Illustration photo

According to preliminary statistics from the General Department of Customs, Vietnam’s rubber exports in January reached 210,327 tons, equivalent to a value of over $296 million, up 55.8% in volume and 62.3% in value compared to the same period in 2023.

The average export price reached $1,410 per ton, an increase of 56% compared to January 2023.

In terms of market, China has been Vietnam’s largest rubber market for many years, accounting for up to 91% in 2023. In January 2024, Vietnam exported 167,814 tons of rubber to China, earning over $232.9 million, up 56% in volume and 64% in value compared to the same period last year, accounting for 79% of the output.

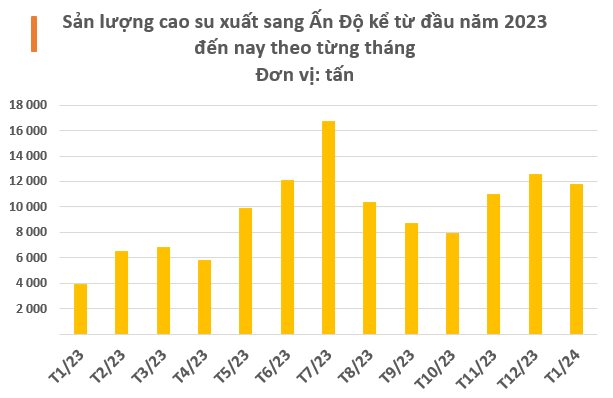

Notably, among the top three major markets of Vietnamese rubber including China, India, and South Korea, the Indian market is witnessing the strongest growth and prices are also surging in January. Specifically, Vietnam exported 11,836 tons of rubber to India and earned over $17.6 million, an increase of over 200% in volume and 225% in value compared to the same period last year, accounting for 5.6%.

Source: General Department of Customs

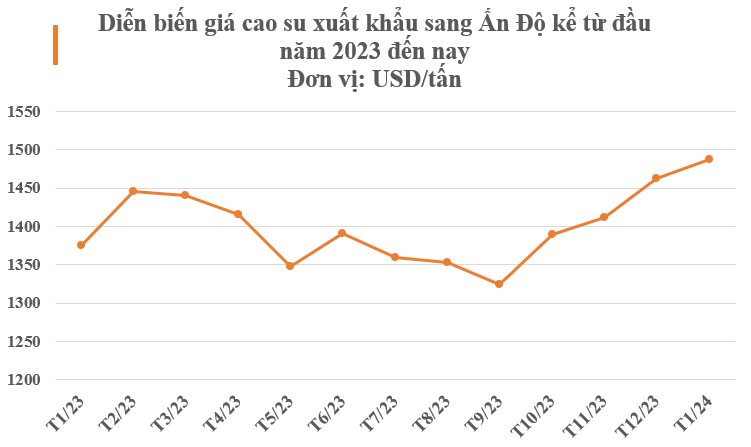

The average export price reached $1,488 per ton, an increase of 8.2% compared to January 2023.

Source: General Department of Customs

The Korean market ranked third with 5,331 tons, equivalent to $8.23 million, a sharp increase of 136.7% in volume, 138.5% in value, and 0.8% in price compared to January 2023, accounting for 2.5% of the total rubber export output of the country.

India ranks as the sixth-largest producer of natural rubber in the world (after Thailand, Indonesia, Vietnam, China, and Malaysia) and the third largest consumer of this product. Combining natural and synthetic rubber, India ranks fourth in the world in consumption after the US, China, and Japan.

With the world’s second-largest population of 1.2 billion people, this country is emerging as a large market for rubber products, including imports. The average per capita consumption is only 1 kg, while in the US, EU, and Japan, the average consumption is 14 kg.

In 2023, Vietnam’s rubber exports to India reached over 112.66 thousand tons, valued at $156.68 million. Indonesia, South Korea, Thailand, Malaysia, and Vietnam are the top 5 largest rubber suppliers to India. Except for Malaysia and Vietnam, the amount of rubber imported from the other three markets increased in both volume and value compared to the same period in 2022.

Vietnam mainly exports natural rubber to India. Among them, the SVR 10 type is the most exported to India, accounting for 54.85% of the total volume of rubber exported to India in 2023. The second is the SVR 3L type, followed by RSS3.

According to the Ministry of Agriculture and Rural Development, in 2023, the rubber tree area nationwide reached 910.2 thousand hectares, a decrease of 8.4 thousand hectares compared to 2022; the dry rubber latex production reached 1.29 million tons, a decrease of 46.2 thousand tons compared to 2022.