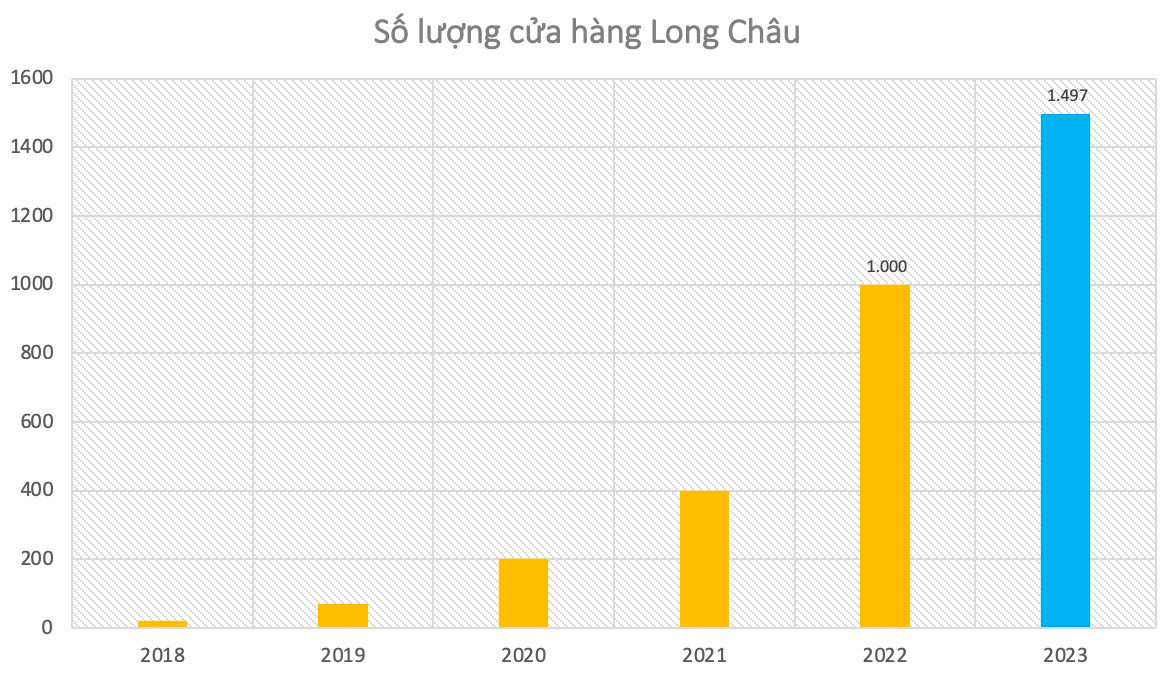

Since acquiring 4 pharmacies in 2017, Long Chau has expanded to nearly 1,500 stores, leading the retail pharmacy chain in terms of scale. The current number of Pharmacity and An Khang stores is 932 and 527, respectively.

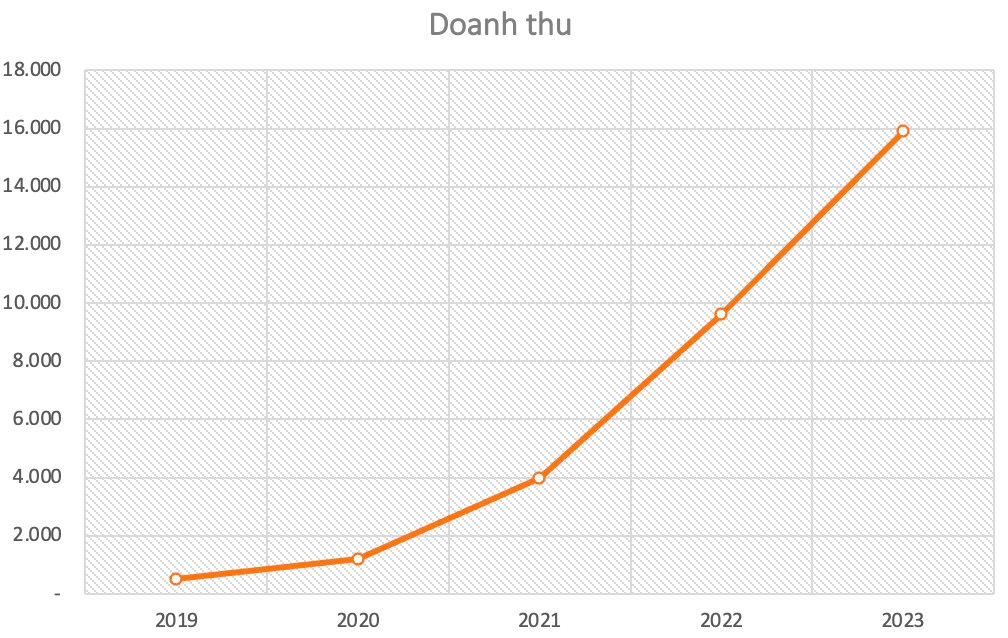

This is also the first pharmacy chain to announce operational profitability while other industry companies struggle to break even. In 2023, the pharmaceutical segment brought in VND 15,925 billion, surpassing FPT Shop and officially contributing 50% of the revenue to the Corporation.

Amidst the “vigorous” stage of the pharmacy chain, Ms. Nguyen Bach Diep – Chairwoman of FPT Retail’s (FRT) Board of Directors – recently shared the success formula and ambitions of Long Chau.

First, according to the leader, Long Chau’s secret lies in two factors: people and technology. Among them, understanding the psychology of customers who want to be advised by pharmacists on diseases and prescribed non-prescription drugs, Long Chau creates the first touch point with customers right at the pharmacy counter.

Currently, Long Chau is applying the pharmacist classification method from level 1 to level 3. If a level 1 pharmacist must complete 1,000 bills per month for 3 consecutive months to be evaluated as accomplished, a level 3 pharmacist must complete 4 credits per year as well as the required number of hours of selling at the counter. The percentage of level 3 pharmacists among 10,000 pharmacists at Long Chau is 58%, and the chain aims to increase it to 75% by the end of this year.

The professional factor is also emphasized through the ability to ensure enough prescriptions, especially specialty drugs and specific treatments. Specialty drugs also have a higher value compared to non-prescription drugs, so the sales of Long Chau stores are higher than those of other companies in the industry. The average revenue per Long Chau store in the past two years is VND 1.1 billion per month, double that of its competitors.

This is also one of Long Chau’s main advantages in the market, according to analysts. The viewpoint of KBSV Securities in the latest report on the industry acknowledges: Long Chau’s difference lies in its expertise in medicines, possessing a diverse and complete portfolio of quality drug groups at reasonable prices. Compared to Pharmacity – an enterprise that was among the first to explore the modern retail pharmaceutical market and the first one to reach 1,000 stores – they choose the drug retail model as a convenience store, where customers can choose to buy functional products and cosmetics.

“The second weapon of Long Chau is the application of technology to management and optimizing logistics, thanks to its advantage from FPT Corporation. According to Ms. Diep, technology helps Long Chau’s profit margin reach 22-25%, compared to 10% for small stores.

“Technology also allows Long Chau to provide 24/7 consultations for 5 million customers using the application or 7 million Zalo users. Thanks to the even distribution of stores, Long Chau provides online shopping and delivery within 60 minutes in Ho Chi Minh City. Online revenue contributes 8% of Long Chau’s total revenue “, Ms. Diep added.

Discussing the industry’s potential, according to Long Chau’s leadership, the retail pharmaceutical market has a scale of about USD 6 billion, with the majority of sales allocated to 60,000 small retail stores and 4% belonging to chains. In the future, the demand for medicines and functional products will increase, especially when Vietnam’s population ages in 2036, according to the World Bank’s forecast. This opens up opportunities for businesses to find the key to the market.

At Long Chau, “We are not only developing horizontally, but also beginning to go deeper “, she shared with the media. Long Chau can understand deep development in two ways:

+ In the service field : Shown through utilities for customers . For example, the old item exchange program, providing new insulin pens for people with diabetes, reduces the cost of purchasing for customers and reduces medical waste. Or guaranteeing prescription drug costs for people with health insurance to save them time for claim procedures…

+ It is also a second understanding of vision: Prevention is better than cure. That is, Long Chau is oriented towards developing the health ecosystem from disease prevention to examination, treatment, and ultimately personal health care.

The Corporation has also just launched the Vaccination Center chain. According to Ms. Diep, the vaccination coverage rate in Vietnam is 4% (according to the Ministry of Health’s statistics), much lower than the world’s 20%. If vaccination is done well, a form of preventive healthcare, the cost of treatment will be reduced. A vaccination shot for hepatitis B costs less than one million dong, while the cost of treating hepatitis B can reach tens of millions of dong.