Busy import-export market at the beginning of the year

According to the latest data from the General Statistics Office, in February 2024, the total import and export turnover of the country reached $48.54 billion, down 25.8% compared to the previous month and down 1.8% compared to the same period last year. However, the total import and export turnover for the first 2 months of 2024 reached $113.96 billion, up 18.6% compared to the same period last year, in which exports increased by 19.2% and imports increased by 18%. The trade balance of goods exports is $4.72 billion surplus.

The import-export market has become bustling with many industries such as automobile, agricultural products, aquaculture products, textiles, footwear, etc.

This can be considered as a good start for import-export activities this year. According to experts, the global and domestic economic context has become more positive. The US Federal Reserve (FED)’s announcement of ceasing interest rate hikes and considering reducing interest rates in 2024 will boost consumer spending, not only in the US but also globally.

However, in a still unpredictable economic context, import-export businesses still have concerns, not only the risk of declining orders but also concerns about costs. Optimizing resources, saving costs and time are extremely important for businesses at this time, especially after a difficult period during the global pandemic in 2020 – 2022 and global economic downturn in 2023.

ACB accompanies import-export businesses

Many banks offer solutions to help import-export businesses optimize their business operations and seize opportunities in 2024. ACB Bank stands out with changes in service policies to help customers save costs, time, facilitate transactions and enhance market reputation.

In addition to providing capital funding with various incentives for customers, ACB also provides international guarantee services, international payment services with competitive fees for import-export businesses. Especially in the export-import field in “difficult” markets with stringent standards, complex customary procedures, and high trade promotion costs, in order to achieve optimal efficiency, businesses need to have thorough preparation and understanding of procedures and processes. The bank’s advisory team plays a crucial role in helping businesses arrange and prepare valid documents and negotiate payment terms to ensure peace of mind when conducting professional transactions with foreign partners at competitive fees.

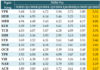

Since February 19, 2024, ACB Bank has also applied new international payment fees with competitive policies. The bank offers a prepaid transfer fee package, helping customers save up to 50% on costs.

With strong investment in digital transformation, ACB customers can make international payments on multiple transaction channels such as ACB One Biz, ACB One Pro, mail/fax transactions, and fast counter transactions. On the leading technology platform, transactions are made through simple, secure, and efficient digital channels that save time. Customers can instantly see the results of their money transfers. ACB meets the Swift GPI standard and can provide real-time notifications when the beneficiary receives the money.

In addition to international payment incentives, businesses are also completely exempt from 100% domestic account service fees on online channels, including: VND transfer fees in/out of the system, salary payments/lot transfers, and other account service fees. This program applies to businesses opening accounts at ACB under the ACB ZERO FEE solution.

ACB provides diverse international guarantee services with competitive collateral policies in the market

In addition to international payment services, guarantee is also an essential product for import-export businesses. Currently, ACB provides diverse guarantee services, ensuring trust for customers including: tender guarantee, contract performance guarantee, advance payment guarantee, payment guarantee, warranty guarantee, loan guarantee and other commitment guarantees as needed. The bank’s guarantee services meet the needs of businesses in various fields, suitable for the characteristics of each industry. What’s more attractive, ACB is applying very competitive collateral policies in the market with high collateral rates, with collateral reserve ratios starting at 0%.

Trading with ACB will offer the opportunity to own luxury cars

In addition, at the beginning of the year, ACB is offering a major promotion program “Tet with ACB: Gifts arrived too fast” for participating customers to have a chance to win valuable prizes. Specifically, from February 8 to March 25, 2024, with each new disbursement, international payment or guarantee generating fees accumulated from VND 3 million, customers will receive regular lottery numbers, with a chance of becoming the next owners of attractive prizes in the second draw on April 4, 2024. Prizes include: 01 Mercedes C-Class car, 01 gold 9999 and 03 Visa Debit cards worth VND 100 million/ card.

Prior to that, the first regular lottery draw took place on February 19 and found the owners of the first Mercedes C-Class car and Visa Debit card among a number of businesses currently transacting at ACB. There are still many gifts and opportunities awaiting customers in the second draw. For details and regulations, please refer to the website: https://uudai.acb.com.vn

According to experts, although there are still many difficulties, the prospects of the import-export market in 2024 are quite positive. Therefore, the bank’s sharing will help businesses have more momentum to regain their growth.