Preliminary statistics from the General Department of Customs show that in January 2024, Vietnam imported 1.49 million tons of iron and steel, equivalent to 1.06 billion USD, a 27.3% increase in terms of volume and a 22.3% increase in terms of value compared to December 2023; compared to January 2023, it increased by 151.2% in terms of volume and 101.6% in terms of value.

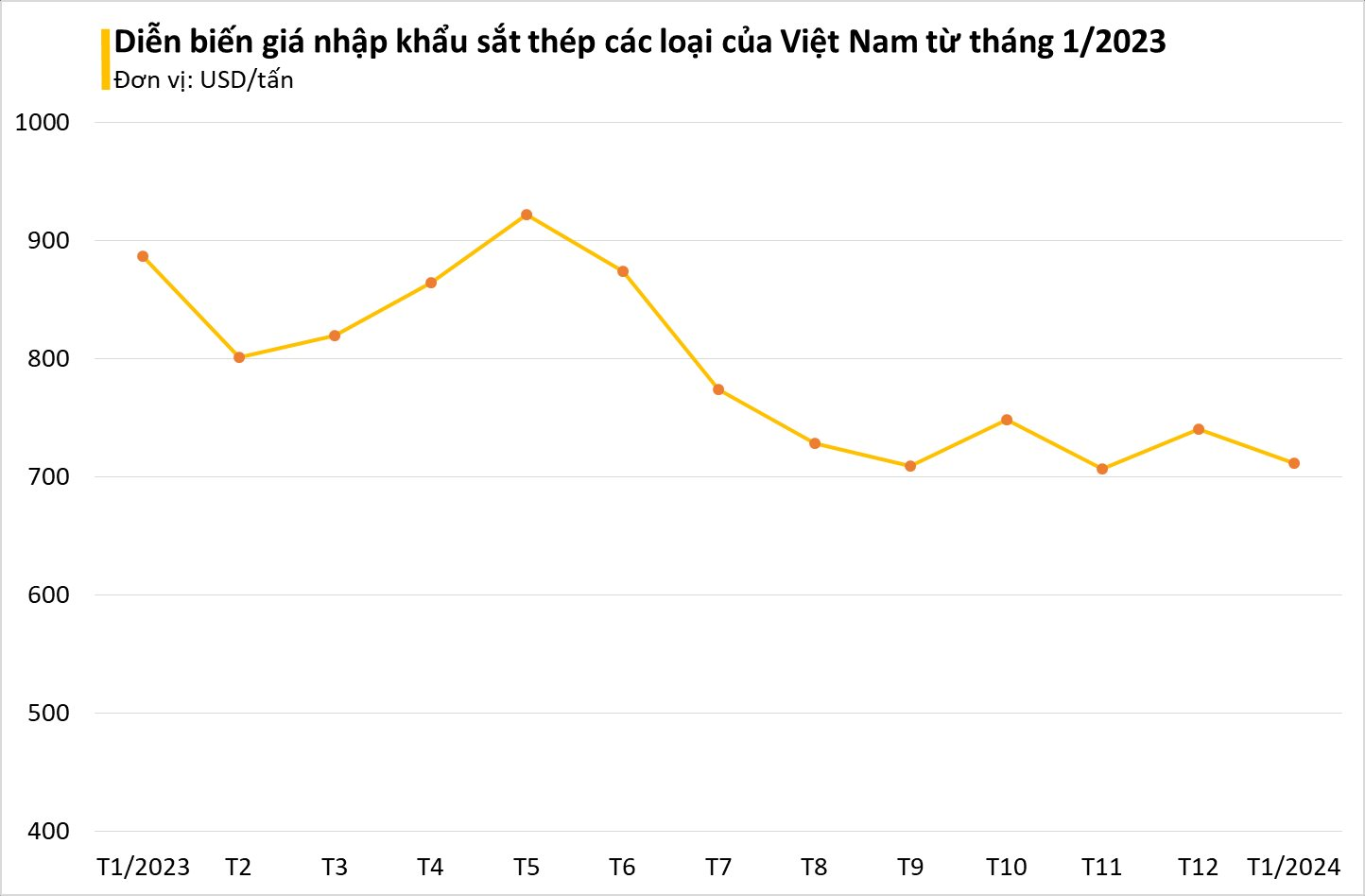

The import price in January 2024 reached 711.9 USD/ton, a 3.9% decrease compared to December 2023 and a 19.7% decrease compared to January 2023.

China is the top supplier of iron and steel to Vietnam, accounting for 67.6% in terms of volume and 60% in terms of value, reaching nearly 1.01 million tons, equivalent to nearly 635.66 million USD, with an average price of 631.5 USD/ton, a 25.7% increase in terms of volume and 24% in terms of value, but a 1.4% decrease in terms of price compared to December 2023; compared to January 2023, it increased by 376.4% in terms of volume and 247% in terms of value, but decreased by 27.2% in terms of price.

Indonesia is the second largest market, accounting for over 4.4% in terms of volume and 9.7% in terms of value of imported iron and steel, reaching 65,140 tons, equivalent to nearly 102.63 million USD, with an average price of 1,575 USD/ton, a 14.3% increase in terms of volume and 7.7% in terms of value, but a 5.8% decrease in terms of price compared to December 2023; compared to January 2023, it decreased by 19.5% in terms of volume, 7.5% in terms of value, but increased by 14.8% in terms of price.

Japan is the third market with 135,841 tons, equivalent to 94.44 million USD, with an average price of 695.2 USD/ton, a 7% increase in terms of volume, 2% in terms of value, but a 4.6% decrease in terms of price compared to December 2023; compared to January 2023, it increased by 28.5% in terms of volume, 23.2% in terms of value, but decreased by 4% in terms of price, accounting for 9% of the total volume and value of imported iron and steel.

Imports from the RCEP FTA markets reached 1.31 million tons, equivalent to 934.22 million USD, a 20.8% increase in terms of volume and a 17% increase in terms of value compared to the same period last year.

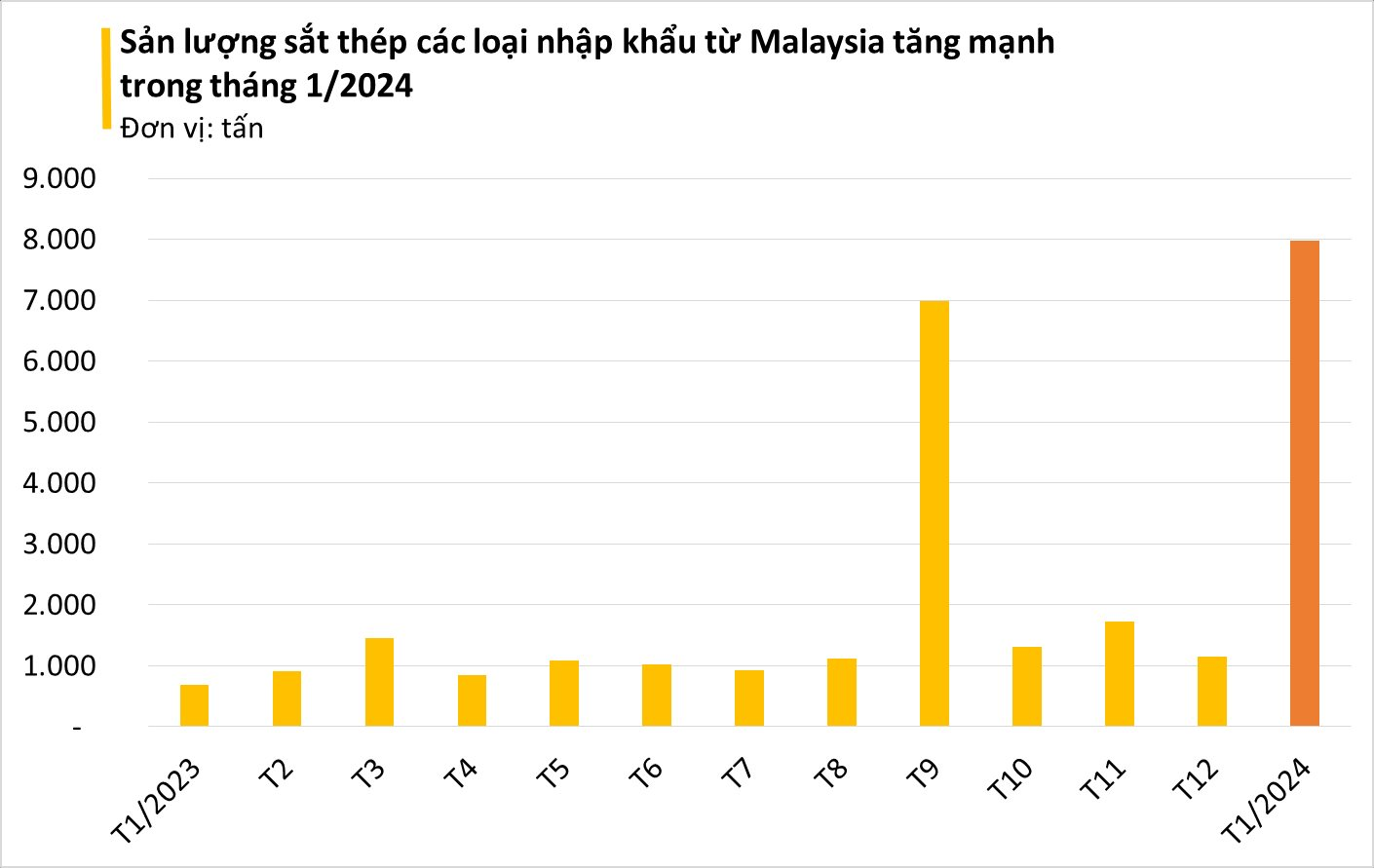

It is worth noting that Malaysia is the export market with the strongest growth rate. Specifically, Vietnam imported 7,984 tons of iron and steel from Malaysia in January 2024, equivalent to 6.18 million USD, an impressive increase of 1,050% in terms of volume and 282% in terms of value compared to the same period last year, accounting for 0.54% of the total. The average import price reached 774.5 USD/ton, a record decrease of 66.7% compared to 2023.

According to the Southeast Asia Iron and Steel Institute (SEAISI), construction activities in the region, especially infrastructure construction, are being intensified. This is expected to drive the demand for steel in ASEAN countries, which is projected to increase in the next two years as construction activities in the region recover.

The Vietnam Steel Association (VSA) expects steel consumption to increase by 6.4% to nearly 21.6 million tons in 2024.

The price difference between Vietnamese steel and Chinese steel is currently at only 30 USD/ton, lower than the average of 50 USD/ton over the past two years. This will help steel products in Vietnam avoid price competition pressure from China.

In the medium term, when the real estate market enters a recovery cycle in 2025, the price of construction steel is expected to increase by another 8%, reaching an average of 16.4 million VND per ton.

Meanwhile, the prices of key raw materials for the steel industry such as iron ore and coke are expected to “cool down” from the beginning of the second quarter of 2024 after a surge in the last months of 2023. Major financial institutions currently forecast that the global supply of iron ore and coke will remain stable in the near future.

Vietnam’s iron and steel industry is forecasted to recover, prolonging the profit recovery of enterprises in the sector.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)