International Women’s Day (March 8) is an occasion for men to take the time to appreciate the important women in their lives, and of course, stock investors are no exception. Many even joke that the stock market’s decline on March 8 is due to “stock warriors” selling stocks to buy gifts.

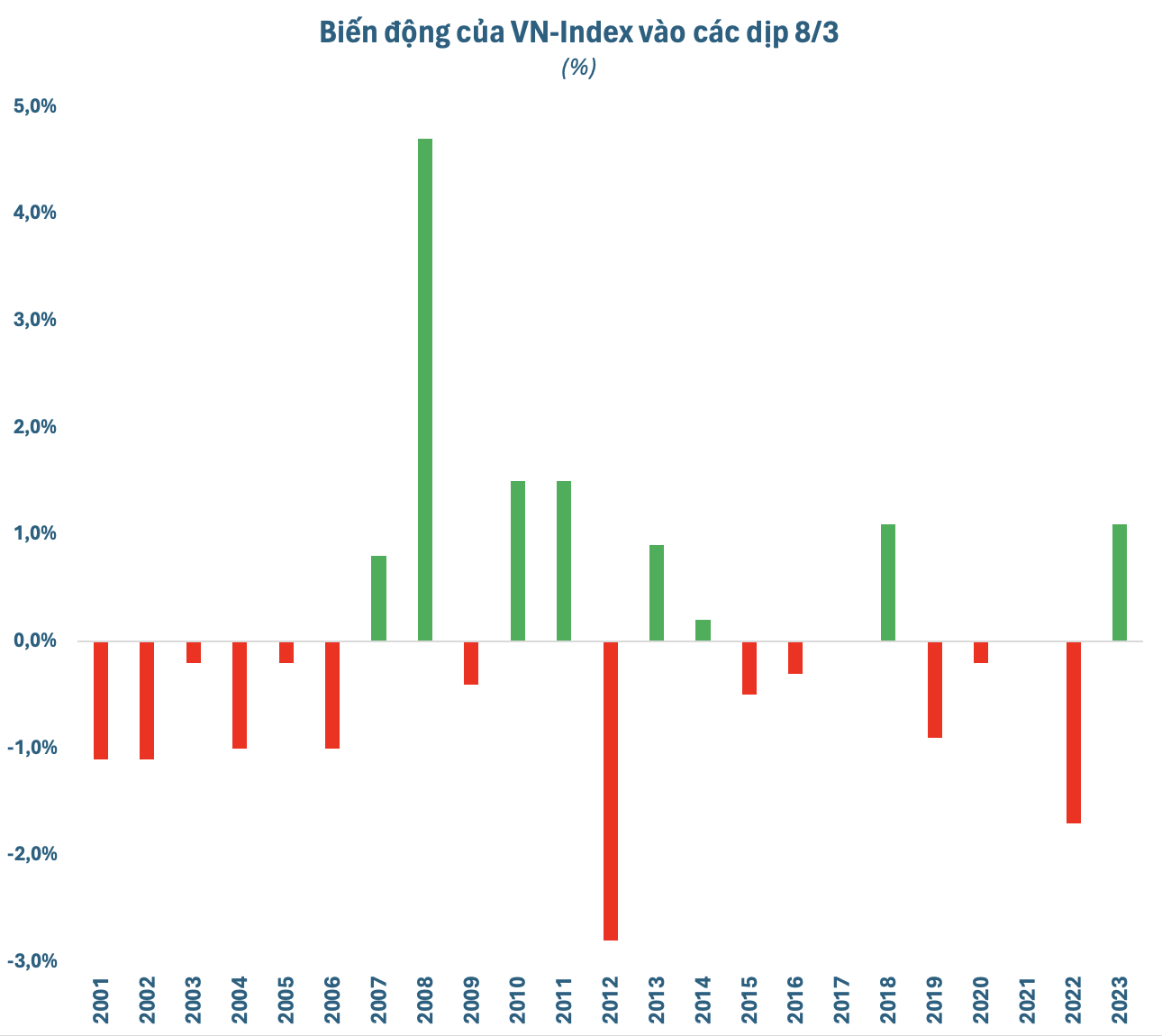

Surprisingly, historical data supports this when VN-Index has decreased 14 times on March 8 in the past 23 years (equivalent to a 60% probability). This trend continues this year as VN-Index is temporarily halted on the morning of March 8, 2024, with a decrease of more than 11 points (-0.9%). Selling pressure is evident across the board, especially in large-cap stocks.

Data from the previous session if March 8 falls on a weekend

Prior to that, the market had a relentless upward trend since mid-December 2023 with hardly any noticeable corrections. Many stocks have surged by tens of percent, even several times, in the past 3 months. Therefore, profit-taking pressure is understandable after VN-Index reached its 18-month highest peak, coinciding with March 8.

However, all statistics are only for reference purposes and the market reality still has the afternoon session to expect a rebound. Furthermore, March is usually a favorable time for Vietnamese stock investors.

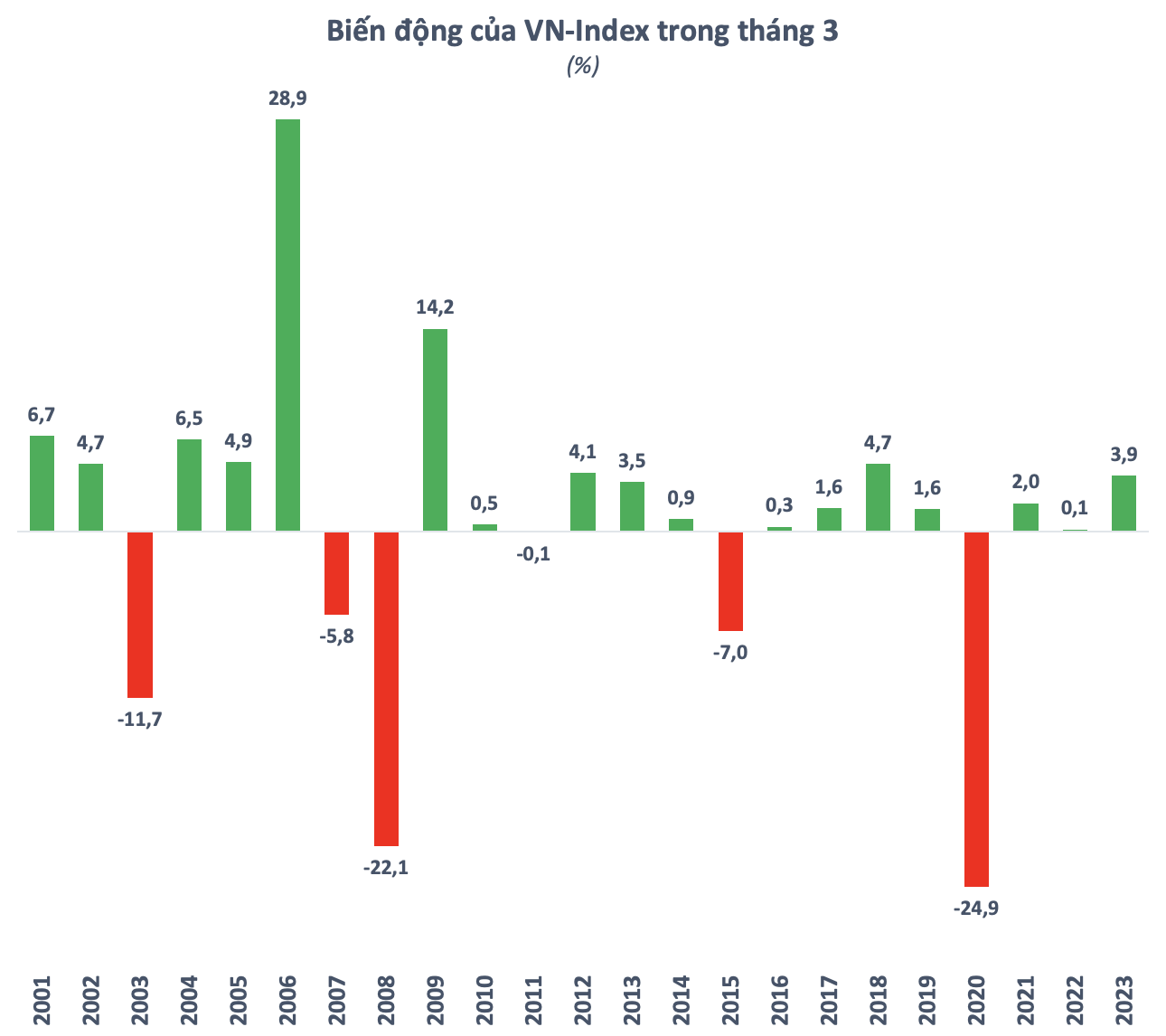

According to statistics from the past 23 years, VN-Index has increased 17 times in March, corresponding to a 74% probability. This makes March the month with the highest probability of gaining points in the year. However, in the past decade, the stock market has typically not surged too strongly during this period (below 5%).

In contrast, the Vietnamese stock market has only declined twice in March in the past 10 years, but both declines were significant. Particularly in 2020, VN-Index even lost up to 24.9% in March, hitting a long-term bottom due to Covid.

In general, March is usually a period for companies to prepare for the Annual General Meeting of Shareholders. Business plans, dividend distributions, capital increases through issuances, and offerings are disclosed in meeting documents and significantly impact stock movements. Additionally, information related to estimated first-quarter business results also has a certain impact on the market.

It is difficult to accurately predict the market trend in March, but the overall prospects for 2024 are highly regarded by large organizations. At the Investor Day held earlier this year, Mr. Le Anh Tuan – Director of the Securities Division at Dragon Capital, said that the stock market has more bright spots than in 2023.

The expert from Dragon Capital believes that VN-Index is in a recovery cycle with convergence of factors such as low interest rates, stable macroeconomic conditions, and the beginning of profit growth. In this cycle, investors can achieve superior returns of over 20%. In the recovery cycle, high-beta sectors with high volatility will perform well.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)