After rising 5.2% in February, the current P/E valuation of the VN-Index is at a reasonable level as it is 5.6% lower than the 5-year average P/E ratio. Improved earnings growth of businesses expected in 2024 will make the P/E ratio more attractive. At the current range, the VN-Index is trading with a year-end 2024 P/E ratio of 12.0, according to VnDirect.

Furthermore, the valuation of the VN-Index compared to other emerging markets is at a reasonable level when comparing the P/E ratio and is cheap when comparing the P/B ratio against the 5-year average.

SECURITIES MARKET WOULD BE UPGRADED IN SEPTEMBER IF KRX OPERATES EARLY

Although the trend of the VN-Index is still relatively positive, investors should pay attention to the following points: The market valuation has approached a reasonable range and the market needs time for improved business results to make the valuation more attractive. The exchange rate risk needs to be considered as the USD/VND exchange rate has increased by 1.6% since the beginning of the year and is approaching the historical peak of 24,867. Therefore, investors need to prioritize portfolio risk management and be cautious with new buying positions or high leverage.

Some supporting factors in March include: Positive prospects for Q1/2024 business results due to the low base of Q1/2023 and Investment capital flow showing signs of spreading from the banking sector to other sectors such as securities, steel, consumer goods… and no signs of capital outflow from the market.

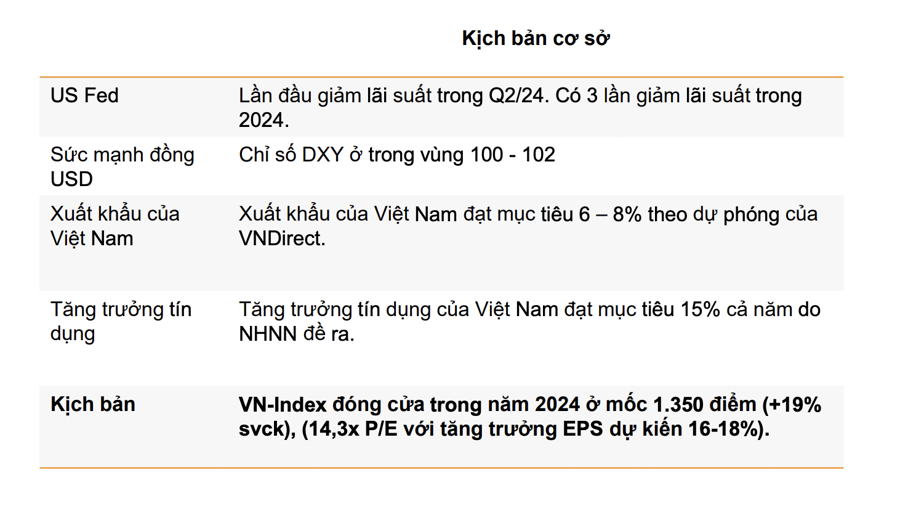

VNDirect is inclined towards the scenario that the FED will cut interest rates for the first time in Q2/24 and have 3 interest rate cuts this year. In addition, positive data from PMI, FDI, and export growth are reinforcing the optimistic scenario for business results of companies in 2024. Therefore, the baseline scenario for the stock market in 2024, in which the VN-Index could reach the milestone of 1,350 points, an increase of 19%.

However, it is not ruled out that Vietnam’s economic growth could be stronger than forecasted and thereby help improve the positive business results of companies. In that case, the stock market could perform even more positively and surpass the 1,400 points mark, an increase of 23.9%.

Although the KRX system has been delayed from operating until the end of 2023, the management agencies are making efforts to put it into operation soon in order to achieve the market upgrading goal.

The KRX system operation not only supports the deployment of new products, improves liquidity, but also replaces the entire trading system and clearing and settlement system currently in use. This is also a necessary condition for rating agencies to consider upgrading the Vietnamese market to a new emerging market.

If the KRX system is put into operation in the first half of 2024, the Vietnamese stock market could be announced by FTSE to be upgraded to a secondary emerging market in September 2024.

FOREIGN CAPITAL FLOW WOULD IMPROVE

After the Lunar New Year 2024, the VN-Index witnessed an impressive upward trend thanks to positive macroeconomic signals domestically.

In February 2024, the 18.1% increase in the Chemicals industry was driven by strong demand for GVR and DGC. GVR led with a 28.6% increase thanks to positive FDI figures. Following is DGC with an 18.4% increase from the previous month, due to the increase in gold platinum prices supported by fertilizer demand from India and investor expectations for the start of construction of the Duc Giang – Nghi Son project in Q2/24.

The Chemical and Transportation sectors are leading the market’s upward trend. While the notable year-to-date performance of the Chemicals industry is 21.6% largely due to the increase of GVR and DGC, the Transportation sector has grown strongly by 17.2% since the beginning of the year, mainly due to VTP as stock prices peaked before the transition from UPCOM to HOSE.

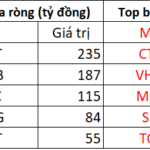

Market liquidity has increased significantly thanks to positive macroeconomic information domestically and positive investor sentiment after the Lunar New Year. The average trading value on the 3 exchanges increased by 20.5% compared to the previous month (80.3% compared to the same period last year) to 22,558 billion dong/session (HOSE: 20,135 billion dong/session, +20.5% compared to the previous month; HNX: 1,558 billion dong/session, +13.8% compared to the previous month, UPCOM: 865 billion dong/session, +20.6% compared to the previous month).

Some factors driving capital inflows into the market include the recovery of corporate profits, low interest rates, expectations of the launch of the KRX system, and the potential upgrade of the stock market. However, investors should be cautious of potential risks, such as the Fed cutting interest rates later than market expectations and any significant reversal of long-term interest rates domestically.

In 2024, VNDirect believes that the trend of foreign capital flows will improve as the Fed shifts its monetary policy, thereby reducing pressure on the DXY; The Vietnamese government continues to prioritize growth through monetary and fiscal policy relaxation, and the expectation of the stock market upgrade will attract foreign investors through the relaxation and improvement of policies related to foreign investors’ transactions.