After yesterday afternoon’s “stuck” session, the market traded slowly this morning, but not too bad, still saw a good increase in the first half of the session. However, there was no enthusiasm, on the contrary, investors are still “waiting” for a good price to take profit. Both the breadth and the movement of the indexes indicate an increasing pressure.

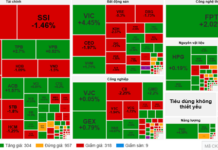

VN-Index reached its highest point at 10:38 AM, rising by approximately 6 points before diving for the rest of the morning. At the end of the morning session, the index decreased by 0.96 points, equivalent to -0.08%. The blue-chip group still performed well, with the VN30-Index increasing by 0.31% with 16 gainers and 11 losers, but the leading stocks were weak.

Out of the 10 largest stocks in terms of market capitalization on VN-Index, only 3 stocks had slight increases: VCB increased by 0.63%, VIC increased by 0.33%, and VPB increased by 0.52%. The remaining 6 stocks decreased and TCB was unchanged. These stocks all faced significant pressure, for example, VCB gave back about 1.23% of its gains by the end of the session, VIC also dropped 0.87% from its intraday high, VPB decreased by approximately 0.51%. Meanwhile, the mid-cap stocks performed well with many stocks contributing to the index increase, such as BCM rising by 2.11% and ranked 18th by market capitalization, DGC increased by 3.36% and ranked 28th…

All stocks in the VN30 basket decreased at different levels during the morning session due to the inability to sustain the high levels under increasing selling pressure. Statistics showed that half of the basket (15 stocks) dropped by at least 1% from their intraday highs. Meanwhile, the liquidity of this basket decreased by 36% compared to yesterday morning, reflecting a slowdown in demand.

Expanding to HoSE as a whole, the downward trend is common. The breadth of VN-Index shows that even when this index was the strongest, the increasing stocks still couldn’t dominate. Specifically, at the peak at 10:38 AM, VN-Index had only 220 gainers and 199 losers. At the end of the session, there were 157 gainers and 286 losers.

However, the market is not entirely negative because there are still stocks/stock groups that are performing better than the general market, or at least there is still enough money flowing in to balance the selling pressure. The securities group stood out this morning as most stocks in the group maintained their gains, with 32 stocks increasing by over 1%. PSI and AGR hit the ceiling, while smaller stocks like EVS, APS, VIG, DSC, SBS, HBS, WSS, ABW, BMS increased from 4% to over 6%.

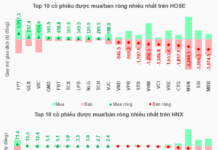

Large-cap, high-liquidity stocks in the securities group, of course, are not able to increase as much as smaller stocks, but they are not weak either. SSI led the market in terms of liquidity with nearly 700 billion VND traded, and its price increased by 1.21%; VIX traded 612 billion VND with a price increase of 3.21%; VCI had 537 billion VND traded and its price increased by 3.68%; VND had 444 billion VND traded and its price increased by 0.87%. Among the top 5 most liquid stocks in the market this morning, 4 stocks belonged to the securities group.

In addition to securities stocks, out of the 157 gainers on HoSE, 51 stocks increased by over 1%, but the majority of them had low liquidity, with only 22 stocks in this group trading over 10 billion VND. Besides securities stocks, there are notable stocks like DGC, GMD, BCM, DGW, BFC with trading volumes over 50 billion VND.

On the downside, there is no clear sign of selling pressure as most stocks have only been pushed down from the intraday highs and had to go through the range above the reference price before falling into the red zone. Among the 286 losers, only 50 stocks decreased by more than 1% with several high-liquidity stocks such as EVF, CTG, STB, HDB, NKG, MWG.

Overall, the liquidity in the morning session on both exchanges decreased by about 22% compared to yesterday morning, reaching 13,195 billion VND. Although it decreased, this trading volume is still significantly higher than the average morning sessions of the previous week (11,897 billion VND per session). This shows that the trading is still active and there is abundant money flowing in and out. In this context, which side creates stronger pressure on the price will reflect the positive or negative nature of the liquidity.