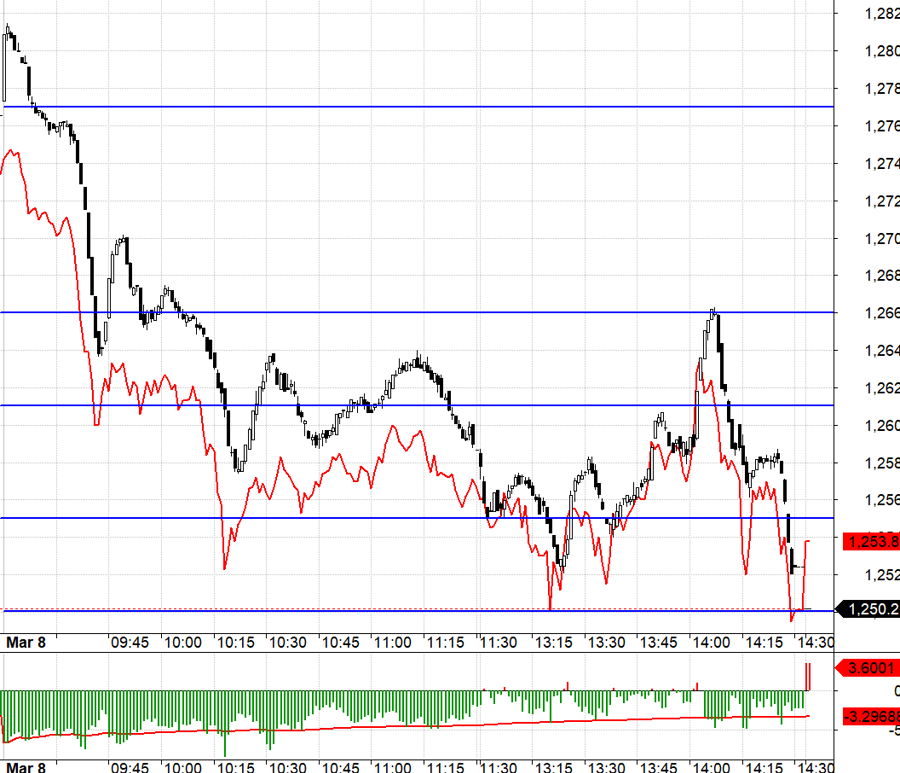

After a psychological consolidation session, the market repeated the “upset” of the session on March 6 with a better completion level as the system operated smoothly. Strong selling pressure and continuous maintenance have forced the price to decrease significantly along with the sudden increase in liquidity.

In the context of many large trading weeks, sudden increases in liquidity are not a good sign. The amount of accumulated stocks over the past period is significant, so as soon as there is a deep enough decrease, it immediately falls into a dangerous state. Furthermore, excessive and prolonged liquidity certainly requires a high degree of margin usage – especially when there is a continuous expectation that the market will reach 1,300 points.

Today’s session may have taken place since March 6, except that the afternoon trading system is unstable. Nevertheless, the morning of that day also had extremely high trading volume, which continued to be enormous today. Although the money flow in recent weeks has been impressive, stocks always outweigh cash, and as the price increases, the weight increases because more money is required to buy the same amount of shares. This has always been the inherent contradiction of any upward trend, unless money is continuously added, which is impossible in the short term.

In general, the market may rise or fall, with no bad news appearing at all, as the market is moving based on normal supply and demand. When supply and demand discrepancies are significantly dominated in one direction, and when sentiments change, the trend will also change. If the upward trend is interspersed with long enough and not too steep correction waves, the duration may vary. If the stock accumulation is too large, the development is usually shocking. This also happened in August and September of last year.

After a week of high volatility and excessive liquidity, it is highly likely that the market will have a correction to balance out. The margin amount needs to be released as this is the most vulnerable group. When holding only “hard money,” the ability to withstand losses will be better, and the market will be more balanced, especially when there is no medium-term concern.

In the short term, the opportunity to buy stocks is still not clear, now is the time to wait patiently. There will still be T + rebounds during the decrease, but the price range to rebuild the portfolio needs stability to reduce risks.

Derivative market today is, of course, a feast for Shorts, F1 liquidity increased by 51% compared to yesterday. No matter how the intraday VN30 rebounded, F1 still maintained the discount because large players understood that when they sold a large number of stocks, the pre-post index would decrease. This is actually a defensive measure to reduce losses when selling a large volume, not to mention the prolonged discount that has been going on for many days when Short positions have been carefully accumulated.

Sharp declines appeared at the end of the week, and the market had time to stabilize during the 2-day break. Usually, after a strong fall day, the market is likely to bounce back. However, when a large amount of money has been withdrawn and is being withdrawn, the supporting force will gradually decrease. The strategy is Long short-term, Short long-term.

VN30 closed today at 1250.2, right at a milestone. The next resistance levels for the next session are 1257; 1261; 1270; 1280. Support levels are 1242; 1236; 1229; 1220; 1213; 1208.

“Stock Market Blog” is personal and does not represent the opinion of VnEconomy. The views and evaluations are of individual investors and VnEconomy respects the views and writing style of the author. VnEconomy and the author are not responsible for any issues related to the published assessments and investment opinions.