Stock Shares of Industrial Leader Surging

After a slow start to the year, the BCM shares of the Industrial Investment and Development Corporation – Becamex IDC unexpectedly surged to the level of 69,000 VND per share, marking 5 consecutive price gains for BCM. Trading volume also exploded in the session with a record-breaking trading value of 1.9 million shares.

The “kingpin” of Industrial Parks leveraged the company’s market capitalization to increase by an additional 6.2 trillion VND in just five trading sessions to reach 71.415 trillion VND, equivalent to 2.8 billion USD.

The surge of the BCM shares is believed to stem from expectations about the company’s industrial park projects.

During a spring meeting between the Government’s Standing Committee and prominent state-owned enterprises held on March 3, Mr. Quang Van Viet Cuong – Deputy General Director of Becamex IDC, revealed that the company had completed its preliminary studies on industrial park projects in Tay Ninh and other provinces and cities. The leader stated that Becamex IDC aims to strive to become a company with a stock market capitalization of more than 5 billion USD after 2025.

In a related development, Becamex IDC was recently presented with an Investment Memorandum by the provincial People’s Committee of Binh Thuan for the Becamex VSIP Industrial Park – Urban Area – Service project at the end of February. The project covers an area of 5,000 hectares with a total planned investment of 20,000 billion VND.

At the same time, Becamex IDC and CapitaLand have started the construction of the first phase of the Sycamore project with a scale of over 18,000 billion VND in Binh Duong.

Potential of “Chaebol” in Binh Duong Province

Becamex IDC is known as the “kingpin” of industrial parks in Binh Duong province and is also the leading infrastructure developer in Vietnam. The company is affiliated with the provincial People’s Committee, which owns 95.44% of the capital. The BCM shares have been traded on the UpCom since 2018 and have been listed on the HoSE since August 2020.

With 7 operating industrial parks covering a total area of over 4,700 hectares, Becamex IDC is the largest industrial park investor in Binh Duong province with over 30% of the market share at the provincial level and the third-largest in Vietnam with 3.6% of the national market share.

Among the list of Becamex IDC’s member units, there are many well-known names on the stock market such as Becamex Trading and Development Joint Stock Company (HoSE: TDC), Becamex IJC (HoSE: TDC), Becamex ACC (HoSE: ACC), Becamex BCE (HoSE: BCE), …

Among them, VSIP – a joint venture between Becamex IDC and Singaporean enterprises, with Becamex IDC owning 49%, is especially noteworthy. With 12 projects nationwide covering a total area of over 10,000 hectares, VSIP has become a leading developer of integrated industrial parks and urban areas in Vietnam.

In terms of industrial park real estate, Becamex IDC currently has 6 Industrial Parks including My Phuoc Industrial Park, with 3 phases covering a total area of 3,429 hectares; Vietnam – Singapore Industrial Park, consisting of 6 industrial parks with a total area of 6,000 hectares, with the company owning 49%; Thoi Hoa Industrial Park and Urban Area, covering 956 hectares; Bau Bang Industrial Park, covering 2,000 hectares; Binh Duong Industrial – Urban Area – Service Complex, covering 4,196 hectares; and Becamex – Binh Phuoc Industrial Park, covering 4,300 hectares.

In addition to industrial park business, Becamex is also active in developing real estate projects with the goal of providing services and housing for experts and workers. Some notable projects are My Phuoc Residential Area, Thoi Hoa, Bau Bang, VietSing, … In addition, Becamex is also intensively developing commercial projects, of which notable projects are the Binh Duong New City (1,000 hectares) and Becamex City Center (6 hectares).

With a large number of large-scale projects and land spanning across different locations in Binh Duong province, Becamex IDC has been dubbed as a “chaebol” of the province. In recent times, in order to expand the scale and meet the sustainable development trend, Becamex IDC has been implementing projects in other provinces and cities such as Binh Dinh, Long An, Binh Phuoc, Binh Thuan.

In addition, Becamex Corporation and VSIP have successfully developed Industrial Parks in the Northern and Central provinces such as VSIP Bac Ninh, VSIP Hai Phong, VSIP Hai Duong, VSIP Nghe An, VSIP Quang Ngai.

Bright Prospects of Industrial Park Real Estate

In addition to being the number one position, what makes BCM’s advantage comes from the attractive story of the industrial park real estate group. The positive factors come from the shift in investment capital flow, FDI attraction policies, along with improved infrastructure and stable tax policies, which are considered bright points for the industrial park real estate group, including BCM.

With an open economic foundation, combined with the government’s special policies to develop industrial parks, Shinhan Securities believes that the prospects for industrial park real estate will continue to be positive.

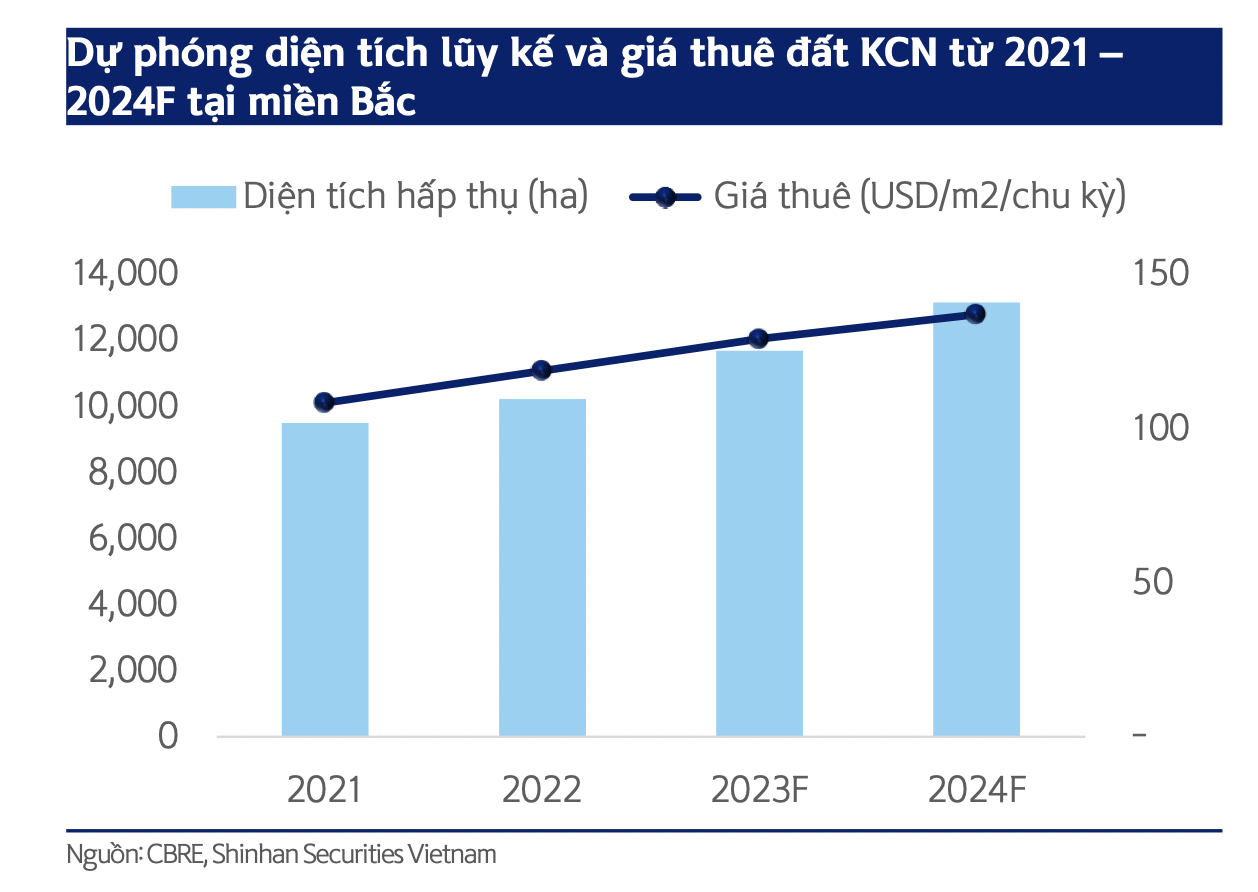

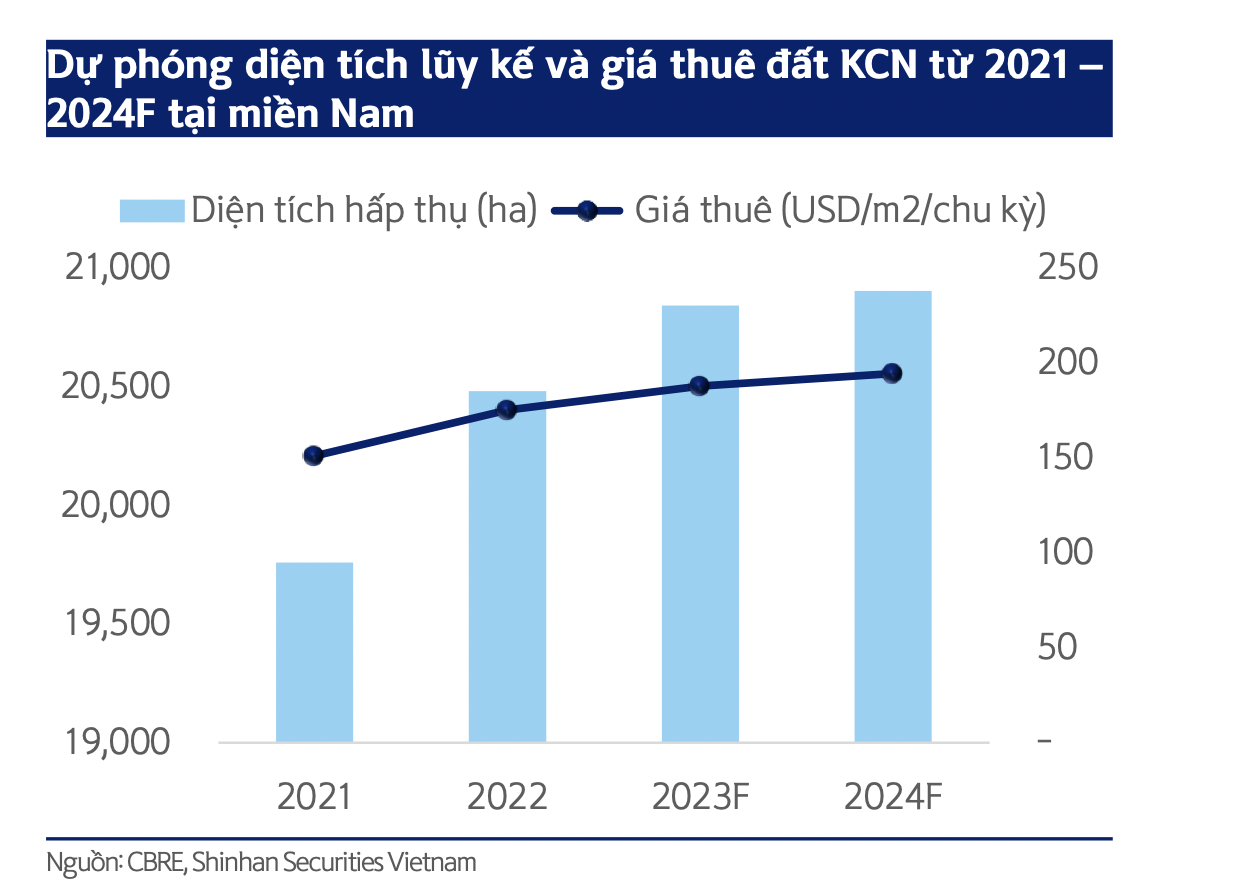

According to CBRE’s report, the industrial park area in the North and South is expected to increase by an additional 3,700 hectares and 9,800 hectares, respectively. The price of industrial park land is projected to continue to grow stably at a rate of 5% – 10% per year in the future thanks to stable rental demand, high occupancy rates, and stable FDI inflows into Vietnam.

ACBS Securities estimates that BCM’s revenue in 2024 is projected to be around 7,800 billion VND, a decrease of 3.1% compared to the previous year, and its net profit is estimated to be nearly 2,500 billion VND, an increase of 6.5% compared to the previous year. In which, revenue from industrial parks is expected to grow by 74% due to the operation of the Cay Truong Industrial Zone, while revenue from real estate projects is expected to decrease by half due to the abnormal revenue from the transfer transaction of 18.9 hectares in the Binh Duong New City.

ACBS estimates that the profit from BCM’s joint ventures and affiliates could increase by nearly 30%, mainly thanks to the new industrial park projects of VSIP (VSIP Bac Ninh 2, VSIP Nghe An 2, VSIP Can Tho – G1, and VSIP Quang Tri with a total area of nearly 1,500 hectares) which will start leasing from 2024.

Looking back at 2023, Becamex achieved approximately 8,200 billion VND in revenue, an increase of nearly 25% compared to the previous year. The after-tax profit of the company was about 2,314 billion VND – the highest level from 2020 until now.