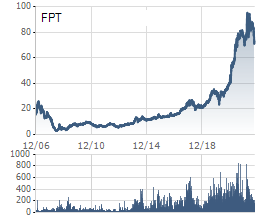

FPT is currently the leading technology corporation in Vietnam with a market value of up to 141 trillion VND. However, before entering the current booming period, FPT also took 10 years to return to the company’s value at the time it went public.

Since its listing, FPT has been valued at around 24 trillion VND, and in just over a month, the company’s market capitalization has risen to over 39 trillion VND.

However, this rapid prosperity did not last long. The 2008 economic crisis and internal issues of FPT caused the company’s value to plummet. By June 2008, the company’s value was only about 4,500 billion VND, a decrease of around 88% compared to its peak at the beginning of 2007.

In the book “FPT 35-year Chronicle,” Hoang Nam Tien – a member of FPT’s founding council – compared FPT to a “sudden rich” disease – a disease that suddenly has a lot of money. FPT fell into a state of “thinking that it was too good, so good that it could do anything.” Therefore, FPT went on to open a bank, a securities company, establish an investment fund, and invest in real estate. “Strangely enough, all of those failed,” Tien exclaimed.

FPT Securities needs to be restructured

In 2007, in the context of the Vietnamese stock market being in the most explosive and fastest developing phase, FPT Securities Joint Stock Company (FPTS) was established in 2007, with a charter capital of 200 billion VND and registered capital of 135 billion VND. FPTS identified online trading as the focus and the target for its development process. The company also achieved early success, after 3 months of conducting surveys at all stock exchanges, investors voted FPTS as the best securities company in January and February 2008.

However, in 2008, due to the impact of the financial crisis, the stock market experienced a severe decline, leading to FPTS incurring losses during the year. Faced with difficulties, the company had to cut staff and carry out a series of restructuring activities.

Failure in financial investments

In 2007, FPT also established FPT Investment Fund Management Joint Stock Company (FPT Capital) as the first fund management company established under the new Securities Law in 2006 and had the largest charter capital in the Vietnamese market at that time (110 billion VND).

On November 27, 2007, SoftBank Investment Holdings (SBI) and FPT signed an agreement to establish the Vietnam-Japan Investment Fund. Excluding the Vietnam-Japan Investment Fund, at that time, FPT Capital managed assets of over 600 billion VND.

FPT Capital participated in numerous real estate projects such as the 109 Tran Hung Dao project, the 136 Ho Tung Mau project, the Nam An Khanh urban area project, etc. The economic recession caused the real estate market to decline significantly and freeze. FPT Capital’s investment projects faced difficulties, and the entrusted investment activities failed to attract more customers.

Since 2012, the positions of Chairman of the Board of Directors and General Director of FPT Capital have been held by people from SBI. As of December 31, 2023, FPT only retained 25% of the charter capital of FPT Capital.

FPT Real Estate Company ceases operations

FPT Land encountered many difficulties right from its early years of business. In 2008, FPT Land had a very difficult and disappointing year. No new projects were launched, and existing projects were continuously adjusted and even suspended. FPT Land had to cut more than 30% of its workforce.

Trinh Ngoc Bien (Deputy Director of FPT Land HCM) then saw that 2009 would be no better. With no new projects developed and projects serving the infrastructure of the Group not different from the previous situation, FPT Land’s people were questioning their existence. By October 31, 2011, FPT Land officially ceased all activities.

“Handing over” TPBank

In 2008, FPT Commercial Joint Stock Bank (TPBank) was officially granted a license to establish and operate by the State Bank of Vietnam with the name TPBank and a charter capital of 1,000 billion VND. FPT was considered the main founder with 15% ownership equivalent to 150 million shares at that time. Other founding shareholders were Vinare National Reinsurance Corporation, VMS MobiFone, and some individual shareholders.

With high expectations, however, just after 4 years of operation, TPBank fell into a weak state with gradually declining net interest income each year, even negative net interest income in the quarters of 2011.

In 2011, TPBank was classified by the State Bank as a weak bank requiring restructuring with a loss equivalent to 50% of charter capital and bad debts exceeding 6%. Recognizing the investment opportunity, the DOJI group bought 20% of TPBank’s shares and became the strategic shareholder of the bank.

According to FPT’s 2011 Financial Report, FPT still held 16.9% of the ownership at TPBank, but the investment in TPBank has been transformed into a financial investment by FPT, no longer consolidated in the financial statements as in previous years. This action showed that FPT officially “handed over” the bank after 2008.

FPT Media dissolved

FPT Media was a project in FPT’s Incubator from 2004, established in 2005, and organized programs such as “Healthy Living Every Day,” “Digital Life” on VTV1.

The most notable highlight during FPT Media’s 7 years of operation was buying the broadcasting rights for the 2006 World Cup from Sohu for a record copyright fee of nearly USD 1 million. This was the first time a computer company gained exclusive distribution rights for all live coverage events of the world’s largest sporting event in Vietnam. Truong Gia Binh flew to Switzerland (where FIFA’s headquarters is located) as well as other countries to introduce FPT’s capabilities and business plans to foreign partners.

In addition, FPT Media also collaborated with Television Stations to produce many programs such as “Financial News” (VTV1), “Sunday Literature and Arts” (VTV3), “Hugo & Friends” (Hanoi Television), “Listen to Your Body” (Hanoi Television), …

While the activities were extensive, they did not bring much business success. In 2012, FPT Media announced its dissolution because the company’s business was ineffective and its goals were not achieved as desired.

Failure with FPT Mobile

In 2009, FPT’s Chairman Truong Gia Binh dreamt of having “Made by FPT” products for the mass market, for the electronic citizen community – “go mass”. In the second half of 2009, F-Mobile phones began to be produced and launched on the market, expected to be an integrated product with full applications such as media, advertising, electronic payment, e-banking, e-commerce, games, online learning, entertainment services like chat, forums, selective news reading, video sharing, etc.

2010-2011 was a glorious period for F-Mobile phones, with PR-marketing campaigns happening throughout the provinces. F-Mobile held a market share of up to 10% in Vietnam. However, like many other Vietnamese mobile phone brands, F-Mobile failed as users switched to smartphones and faced fierce competition in the market.

The product revealed many weaknesses, such as quality not being maintained, a high warranty rate, complaints from dealers, and customers turning away. FPT’s profits and reputation declined significantly. Therefore, F-Mobile was no longer invested large-scale and later completely disappeared from FPT’s business activities.

F-Mobile Phone

Ceasing online game business

FPT wanted to venture into online games since 2003 but faced difficulties. In 2007, a favorable opportunity came when FPT approached Sohu with the product “Thien Long Bat Bo” and a record high copyright fee of nearly USD 1 million. This also marked the beginning of FPT Online.

However, the online game “playground” had never been a favorable land. In just a few short years, many games had to close. The fierce market, along with FPT Online’s slow pace in changing to other platforms, led to the collapse of the “empire” that once held a lot of sentiment in the gaming community.

In September 2014, Thien Long Bat Bo parted ways with FPT. In the fourth quarter of 2014, FPT Online stopped its gaming operations, leaving much regret for the Vietnamese gaming community.