The information about the implementation of the KRX system and the prospects for upgrading the Vietnamese stock market in 2024-2025 has helped stock prices recover strongly from the beginning of the year until now.

In the group’s latest updated report, VnDirect believes that stock prices will rise as the actual results of the monetary policy seep into the economy. In this context, stocks with good and sustainable business results will attract more investor attention. Growth momentum is the investor’s expectation of better business results and successful capital mobilization.

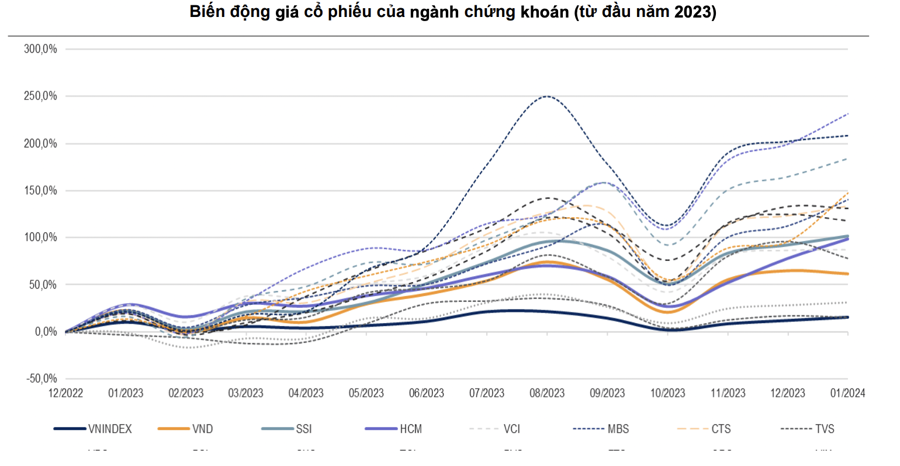

In the context of a sluggish economy, low deposit interest rates, and a frozen real estate market, money is flowing into the stock market. The securities industry has outperformed the market index with many securities stocks growing by more than 50%.

Notably, the first strong increase came from small and medium capitalization stocks such as VIX, BSI, FTS, with increases of 208.7%, 231.5%, and 183.9% respectively as of T1/2024 compared to the beginning of 2023. This reflects the willingness of investors to speculate in the short term as the stock market is in an accumulation phase.

VnDirect expects that large capitalization stocks in the sector, with good business results, will have better opportunities in 2024 due to good or better-than-expected business results and better price prospects than small and medium capitalization stocks that have not increased much in the previous year.

The long-term valuation of the securities industry is no longer cheap but still suitable for the short and medium term. Long-term prospects have been reflected in stock prices. The government is determined to turn the stock market into a long-term capital mobilization channel for businesses, reducing the pressure on the banking system.

In the context of improving people’s income, securities are seen as an investment channel alongside the traditional real estate market. Further technological development will contribute to increasing the number of people accessing this investment channel.

Foreign investors find it more attractive due to higher returns than other industries, with no restrictions on the FOL ratio.

The motivations for short and medium-term strategies: Loose monetary policy is maintained, and the possibility that the State Bank of Vietnam will lower the policy interest rate. The prospect of upgrading to a new market by FTSE, attracting capital from foreign investors. The KRX system will increase market liquidity when operational.

Credit growth is increasing, with the expectation that capital will flow into asset markets as the economy has not been fully absorbed. Foreign capital will return after net selling in 2023.

In terms of investment strategy, investors should maintain a short- and medium-term perspective with stocks in this industry, as long-term prospects have been reflected in the price increase of the industry’s stocks. Therefore, there will be differentiation among stocks, and potential stocks are those with reasonable valuation, expected to have good business results and are often preferred by foreign investors.

Speaking more about the securities investment channel, according to VnDirect, the stock market continues to maintain its appeal in the context of low deposit interest rates.

The earnings yield on price (E/P) of the Vn-Index slightly increased to 7.1% although the VN-Index increased by 7.6% in February 2024 as listed companies continued to update their Q4/2023 business results with strong profit recovery.

The average 12-month deposit interest rate of NHTMs in February 2024 decreased slightly to 4.75% (-0.03 percentage points compared to the previous month), making the difference between the market’s E/P and deposit interest rates wider. The high difference between the earnings yield on price (E/P) of the Vn-Index and the deposit interest rate shows that the attractiveness of the stock market is still maintained compared to the savings deposit channel.

VnDirect believes that banks will continue to maintain low deposit and lending interest rates in the first half of 2024 to support economic recovery.