Price and demand are both on the rise

Shared at the “Real Estate Market Trends 2024” event, Mr. Vo Huynh Tuan Kiet, Director of CBRE Vietnam Housing Department, said that apartments in Hanoi tend to have a higher price increase compared to Ho Chi Minh City. Compared to the beginning of 2023, the current price increase of apartments in Hanoi is around 15%. The main reason is the scarcity of supply, with low new products entering the market leading to an overall increase in prices. Additionally, the majority of the newly opened supply belongs to the high-end segment.

The representative of CBRE affirmed that the prices of apartments in both Hanoi and Ho Chi Minh City are at a high level, especially in Hanoi, where primary prices are increasing rapidly. Based on the total new supply in 2023, the high-end segment accounted for 75% in Hanoi and 84% in Ho Chi Minh City. On the other hand, the mid-range segment, which has prices suitable for the majority of people, represents a small proportion, while the affordable segment has completely disappeared from both markets in recent years.

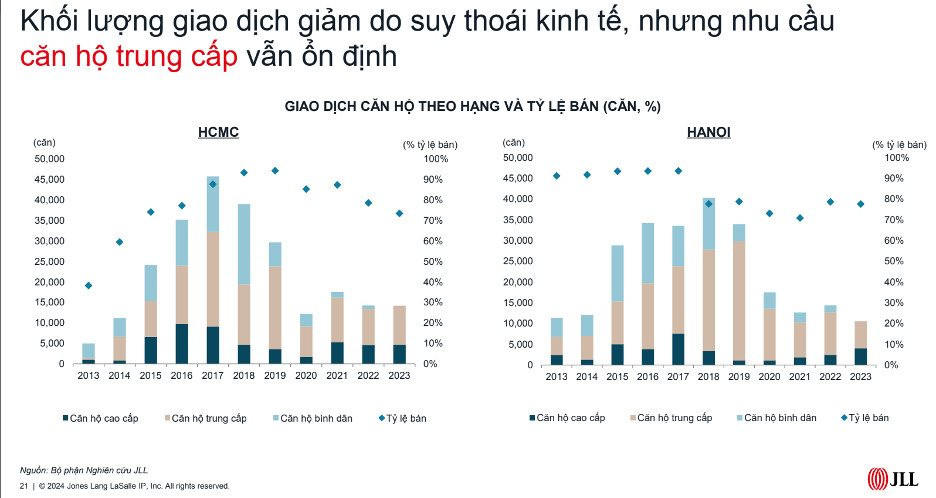

Demand for apartments remains high. Source: JLL

CBRE’s report also points out that in 2023, the real estate market in Hanoi and Ho Chi Minh City shifted roles, with Hanoi following the trend of the Ho Chi Minh City market three years ago. Specifically, at the end of 2023, the average primary selling prices in Hanoi reached 53 million VND/m2 (excluding VAT and maintenance fees), increasing by 4.6% quarterly and 14.6% annually. This is equivalent to the prices recorded in Ho Chi Minh City in the 2020-2021 period. Meanwhile, the current primary selling price of apartments in Ho Chi Minh City has stabilized at over 61 million VND/m2, a decrease of 1.7% compared to 2022. Due to the relatively lower prices compared to Ho Chi Minh City, the number of apartment transactions in Hanoi has been slightly higher in recent times.

In the secondary market, selling prices of apartments in Hanoi and Ho Chi Minh City are moving in opposite directions. Selling prices in Hanoi in Q4/2023 continued to increase from previous quarters, reaching an average of 33 million VND/m2, equivalent to a 5% increase annually. Limited supply, along with newly opened projects with high prices, has contributed to a more vibrant secondary apartment market in Hanoi.

On the contrary, secondary selling prices in Ho Chi Minh City reached 45 million VND/m2 for the apartment market and 140 million VND/m2 for the low-rise housing market, corresponding to a decrease of 5% and 2%, respectively, compared to 2022. Although the secondary market in Ho Chi Minh City experienced price adjustments throughout 2023, the rate of price reduction gradually decreased in the last quarter.

Target buyers of apartments are getting younger in both Hanoi and Ho Chi Minh City.

Despite the price increase, the demand in this segment is still quite good. According to the latest data from Batdongsan.com.vn, the number of real estate searches in January and February 2024 has soared, exceeding the entire year of 2023. Specifically, the number of apartment searches in Hanoi in January 2024 increased by 71% compared to the same period. In Ho Chi Minh City, it increased by 59%. This shows relatively positive signs for the real estate market, especially in the apartment segment. Previously, in Q3 and Q4/2023, with positive signals from lowered interest rates and improved buyer sentiment, the number of sold houses in the last two quarters of the year increased by over 60% in Hanoi and doubled in Ho Chi Minh City compared to the first half of the year (data from CBRE).

Demand does not only come from actual buyers such as households, workers, and students in the city, but also from a significant number of investors who see the potential from renting apartments and making long-term investments in the current volatile market.

It is noteworthy that the target buyer group is getting younger. According to a survey by Property Guru, the group of people aged 22 to under 39 has the highest demand for purchasing apartments in 2023. Especially for the age group from 22 to 35, the demand for real estate purchases has increased from 39% in 2021 to over 42% in 2023.

In terms of ongoing apartment projects, the purchasing power is getting younger and includes both actual and investment demands. For example, in Hanoi, the Grand Sunlake project (Van Quan, Ha Dong) is currently attracting positive attention. Recently, the project introduced the Bespoke Collection – a super collection of cash-home real estate with prices starting at only 43 million VND/m2 and many attractive incentives. Specifically, a 5% discount will be given when customers pay 70% of the apartment value quickly, and a 9% discount for customers who pay 95% quickly. Customers choosing bank loans will receive assistance in borrowing 70% of the apartment value. The developer supports 0% interest rates and defers the principal for 18 months. It is known that this reasonably priced apartment project has received considerable attention from buyers and has sold well in previous stages.

Supply continues to be scarce, apartments are hard to stay empty

Thus, while prices and demand for apartments are increasing, the supply continues to decline. Data from market research entities shows that by the end of 2023, the supply in both Hanoi and Ho Chi Minh City reached the lowest level in the past ten years. The supply shortage trend is expected to continue in 2024.

According to Ms. Trang Bui, General Director of Cushman & Wakefield, despite the strong increase in housing demand, apartment supply is still not developing accordingly. In Hanoi, the new apartment supply in 2023 is estimated at 10,500 units, a decrease of about 31% compared to the previous year. In Ho Chi Minh City, the new apartment supply is estimated at nearly 7,500 units, a decrease of over 50% compared to the same period in 2022.

The decline in apartment supply in recent times is due to the increasing scarcity of newly approved real estate projects, while ongoing projects face difficulties related to legal issues and capital sources. Although the Government and relevant ministries and agencies have made some noticeable efforts to address difficulties, the overall housing supply to the market is still limited.

In the short term, experts believe that the supply will continue to be limited while the strong demand will keep prices at a high level.

Supply continues to be scarce, and apartment prices are hard to decrease.

Mr. Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokers Association (VARS), believes that the prices of downtown apartments will continue to increase due to high demand and limited supply. At the same time, input costs such as materials, labor, and land prices are all increasing, positively affecting apartment prices. However, starting from 2024, it will be a year to lay the “first brick” for a new development cycle of the market. This is also the year where the market overcomes obstacles to change in a positive direction. In particular, the apartment segment is forecasted to “lead” the market as the actual demand is still significant.