Decision Lab, the exclusive partner of YouGov in Vietnam, has just released the ranking of the best retail brands in 2024, including a list of the brands with the best brand health and the brands with the most improvement in the past year.

The brands are ranked according to the Index score from YouGov BrandIndex. This score evaluates the overall brand health, based on the average scores of factors like Impression, Quality, Value, Satisfaction, Recommendation, and Reputation.

The top 3 in the ranking of the best retail brands all belong to the electronics industry. Leading with a score of 32 is The Gioi Di Dong – a chain of mobile phone and digital device retailers. Also from The Gioi Di Dong (MWG), Dien May Xanh – a chain of household electrical device retailers – holds the second place with a score of 28.1. FPT Shop has improved its ranking by 2 positions and is currently in third place.

Go! (Big C) ranks fourth, dropping one place compared to the previous year.

While supermarkets and grocery stores have seen a decrease in their Index scores, the food retail chain of MWG – Bach Hoa Xanh – has a strong increase, jumping up 2 positions and ranking fifth.

Pharmacity maintains its sixth position with a score of 17.9. Other brands in the top 10 include WinMart (seventh), Saigon Co.op (eighth), Nguyen Kim (ninth), and Viettel Store (tenth).

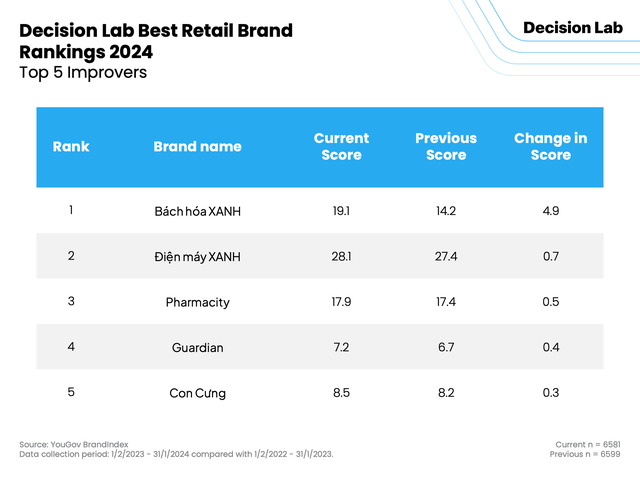

In addition, Decision Lab also announced the top 5 brands with the highest improvement in scores. 3 out of 5 of these brands are also in the top 10 brands with the highest scores.

Bach Hoa Xanh leads the ranking with an impressive increase of 4.9 points. Other brands have seen slight increases in their scores. Dien May Xanh and Pharmacity respectively rank second and third.

The beauty and healthcare product retail chain Guardian has increased by 0.4 points and ranks fourth. Con Cung, a retailer for mother and baby products, is the last name in the top 5 thanks to an additional 0.3 points.

Looking at both rankings from Decision Lab, we can see that MWG still asserts its brand strength in the retail market, despite the poor business results last year. Throughout 2023, MWG recorded a revenue of 118,280 billion VND (completing 88% of the annual plan), a decrease of 11% compared to 2022. After-tax profit was only about 167 billion VND, the lowest level for the company since 2013.

In 2024, MWG aims for a revenue of 125,000 billion VND, and an after-tax profit of 2,400 billion VND, an increase of 5% and 14 times respectively compared to the same period last year. In a recent meeting with investors, Mr. Nguyen Duc Tai – Chairman of MWG’s Board of Directors – said that the target profit of 2,400 billion VND is not a high number.