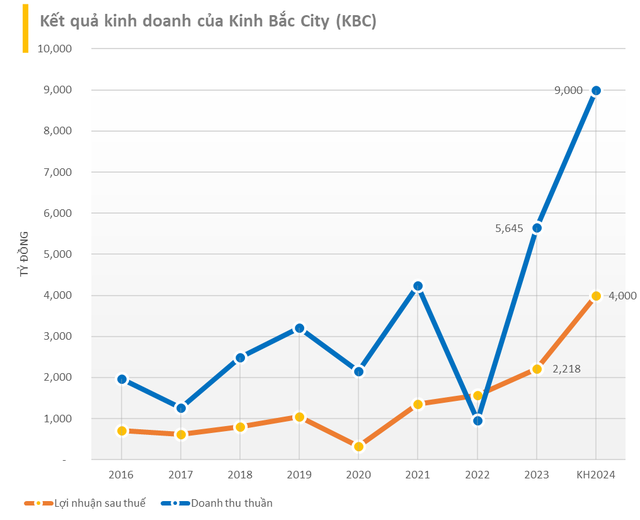

Kinh Bac Urban Development Joint Stock Company (stock code: KBC) has just announced the documents for the extraordinary shareholders’ meeting in 2024. Accordingly, the company targets a total revenue of VND 9,000 billion and a after-tax profit of VND 4,000 billion, increasing 53% and 80% respectively compared to 2023.

According to the published documents, the Board of Directors stated that the company is striving to complete the legal procedures for projects that are still lacking, which will be completed and approved from the second quarter of 2024, such as Trang Due 3 Industrial Zone, Loc Giang Industrial Zone, Phuc Ninh Urban Area, Trang Cat Urban Area, etc.

Therefore, the CEO estimates that the leased area of industrial zones in 2024 will be approximately 150 hectares from Nam Son Hap Linh Industrial Zone, Quang Chau Industrial Zone, Tan Phu Trung Industrial Zone, industrial clusters in Hung Yen, Long An and especially Trang Due 3 Industrial Zone,…

In addition, some urban projects of the company are expected to generate revenue and profits in 2024. Kinh Bac Urban Area also stated that it is carrying out the necessary legal procedures to continue to obtain approval for new projects in localities such as Bac Ninh, Thai Nguyen, Hau Giang, Can Tho, Vung Tau, with an expected total area of approximately 3,500 hectares for industrial zones and 650 hectares for urban areas.

Cancel the 2022 dividend payment plan

At the upcoming meeting, Kinh Bac Urban Development Joint Stock Company will inform shareholders of the contents that have not been completed in 2023. First, according to the Annual General Meeting resolution in 2023, the company has approved a dividend payment plan for 2022 in cash at a rate of 20% (VND 2,000 per share).

However, as of December 31, 2023, the company has not been able to implement the dividend plan in cash for existing shareholders as planned. The reason is that in 2023, the Board of Directors of the company prioritized allocating all financial resources to redeem all outstanding bonds before maturity and pre-maturity with an amount of VND 3,900 billion in principal and VND 162 billion in interest, bringing Kinh Bac’s bond debt to zero before June 30, 2023.

In addition, the Board of Directors had to arrange financial resources to ensure financial capacity to implement and expand project scale. Therefore, the Board of Directors has not been able to implement the plan to pay dividends in cash in 2023.

Therefore, Kinh Bac Urban Development Joint Stock Company will propose to cancel the plan to pay dividends in cash. The Board of Directors will propose another profit distribution plan at the Annual General Meeting in 2024.

Secondly, according to the Annual General Meeting resolution on December 28, 2022, the company approved a plan to repurchase 100 million shares to reduce charter capital, and authorized the Board of Directors to decide on all matters related to the share repurchase. Kinh Bac Urban Development Joint Stock Company stated that immediately after the resolution was approved, the company proposed several share repurchase plans.

After submitting the share repurchase report to the State Securities Commission, the Board of Directors found that the documents were incomplete, so a resolution was issued on April 17, 2023 to withdraw the share repurchase report. However, during the process of completing the documents, the securities market also showed positive developments, and the KBC share price also followed an upward trend and maintained a price of over VND 30,000 per share, close to the purchase stop price. Therefore, the Board of Directors has not continued to implement the share repurchase plan in 2023.

In addition, many projects of Kinh Bac need to accelerate investment again. Therefore, the Board of Directors will propose to cancel the plan to repurchase shares to reduce charter capital to ensure the financial capacity of the company for expansion and participation in new projects.