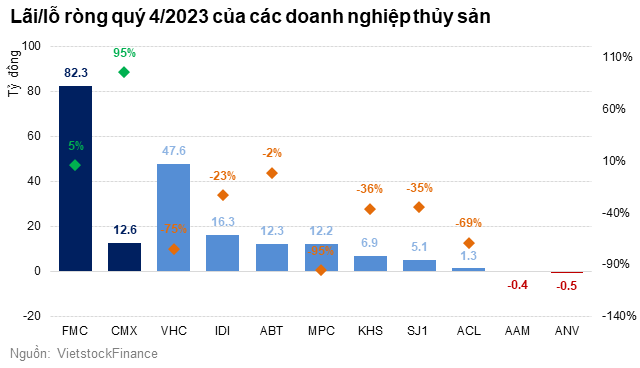

According to VietstockFinance, the net profit of 11 seafood processing companies in the fourth quarter of 2023 (excluding BLF as the financial statements have not been released) reached VND 196 billion, an increase of 28% compared to the same period last year. In the third quarter of 2023, the net profit of 12 seafood companies on the exchange decreased by 74% compared to the same period.

In the shrimp group, FMC (FMC) and Camimex Group (CMX) had the most positive profit growth, recording VND 82 billion and VND 13 billion respectively, corresponding to increases of 5% and 95% compared to the same period last year. However, the accumulated net profit of these two companies declined from the beginning of 2023. FMC reached VND 278 billion (-11%), while CMX reached VND 51 billion (-22%).

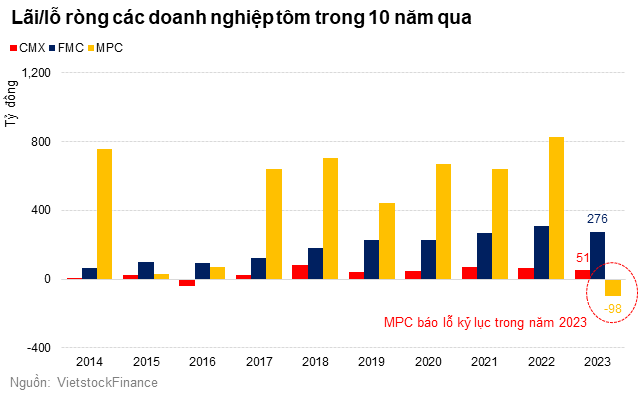

Another major player in the shrimp industry, Minh Phu Seafood (MPC), reported a record loss of nearly VND 100 billion in 2023, mainly due to the profit of the second quarter (VND 11 billion) and the fourth quarter (VND 12 billion) not enough to compensate for the heavy losses in the first quarter (VND 97 billion) and the third quarter (VND 23 billion).

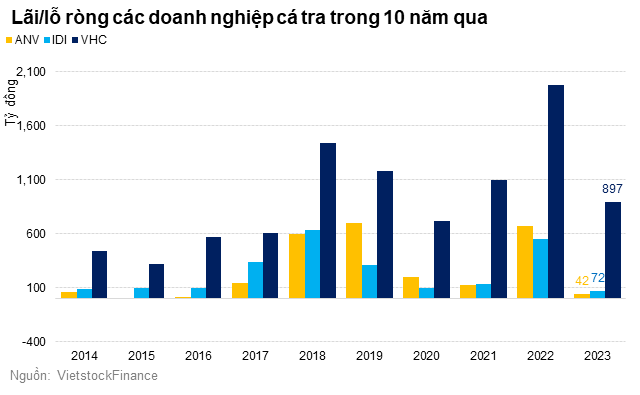

Most of the catfish companies saw a decline in business results in the fourth quarter of 2023. Facing difficulties in the US market, Vĩnh Hoàn (VHC) only achieved nearly VND 48 billion in net profit, a decrease of 75% compared to the same period. Throughout 2023, this figure was VND 897 billion, a decrease of 55% compared to the record high of the previous year.

IDI (Investment and Development Corporation) reported a 87% decrease in net profit in 2023 compared to the previous year, reaching VND 72 billion. The company’s sales of catfish in 2023 decreased by 19%, while sales of fishmeal and fish oil decreased by 2%. On the other hand, IDI’s interest expense remained high in the past year, recording VND 362 billion (+55%).

With the worst result in the fourth quarter of 2023, ANV (Nam Viet Joint Stock Company) incurred a net loss of over VND 518 million. Net revenue was VND 1,111 billion, a decrease of 3%. Specifically, domestic market revenue increased by 80% (VND 369 billion) but it was not enough to offset the 21% decline in exports (VND 742 billion). From the beginning of 2023, ANV had a net profit of VND 42 billion, a decrease of 94% compared to the previous year.

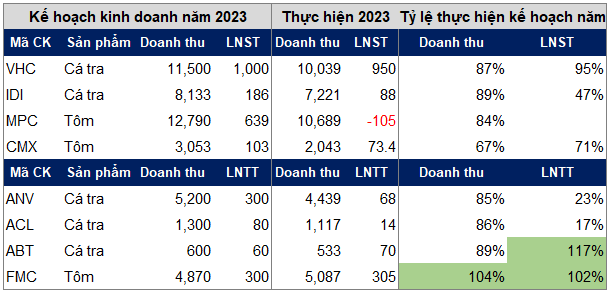

In the context of declining business results, most seafood companies did not meet their annual targets. FMC, in particular, exceeded its profit target by only 2% after the target was adjusted to a 25% decrease from the previous level. The only company that surpassed its annual target was ABT, which exceeded it by 17%.

|

Implementation of annual plans for seafood companies in 2023

Unit: billion VND

Source: Compilation

|

In addition to the above-mentioned companies, some other seafood companies have been suffering losses for several consecutive quarters. Cadovimex Seafood Processing and Import-Export Corporation (CAD) in particular, has had 28 consecutive quarters of negative business results. In 2023, the company incurred a net loss of VND 142 billion.

Minh Hai Seafood Processing and Exporting Company (JOS) is also notable with 13 consecutive quarters of losses. In the fourth quarter of 2023, JOS incurred a net loss of over VND 18 billion. For the whole year, the company had a net loss of nearly VND 34 billion, marking the 12th consecutive year of losses since 2012.

In 2023, the stock prices of seafood companies in general increased. The VS-Seafood sector index increased by 15%, higher than the average increase of 12% of the VN-Index. FMC (+47%) and ANV (+43%) were the two stocks with the highest price increases, while MPC (+1%) had the lowest price increase.

Entering 2024, the momentum of the seafood stock group remains strong. From the beginning of the year to February 15th, the VS-Seafood sector index increased by 3%, closely following the 6% increase of the VN-Index. Among them, some stocks such as CMX (-1%) or MPC (-2%) showed signs of slowing down at the beginning of the year.

What can we expect in 2024?

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), seafood exports will see a recovery and the situation will be more optimistic in the second half of the year. Export turnover may reach VND 9.5 – 10 billion, an increase of 6 – 11% compared to the previous year.

|

In 2023, Vietnam’s seafood exports reached USD 9 billion, a decrease of 18% compared to the previous year. The main products were shrimp, which reached USD 3.4 billion, a decrease of 22%. The US and China remained the two largest export markets in 2023, reaching USD 682 million (-15%) and USD 607 million (-9%) respectively. Exports of catfish reached USD 1.8 billion, a decrease of 25%. In particular, exports to China and the US reached USD 536 million and USD 271 million respectively, a decrease of 20% and 50% compared to the previous year. |

Although the seafood industry is expected to recover in 2024, the analysis team at SSI Research believes that the recovery rate will be slow. The analysts point out that the rate of decline in seafood exports has been gradually decreasing since the second quarter of 2023, but there has not been significant growth and the average selling price compared to the previous year is still decreasing.

For the catfish industry, SSI Research expects that the average selling price of catfish may increase again in the second half of 2024, after 2 years of decline. The volume of exports to Europe and China will partially compensate for the decrease in exports to the US in the first half of 2024, and demand from the US will recover from the second half of 2024, entering the peak season.

“The preliminary results of the anti-dumping tariff review bring prospects for Vietnam’s catfish export industry in 2024, as the tariff rate decreases by 94% compared to last year, making Vietnamese catfish more competitive when exporting to the US market” – SSI analysts stated in a recent report on the seafood industry.

Many catfish companies on the exchange have their own stories of investment expansion and capacity improvement. According to VCBS, ANV plans to continue implementing Phase 2 and Phase 3 of the C&G segment to increase annual production capacity to 1,200 and 2,400 tons; and this segment has generated revenue in the fourth quarter of 2023.

VHC has also expanded the production line of the C&G factory in the past year, with the capacity expected to increase by 50% after completion, mainly serving the European market. In mid-December 2023, the Board of Directors of VHC approved the expenditure of over VND 20.5 billion for 6 plots of land in An Giang province to expand the farming area.

According to VCBS’s report, the completion of IDI’s catfish fillet processing plant No. 3 is expected to be completed in the third quarter of 2024, increasing the total capacity of processing catfish fillets by an additional 400 tons of raw materials/12 hours/day. In addition, IDI has planned to increase self-sufficiency from 85% to 90% by increasing the capacity of the fishmeal plant to 600 tons of raw materials/day, expanding the linked farming area by an additional 450 hectares to prepare the source of raw materials when plant No. 3 is completed.

As for the shrimp industry, SSI Research predicts that domestic shrimp exporters will focus on products with added value and monthly export value is expected to increase at a slow pace. Currently, Vietnam is the 4th largest shrimp exporter in the US market (after India, Indonesia, Ecuador).

The average selling price of shrimp in 2024 may remain stable or increase slightly compared to the same period, as weak consumer demand recovery and the need to compete with countries such as Ecuador, India, Indonesia with higher discount prices.

However, the shrimp industry may face new challenges. On November 21st, 2023, the US Department of Commerce (DOC) announced the initiation of a countervailing duty investigation against imported warm-water and cold-water shrimp products from some countries, including Vietnam. This raises concerns that shrimp exports to the US will be affected.

“The lawsuit against Vietnam’s shrimp industry for subsidies from the US side will pose a significant challenge starting in 2024” – quoted from Mr. Ho Quoc Luc, Chairman of the Board of Directors of FMC, in a post on the company’s website at the beginning of 2024.

Duy Khanh