Vietnam Prosperity Joint Stock Commercial Bank (VPBank) has officially adjusted its savings interest rates. The new interest rate table will be effective from March 5, 2024.

VPBank has reduced the interest rate by 0.3 percentage points for deposits with terms from 1 month to 12 months.

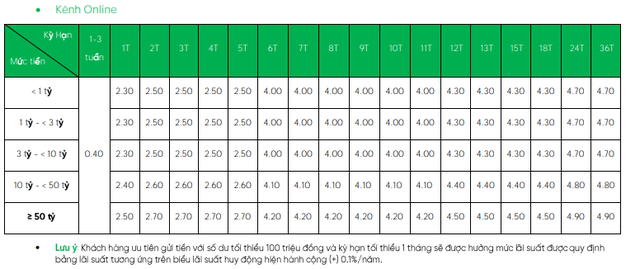

Specifically, the VPBank savings interest rate for online deposits under VND 10 billion, at 1-month term, is now 2.3% per year; for 1-5 month terms, it is only 2.5% per year; for 6-11 month terms, it is 4% per year, and for 12-18 month terms, it is 4.3% per year.

The savings interest rate for 24-36 month terms remains at 4.7% per year.

The latest savings interest rates in March by VPBank.

For customers with deposits over VND 10 billion, the interest rate is additionally increased by 0.1% per year.

For customers with deposits over VND 50 billion, the interest rate is increased by 0.2% per year for various terms compared to the savings interest rate table for customers with deposits under VND 10 billion.

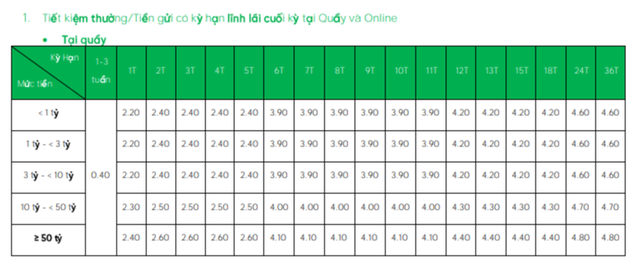

Similarly, for the savings interest rate table applicable to end-of-term interest payment at the counter, the interest rate has decreased by an average of 0.3 percentage points for various terms and remains the same for 24-36 month terms.

VPBank still maintains its preferential customer deposit policy with a minimum balance of VND 100 million and a minimum term of 1 month, enjoying the prescribed interest rate equal to the corresponding interest rate on the current rate table plus 0.1% per year.

Previously, at the beginning of March, some other banks also adjusted their savings interest rates, including BVBank, BaoViet Bank, and PGBank.