At the event’s information, Mr. Dam Nhan Duc, MB Chief Economist, evaluated the growth motivation of the banking industry in 2024 including: (1) the recovery of the economy; (2) Vietnam is in the golden population period and the government will take advantage of this opportunity; (3) credit growth at a high level compared to GDP (usually double), especially retail credit always higher than the credit growth of the whole industry; (4) increasing digital payments, averaging about 30% but transactions through digital channels are growing strongly. (5) Along with Vietnam’s credit to GDP ratio being lower than other countries like Thailand, Singapore… so these are the growth motivations for the banks in general including MB, especially in the retail and digital sectors.

MB Bank’s Chief Economist – Mr. Dam Nhan Duc

According to MB’s Chief Economist, in 2023, the economic growth momentum was only public investment, but in 2024, the import and export sector has shown good growth, a clear signal for the economy. Besides, the consumer demand, although slightly weak, is still good and this factor will support the positive growth of the banking industry compared to 2023.

Regarding MB’s operations, in 2023, MB has maintained steady and solid growth. Affiliated companies have sustainable growth and maintained market share. The Group’s total profit is more than 26.3 trillion VND, the highest level ever. In terms of asset quality, if seen on a quarterly basis, MB has overcome the most difficult period; bad debts are all well-provided.

Where is MB’s competitive advantage? According to Mr. Dam Nhan Duc, MB has clear differences, a strong “fighting” spirit, and innovations. “We are proud to lead in digital transformation”. This is derived from our history (MB leaders have strong personalities, determination, what they say is what they do). That determination, the “gene” in MB human has helped MB grow rapidly and steadily for the past 7 years.

In addition, MB has shifted and expanded its retail business well, currently leading in digital transformation and having the largest transaction volume on digital channels; CASA (proportion of demand deposits to total deposits) sustainably grows over the years and is at the top of the market.

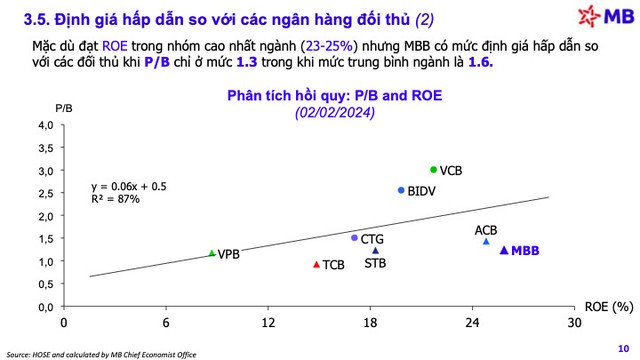

“We are very grateful to investors for helping MB outperform the market” with fast capitalization growth rate, from 2017 to 2024, the capitalization growth rates is seven times higher, higher than the market average. However, the value of MB is still very large, trading at a much lower price than the market. “People say cheap things are not good, but it is not like that for MB”.

Also sharing at the investor meeting, Mr. Luu Hoai Son, Director of MB Planning & Marketing Department said, in 2024, MB expects credit growth to be higher than the assigned level of 16% and based on the 4th quarter’s growth, MB expects profit to reach more than 28.8 trillion VND.

The growth momentum of MB in the 2024 period and the following years, MB’s expectation is based on 3 major growth drivers.

The first is retail. If looked inside, MB has many favorable conditions to support this reasonable growth strategy. Currently, MB has more than 26 million customers, is expected to reach 30 million in 2024. Customers using MB’s basic product of loans currently account for 453 thousand customers and are growing well. This is a highly expected point in the future.

Retail and micro SME loans account for 51% of MB’s total loan structure, and the growth rate is still very good, which is the motivation for MB’s very good growth in the past 3-4 years. Currently, the number of frequent interactions with customers through the App and BizMB is very high, accounting for about 10-15% of the number of transactions that can be transferred through digital platforms and hoping to expand in 2024.

Retail will help MB’s CASA continue to grow in the coming time. In the context of 2024 when credit institutions enter a new economic cycle, which means the lending interest rate floor declines, the advantages of CASA and capital costs will help MB provide customers with loans at reasonable costs while still ensuring high profits in the future.

The second driver is digital transformation. In recent years, MB has made a big investment in digital transformation, connecting with customer ecosystems on various platforms, creating good experience for customers. Thanks to digital transformation, the number of transactions has grown very high but the operating costs and transaction personnel costs remain unchanged.

The third growth driver is the synergy of the financial conglomerate. Currently, MB’s ecosystem is a financial conglomerate with full financial services, from securities, banks, insurance… creating the most complete and largest internal motivation in the banking and financial industry. This has been clearly demonstrated through the growth of each member, for example, the number of MBS customers has tripled in just 2 years.

Besides the advantages, MB also identifies certain difficulties and challenges. First is credit management. Currently, MB has implemented a multi-layer credit risk management model. Besides, the bank also transforms MB’s business model towards ESG to ensure sustainable development.

Overall, despite the challenges, MB’s leadership still believes that MB has a strong growth momentum in 2024.