top 10 stocks with the strongest impact on VN-Index on March 6, 2024 (In points) |

HNX-Index also had a similar trend, in which the index was negatively affected by stocks such as L18 (-3.17%), TVC (-2.27%), CEO (-2.22%), SHS (-2.2%),…

|

Source: VietstockFinance

|

The electric equipment sector had the biggest decline in the market with -2.14%, mainly due to stocks like GEX (-2.98%), RAL (-1.26%), and PAC (-2.71%). This was followed by the construction and retail sectors with declines of 2.09% and 2.05%, respectively. On the contrary, the seafood processing sector had the strongest recovery with 0.57%, mainly driven by stocks like VHC (+1.64%), FMC (+0.1%), and ABT (+4.12%).

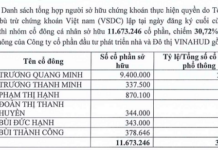

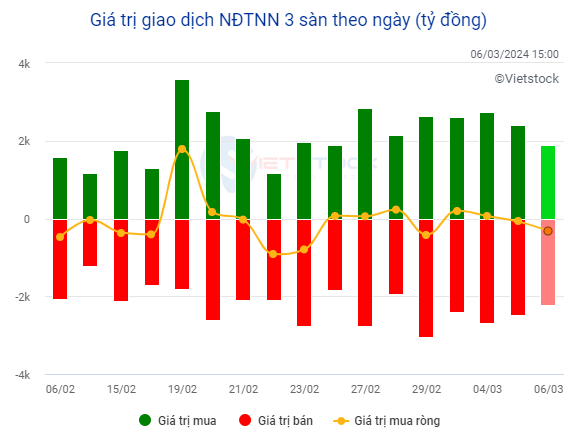

In terms of foreign trading, this group continued to sell net over 251 billion VND on HOSE, focusing on stocks VHM (216.14 billion), VIX (115.77 billion), VCI (54.89 billion), and GEX (39.71 billion). On HNX, foreign investors sold net over 76 billion VND, focusing on stocks PVS (38.1 billion), SHS (24.19 billion), and CEO (8.06 billion).

Source: Vietstock Finance

|

Morning session: Market volatility ends, VN-Index returns to decline

VN-Index after a volatile state above the reference level during the first half of the morning session, returned to decline. At the same time, foreign investors turned to net selling after the previous net buying session, indicating a more negative trend. At the end of the morning session, VN-Index decreased by 6.15 points, equivalent to 0.48%. HNX decreased by 2.24 points, equivalent to 0.95%.

The trading volume of VN-Index recorded in the morning session reached nearly 663 million shares, with a value of over 15 trillion VND. HNX-Index recorded a trading volume of over 61 million shares, with a trading value of over 1.2 trillion VND.

Source: VietstockFinance

|

Most industry groups ended the morning session in the red, including the food and beverage sector, which was also affected despite a good growth rate at the beginning of the session. Some large-cap groups such as retail, plastic-chemical, and construction also experienced more negative declines. On the other hand, the wholesale and insurance groups, although showing good growth since the beginning of the session, still maintained a relatively low proportion.

The retail group contributed to the index growth at the beginning of the morning session. With stocks like MSN (+0.79%), BHN (+1.81%), BBC (+3.47%),… SAB stock still maintained a very good increase of 4.2%.

In contrast, the retail group did not start the session very positively, with major stocks in the industry all in the red, such as MWG down 2.4%, PNJ down 1.96%, and FRT down 0.34%.

Source: VietstockFinance

|

Foreign investors returned to net selling, contributing to the decline of VN-Index in the morning session. In both HOSE and HNX, stocks like VIX, VHM, and GEX were heavily sold net, taking a significant proportion compared to other stocks such as VCI, MWG, LCG, and VND.

For stocks like BSI, KSB, HPG, GMD, HSG, DGW, they were also net sold by foreign investors, but only at a relatively low level with relatively uniform proportions.

10:30 AM: Breakthrough is not yet possible

The main indices have differentiated and continuously fluctuated around the reference level as selling pressure returned. As of 10:30 AM, VN-Index increased by more than 1 point, trading around 1,271 points. HNX-Index decreased by 0.92 points, trading around 236 points.

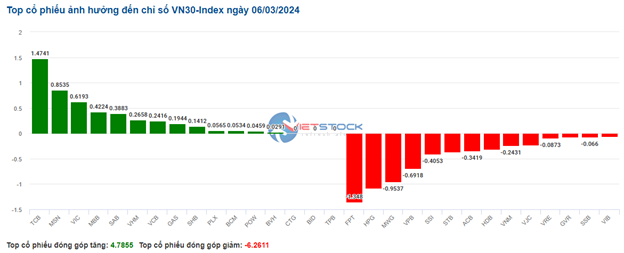

The VN30 stocks had a fairly balanced increase and decrease, but selling pressure still dominated. Specifically, FPT, HPG, MWG, and VPB took away 1.35 points, 1.08 points, 0.95 points, and 0.69 points from the index, respectively. On the contrary, TCB, MSN, VIC, and MBB were being bought quite well, contributing more than 3 points to the index.

Source: VietstockFinance

|

The banking sector is one of the highlights for the market. Other stocks in the sector such as MBB, VIB, and ACB also saw slight increases.

Ly Hoa