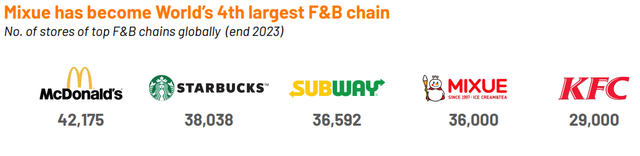

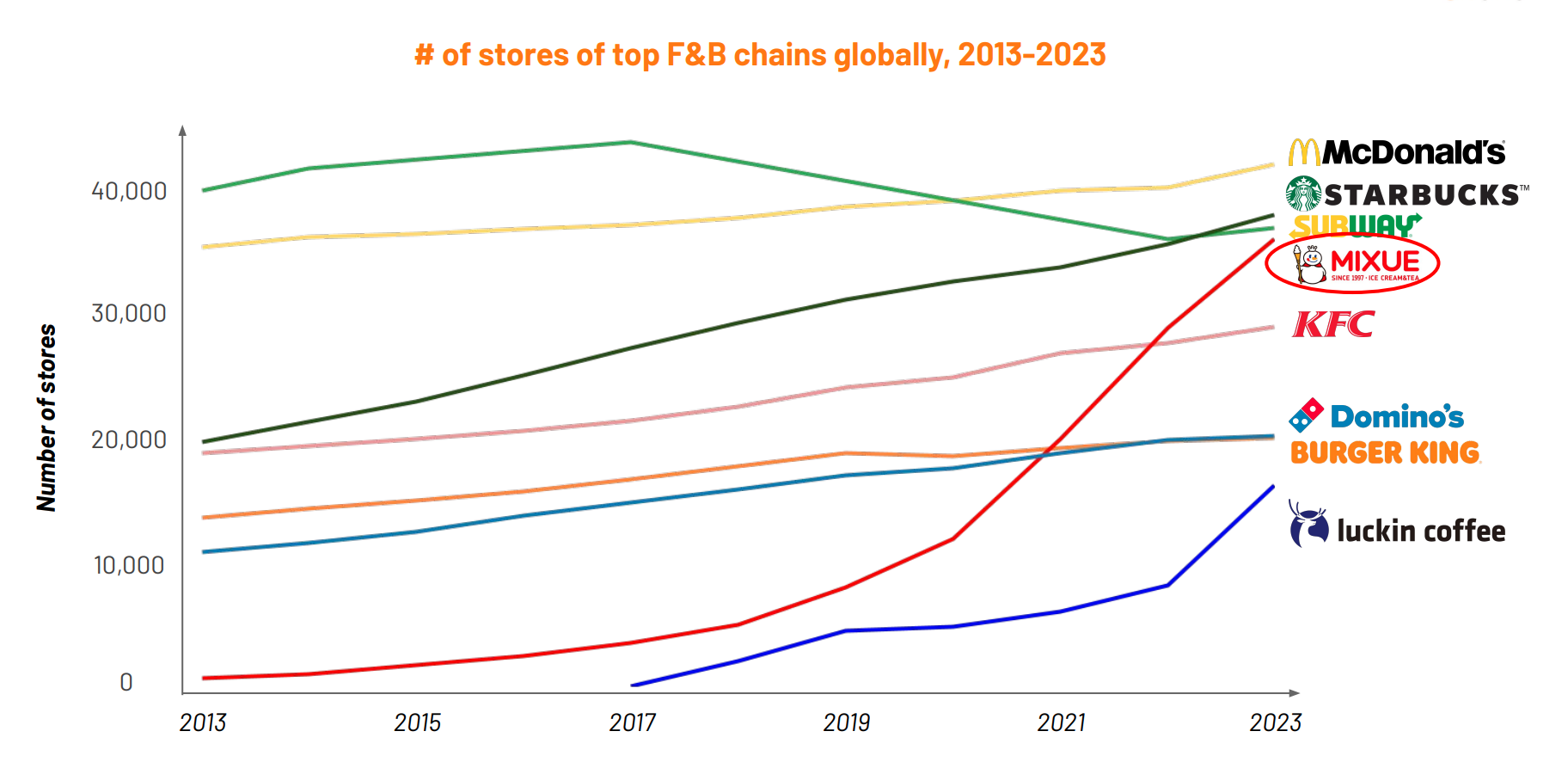

According to statistics from Momentum Works, Mixue has become the fourth largest F&B chain in the world. With approximately 36,000 stores worldwide, Mixue’s scale has surpassed KFC (29,000 stores), ranking only behind McDonald’s (42,175 stores), Starbucks (38,038 stores), and Subway (36,592 stores). Mixue is also considered the first Chinese brand to enter the Top 5 largest F&B chains – a place that has been dominated by brands from the United States.

Store scale of the largest F&B chains in the world now (Source: Momentum Works)

In the past decade, especially from 2017 to now, while Subway has witnessed a decline in scale, Starbucks, McDonald’s, Domino’s, and Burger King have maintained a fairly stable increase in store scale, Mixue’s graph has declined even more. If it continues at this pace, Mixue could surpass McDonald’s in just 1-2 years.

Store scale growth rate of Mixue is superior to other chains (Source: Momentum Works)

Currently, over 32,000 Mixue stores are located in China, the remaining number mainly concentrated in Southeast Asian countries. Vietnam was the first foreign market that Mixue reached in 2018. With about 1,000 stores spread across provinces, Vietnam is Mixue’s second largest foreign market in Southeast Asia, only behind Indonesia (about 2,800 locations).

In China, Mixue also holds a superior market share in terms of GMV and the number of cups of beverages sold. According to Momentum Works, in the fragmented and competitive market like China, Mixue has a 11.2% GMV market share, while Luckin Coffee is 7.4% and Starbucks is 6.2%. In terms of the number of cups sold, Mixue also holds a 32.7% market share, while other major chains do not exceed 10%.

However, Momentum Works’ assessment is: “Mixue is a supply chain company rather than an F&B enterprise. Mixue positions itself as a new high-quality, value-for-money beverage brand, with products usually priced around or below 1 USD. Unlike most F&B franchise brands that primarily earn money from copyright and profit sharing, Mixue primarily operates as a supply chain company, selling ingredients and equipment to licensees as its main source of revenue.”

In 2022, Mixue achieved a total revenue of 1.9 billion USD. After the first 9 months of 2023, this number reached 2.16 billion USD. The main contribution is not from bubble tea or ice cream. 98% of the revenue comes from selling and supplying ingredients. This business model and revenue structure are completely different from Starbucks, Luckin Coffee, or McDonald’s.

Behind the 36,000 stores, the parent company of Mixue also built a global supply chain network, 5 manufacturing plants, and its own warehousing system and distribution network.

Although the scale has approached Starbucks, the revenue of Mixue compared to the coffee giant is like loose change. In 2022, Starbucks’ total global revenue reached 32.25 billion USD, while in 2023, it was 36.687 billion USD.