A store introducing and selling rice products of FHN. Source: FHN

|

Specifically, this decision was made by the Hanoi Stock Exchange (HNX) based on the review of Vihafood Joint Stock Company’s 2023 financial statements (UPCoM: FHN), which were fully accepted by VACO Audit Company.

It has been exactly one year since the HNX included FHN stock in the warning category due to the company’s financial statements receiving a qualified opinion from an external auditor for more than three consecutive years as prescribed.

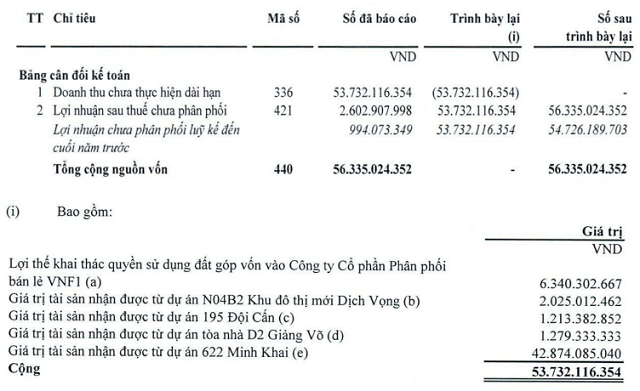

According to FHN’s financial statements for the years 2020-2022, an external auditor had given a qualified opinion on two issues. Firstly, the value of real estate received by the company from business cooperation agreements arising from before 2020, totaling more than 53 billion VND, had not been recognized as revenue upon receipt but had been recorded under the “Unearned long-term revenue” item and allocated to other income over the estimated useful life of the assets.

In explaining this matter, FHN stated that, at the time of receiving the real estate, the company did not have cash flow to recognize as revenue and distribute dividends.

Therefore, to ensure prudence in accounting, FHN recorded the value of the received real estate under the “Unearned long-term revenue” item and allocated it to other income over the estimated useful life of the assets (from 25 to 40 years), as the company had received products in the form of houses and architectural structures, which are fixed assets and do not have a monetary value.

At the same time, FHN fully complied with tax obligations related to the total value of the received real estate, as confirmed in the 2021 tax inspection report.

The second issue is similar, concerning the value of the exploitation rights contribution to VNF1 Retail and Distribution JSC, totaling more than 14 billion VND, which had not been recognized as revenue at the time of the contribution but had been presented under the “Unearned long-term revenue” item.

Mr. Nguyen Van Huong, Member of the Board of Directors and CEO of VNF1 Retail and Distribution JSC, speaking at the inauguration ceremony of the online Food Distribution and Sales Center in Tuyen Quang city. Source: Vinafood1

|

FHN stated that, as of the end of 2022, the accumulated losses of VNF1 Retail and Distribution JSC amounted to 76 billion VND, and the company had never distributed dividends to shareholders. At the same time, the company allocated a portion of the value of the exploitation rights of this real estate to its income, totaling 7.8 billion VND.

The company believes that the remaining 6.3 billion VND of the real estate exploitation rights under the “Unearned long-term revenue” item as of the end of 2022 will be used to offset the corresponding financial investment reserve obligations in VNF1 Retail and Distribution JSC in the following years, to ensure no impact on the unit’s annual business results and the interests of shareholders. At the same time, FHN has fulfilled tax obligations related to this contribution.

However, on the 2023 financial statement, the unit has made an adjusting entry, recording the entire remaining value of the exploitation rights of the real estate and the remaining value of the received real estate as of the previous years’ business cooperation agreements in the “Undistributed profit carried forward until the end of the previous year.”

FHN has also received an administrative penalty decision on tax violations from the Hanoi Tax Department in October 2021 due to incorrect declarations resulting in the omission of tax payments. At that time, the company was fined 7.8 million VND in corporate income tax and was required to pay the missing tax amount of 39.1 million VND, along with a late payment penalty of 3.2 million VND.

Details of the adjusting entry on FHN’s 2023 financial statement. Source: FHN

|