Looking back to the fourth quarter of 2023, Mobile World (MWG) stock witnessed a sharp decline. The price of MWG stock fell nearly 40% in just over a month, hitting a low of 35,100 VND/share. At that time, when shareholders were on edge, MWG Chairman Nguyen Duc Tai registered to buy 1 million MWG shares. He shared with investors in a meeting on November 13, 2023 that he had plans to increase his ownership, with the funds already available in his account, but due to a busy schedule, he had not had time to make a decision.

“For those who have faith in the corporation, they will remain calm and even see this as a buying opportunity. For those who lack confidence in the company, they can sell. As an insider, I know exactly where I am going, so I intend to increase my ownership ratio“, Tai said.

He also hinted that if MWG were to go ahead with its plan to buy back shares as treasury stock, it would not happen until the end of the first quarter of the following year (2024), and that it would be too late.

As a result, from November 8 to December 7, Tai was only able to buy 110,000 MWG shares out of the total registered 1 million shares, corresponding to a successful purchase rate of 11%. From December 12 to January 10, 2024, the Chairman purchased an additional 200,000 MWG shares out of the total registered 500,000 shares, with a successful purchase rate of 40%. The reason for Tai’s “drip-feed” buying behavior was due to “inappropriate market developments”.

In fact, MWG stock started to recover well from early November 2023 – the same period Tai bought the shares. Since November 13, 2023 (following Tai’s announcement at the meeting) to the present, MWG stock has surged by 25%, reaching a 5-month high and is currently trading at 50,000 VND/share.

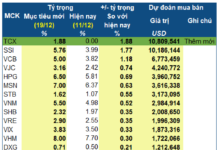

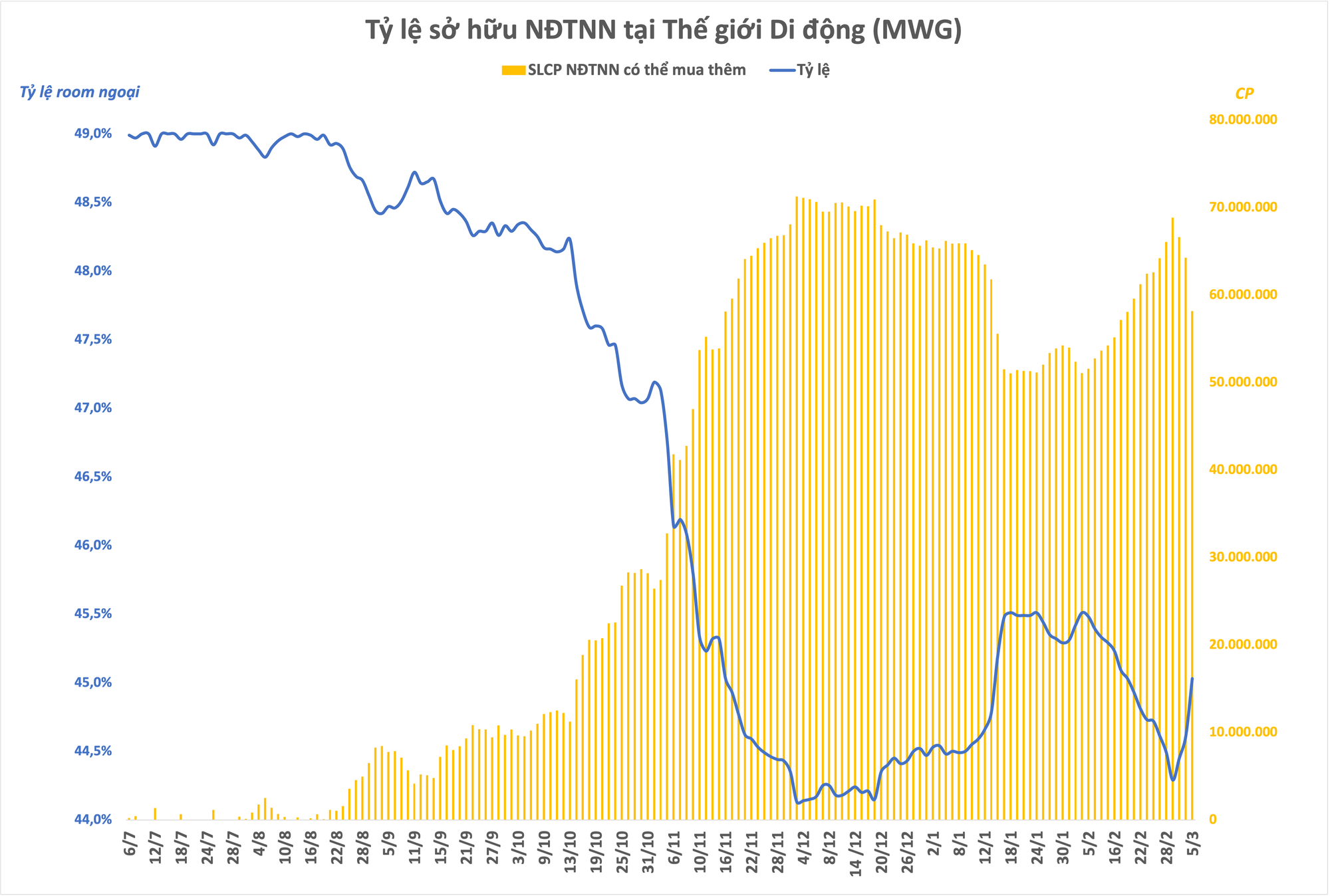

MWG’s stock received more positive signals as international capital flows started to return. In the past week (from February 28 to March 5, 2024), foreign investors registered a net buying value of 455 billion VND in MWG, the highest in the market.

As of the end of March 5 trading session, foreign investors’ ownership ratio in Mobile World was at 45.03%, which means they are able to buy more than 58 million shares. Previously, the biggest net room available to foreign investors in recent years was recorded on December 1, 2023 at 44.13% (exceeding the room by 71.2 million shares).

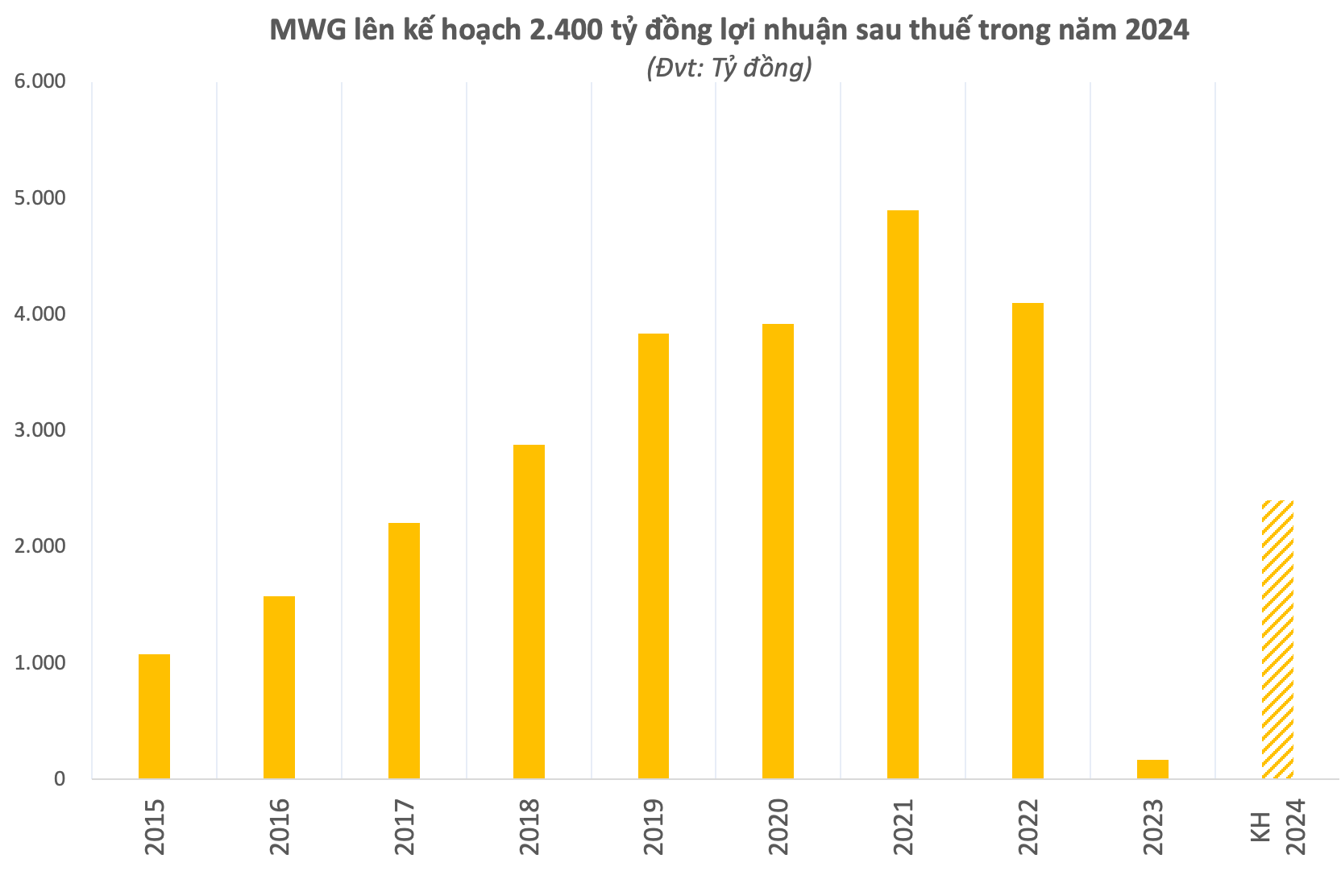

After being unleashed, MWG’s stock price has been shining due to positive business results from Mobile World. Although the net profit for the whole year 2023 reached nearly 168 billion VND, shrinking by 96% compared to 2022 and only achieving 4% of the annual target, Bach Hoa Xanh (BHX) chain has achieved its breakeven goal with an average revenue of 1.8 billion VND/store.

This is considered an important milestone for Mobile World as Bach Hoa Xanh is evaluated as the growth driver of the whole company. Tai affirmed that the company’s growth for the next 5 years will focus on the Bach Hoa Xanh chain. He rated this as a very large industry and currently this supermarket chain has not yet gained a significant market share, therefore there is still a lot of room for expansion.

For 2024 alone, MWG plans to achieve a revenue of 125,000 billion VND, a 5% increase, and a post-tax profit of 2,400 billion VND – 14 times higher than last year’s achievement. Tai said the 2,400 billion VND profit figure is not a high number and is within reach.

Preliminary information about the situation in the first two months of 2024, MWG representatives said business performance is relatively stable. Despite the reduced number of stores, Tet revenue in 2024 remains stable compared to the previous year. As for Bach Hoa Xanh, the average revenue per store reached 1.8 billion VND during the first two months of 2024.