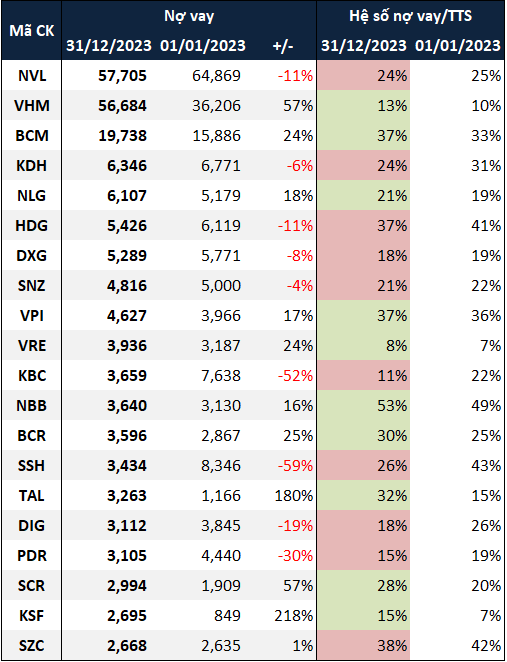

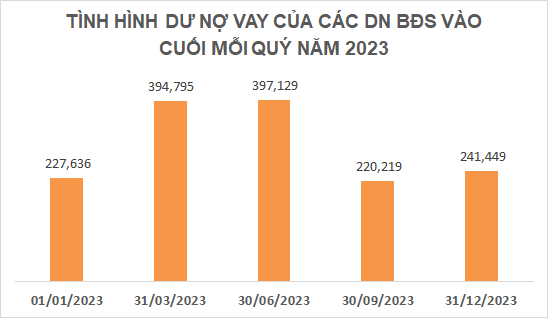

Unit: Billion VND. Source: VietstockFinance

|

Many large companies have been aiming to reduce their debts.

Last year, major players in the market decided to reduce their debts in order to alleviate financial leverage pressures, especially bond debts.

Specifically, among the top 20 real estate companies with the largest outstanding debts as of December 31, 2023, 9 companies saw a decrease in debt compared to the beginning of the year and only 1 company had a debt that remained almost the same.

|

Top 20 real estate companies with the largest outstanding debts as of December 31, 2023 (Unit: Billion VND)

Source: VietstockFinance

|

No Va Real Estate Investment Corporation (Novaland, HOSE: NVL) continued to be the leader in terms of outstanding debts, even though the value decreased by 11% compared to the end of 2022, amounting to 57.7 trillion VND. The largest proportion of the debt is still in bonds, but it has decreased by 13% to over 38.6 trillion VND.

On December 15, 2023, Novaland announced the restructuring of their 300 million USD international convertible bond package, which helped alleviate the pressure on the corporation in a difficult market situation.

Other real estate companies such as Nha Khang Dien (HOSE: KDH), Investment and Development Construction Joint Stock Company (HOSE: DIG), and Dat Xanh Group (HOSE: DXG) also managed to reduce their debts by 6%, 19%, and 8% respectively, to the levels of 6.3 trillion VND, 3.1 trillion VND, and 5.3 trillion VND.

For KDH, the majority of the debt is from bank loans, with nearly 4.9 trillion VND, including short-term loans from VietinBank of over 1 trillion VND, while the rest is long-term loans from OCB secured by ongoing housing projects.

As for DIG and DXG, the decrease in debts is mainly due to a significant reduction in bond debts, with nearly 39% for DIG (remaining at over 1.1 trillion VND) and 36% for DXG (remaining at over 1.4 trillion VND).

In regard to bonds, Kinh Bac Urban Development Corporation (HOSE: KBC) and Phat Dat real estate development joint stock company (HOSE: PDR) successfully managed to bring their bond debts to zero, thus reducing their overall debts by 52% and 30% respectively, to 3.7 trillion VND and 3.1 trillion VND.

On the other hand, there are still many large companies that have chosen to increase their debts. Vinhomes (HOSE: VHM) and Industrial Investment and Development Corporation (HOSE: BCM) are notable examples. The two leading companies in the commercial and industrial real estate sectors have experienced a significant increase of 57% and 24% in debts, reaching 56.7 trillion VND and 20 trillion VND respectively.

On November 23, 2023, VHM successfully issued private bonds worth 2 trillion VND, with the code VHMB2325004, a term of 2 years, due on November 23, 2025. The stated interest rate is 12% per year.

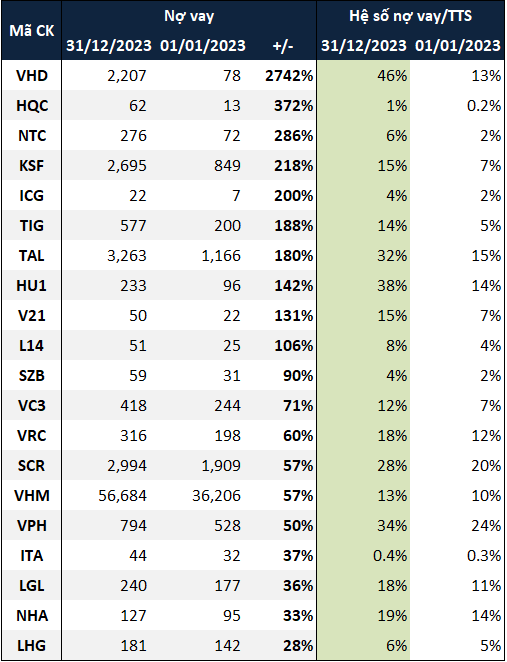

In terms of the rate of increase, the top performers are Vietnam Housing and Urban Development Investment Corporation (UPCoM: VHD), Hoang Quan Real Estate Trading Services and Consulting Joint Stock Company (HOSE: HQC), and Nam Tan Uyen Industrial Zone Development Corporation (UPCoM: NTC).

|

Top 20 real estate companies with the highest increase in outstanding debts in 2023 (Unit: Billion VND)

Source: VietstockFinance

|

The increase in debts for VHD is mainly due to the merger of financial statements with its subsidiary companies, while the increase in debts for HQC is mainly from additional borrowings from related parties. Specifically, HQC borrowed more than 4.5 trillion VND from Hoang Quan Group Limited Liability Company and an additional 3 billion VND from Agribank Thanh Do.

According to the financial statements of NTC, all of their debts are short-term loans from Vietcombank for corporate tax payment, VAT payment, dividend payment, bonus payment, and stock purchase.

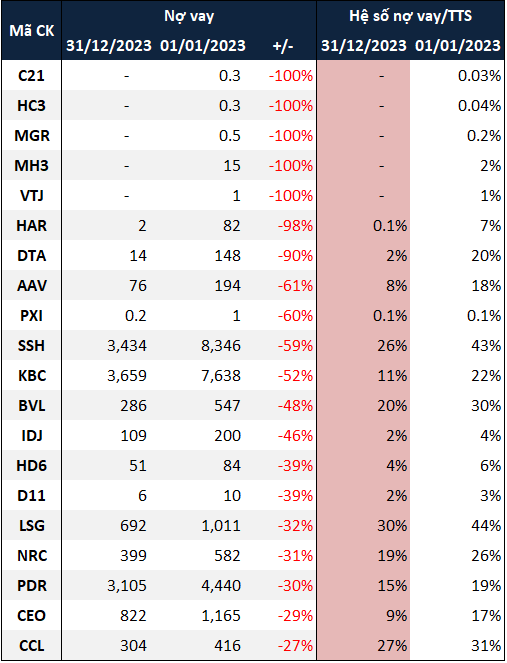

On the other hand, there are 5 companies that have successfully reduced their debts to zero. They are Century 21 Joint Stock Company (UPCoM: C21), Construction Joint Stock Company No.3 Hai Phong (UPCoM: HC3), MGROUP Corporation (UPCoM: MGR), Binh Long Rubber Industrial Zone Joint Stock Company (UPCoM: MH3), and VNATA Trading and Investment Joint Stock Company (HNX: VTJ).

|

Top 20 real estate companies with the largest decrease in outstanding debts in 2023 (Unit: Billion VND)

Source: VietstockFinance

|

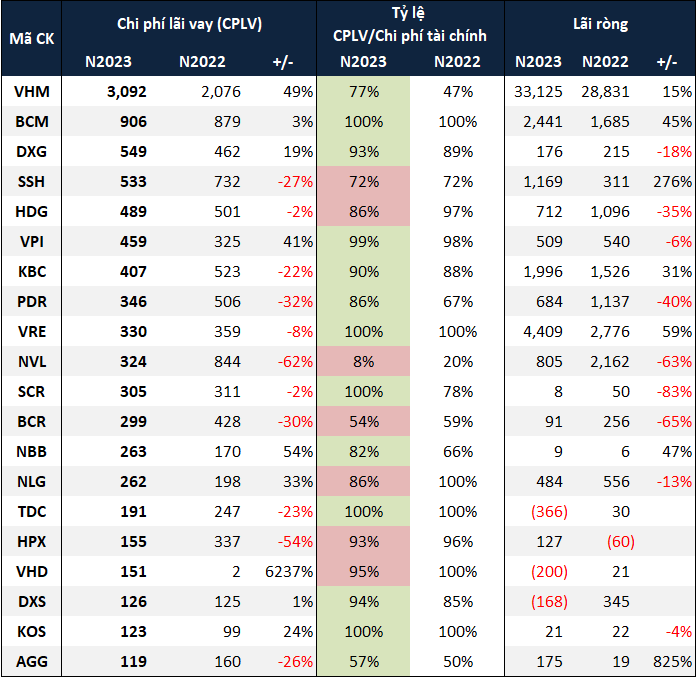

How are the interest payments for real estate companies?

Despite the fluctuations in outstanding debts, the total interest payments made by real estate companies in 2023 remained relatively stable. This partly reflects the decrease in interest rates for loans due to the continuous reduction in deposit interest rates and policy rates over the past year. According to statistics from VietstockFinance, the total interest expenses of 110 companies in 2023 amounted to 11.4 trillion VND, a decrease of nearly 1% compared to the previous year.

Although ranking second in terms of outstanding debts, VHM stands out in terms of interest payments made in the year, with over 3 trillion VND, a 49% increase. On the other hand, while NVL has the largest outstanding debts, it has experienced the highest decrease rate of 62%, with only 324 billion VND remaining.

|

Top 20 real estate companies with the highest interest expenses in 2023 (Unit: Billion VND)

Source: VietstockFinance

|

If we consider the entire real estate industry, credit debts for real estate business activities as of the end of November 2023 amounted to over 1 quadrillion VND, an increase of nearly 28% compared to the end of 2022.

Although credit debts for real estate companies increased by 6%, the interest expenses remained stable, which reflects the decreasing interest rate environment in Vietnam.

In 2023, the State Bank of Vietnam (SBV) has lowered the policy rates 4 times, with a reduction of 50 basis points for certain key interest rates such as the discount rate for refinancing operations, the open market operations rate (OMO), and 25 basis points for the deposit rate below 6 months.

As a result, most of the interest rates have decreased to levels equivalent to those of the 2020 period when SBV implemented monetary policies to support economic recovery after the COVID-19 pandemic.

Speaking at the “Real Estate Market in 2024” forum, Deputy Minister of Construction Nguyen Van Sinh expressed the hope that real estate companies would proactively reduce financial leverage and limit scattered investments.

According to Mr. Sinh, the increase in credit debts for real estate companies compared to the previous period indicates that financial resources flowing into the market have become more active. However, businesses need to diversify their sources of funding, in addition to bank credit, with bond issuances, equity investments, investment funds, and financial leasing options.

At the same time, capital mobilization should be linked to specific purposes, reducing financial leverage and limiting scattered investments. Investments should be focused on completing ongoing projects, especially social housing, worker housing, and affordable housing projects to increase liquidity.