The US stock market ended the week on a down note as investors took profits in Nvidia shares and faced conflicting signals from the jobs report. Crude oil prices also declined for the week, while bitcoin maintained its upward trend and set a new record above $70,000.

At the close, the S&P 500 fell 0.65% to 5,123.69. The Nasdaq dropped 1.16% to 16,085.11. Both benchmarks hit intraday records before finishing in the red. The Dow Jones slipped 68.66 points, or 0.18%, to 38,722.69.

All three indexes ended the week lower. The S&P 500 fell 0.26% for the week, while the Dow and Nasdaq slid 0.93% and 1.17%, respectively. It was the Dow’s worst weekly performance since October 2023.

Nvidia was the biggest drag on the market, with investors cashing in on the chip giant after its recent surge. The AI-focused company closed down over 5%, marking its biggest decline since late May.

However, Nvidia still gained over 6% for the week, extending its impressive rally that has added $1 trillion in market value since the start of the year.

“This pullback doesn’t mean the long-term upward potential of Nvidia has diminished. It’s just that the stock has risen too fast. Investors have been overbuying, and now it’s time for them to take profits,” said Sam Stovall, chief investment strategist at CFRA Research, about Nvidia’s decline.

While Nvidia weighed on the tech sector, Apple helped limit losses with a 1% gain. The tech giant ended a seven-session losing streak, the longest of the year, and finished the week down nearly 5%, making it the weakest Dow component for the week.

Investors also digested the February jobs report from the Labor Department. The much-anticipated report delivered conflicting signals about when the Federal Reserve may begin tapering its bond purchases.

The data showed the US nonfarm payrolls added 275,000 jobs in February, higher than economists’ forecast of 198,000 in a Dow Jones survey. The strong figure suggests the economy may still be hot.

However, the unemployment rate unexpectedly ticked up to 3.9% on more people entering the labor force and wage growth came in weaker than expected. These are signs that inflation has cooled enough to convince the Fed to start cutting rates. Additionally, January’s job growth was also revised lower.

“Overall, you can take whatever message you want out of today’s jobs report. But we think the data still leans positive and will give the Fed the confidence to modestly reduce rates,” said George Mateyo, director of investment at Key Private Bank.

In the oil market, US crude oil prices fell $0.92, or 1.17%, to close at $78.01 per barrel in New York. Brent crude dropped $0.88, or 1.06%, to settle at $82.08 per barrel in London.

Crude prices declined this week on concerns about weakening energy demand in China and the International Energy Agency’s forecast that the oil market is well supplied. Brent fell nearly 1.8% for the week and WTI dropped nearly 2.5%.

Chinese crude oil imports slumped about 5.7% to 10.8 million barrels per day in the first two months of the year from 11.44 million barrels per day in December, according to S&P Global Commodity Insights.

“Disappointing signs continue to point to a lack of recovery for China’s oil demand. It’s hard to try to maintain these levels and go higher. WTI will have a hard time getting back above $80,” said John Kilduff, portfolio manager at Again Capital.

This week, a senior official at the International Energy Agency told Reuters that the global oil market will have ample supply this year.

During their congressional testimonies on monetary policy this week, Federal Reserve Chair Jerome Powell signaled the possibility of interest rate cuts this year. While rate cuts are supportive of oil demand, the Fed only cuts rates when the economy is showing signs of weakness – not great news for oil prices, Kilduff noted. He said this was a factor causing oil prices to fluctuate this week.

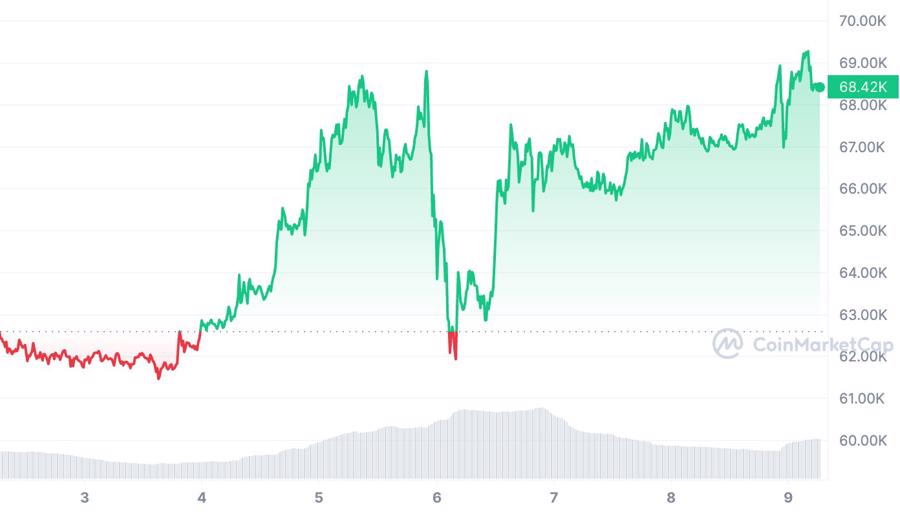

In the cryptocurrency market, the price of bitcoin hit a new all-time high above $70,000 per ounce. This record was set after bitcoin surpassed the previous high of nearly $69,000 established at the end of 2021.

As of early morning Vietnam time, the price of bitcoin stood at around $68,400, up 2% from 24 hours ago and up over 9% for the week. The market capitalization of this cryptocurrency at the same time reached over $1.34 trillion, accounting for a total cryptocurrency market capitalization of $2.59 trillion, according to Coinmarketcap.com.

Analysts believe that bitcoin’s bullish momentum is strong, supported by investor enthusiasm for the upcoming US bitcoin ETFs and the halving event set to take place in April.