Continuous increase in apartment prices

Despite the overall difficult market conditions of the real estate sector, apartment prices have continued to rise over the years. While the new real estate market is “tentatively” hitting the bottom in the last few months of 2023, the apartment segment serving real housing needs has recovered and regained growth momentum, even maintaining a constant upward trend throughout the challenging period.

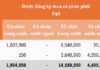

Specifically, research data from the Vietnam Association of Realtors (VARS) shows that the average apartment prices have grown by double digits each year in recent years. In 2023 alone, the apartment price index in Hanoi at the end of the year increased by 16 percentage points compared to the beginning of the year.

This index has also entered a growth cycle in Ho Chi Minh City since the third quarter of 2023, thanks to a slower price reduction trend in high-end and luxury projects in the secondary market. The average primary apartment selling price in the country is also hovering high, with most of the new supply coming to the market being products priced over 40 million VND/sqm, with almost no affordable housing projects.

Apartment projects in cities continue to set new price benchmarks, and the rental prices of old and new apartments in residential areas continue to rise. This is especially true since the middle of 2022 when rental contracts during the peak pandemic period were renewed if both parties continued to have a need. Many apartments have increased prices by up to 40% compared to the peak pandemic period, and by about 20% compared to mid-2022.

Information from VARS shows that apartment rental prices in Hanoi have increased significantly in recent years, especially for studio apartments (1-bedroom apartments) with higher profit margins compared to larger apartments.

In Long Bien district, studio apartments are now being rented at prices of 7-8 million VND/month, an increase of 10 – 15% compared to the same period last year and about 30 – 40% compared to 2022. 2-bedroom apartments, fully furnished, have higher prices with a lower increase, about 10% compared to the same period, reaching about 10-11 million VND/month.

At the Greenbay Me Tri project (Nam Tu Liem), fully furnished studio apartments are now being rented for about 10 million VND, while 2-bedroom apartments range from 14-16 million VND, an increase of over 15% compared to the same period. Rental prices for apartments in other districts have similarly increased.

Similarly, in Ho Chi Minh City, apartment rents have started to show a slight upward trend recently, especially in the inner city area, with prices ranging from 500 thousand to 1 million VND/month. Although apartment rents in Ho Chi Minh City remained stable in mid-2023, even slightly decreased in some larger apartments after a surge in rental prices when the pandemic ended.

For example, the rent for a 1-bedroom apartment in Vinhomes Golden River in District 1 has increased from 15 million VND/month to 20 million VND/month when the previous contract expired. The new price was announced by the landlord and immediately taken by someone. Projects further from the city center, such as Sunrise Riverside, New Saigon (Nha Be District) also raised their rental prices as the demand for rental properties surged.

VARS predicts that apartment rental prices will continue to increase, but at a slower pace. The prospects of the apartment market are becoming clearer as business activities are gradually fully recovering, accompanied by a strong demand for housing in major cities. In the face of the skyrocketing apartment rental prices, long-term tenants need to make appropriate decisions.