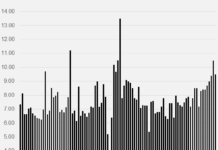

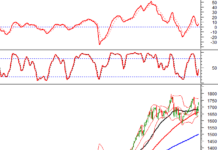

Trading has stabilized after last weekend’s intense selling session. Selling pressure has weakened, leading to a 45% decrease in liquidity on the two exchanges. However, the market breadth is still leaning towards a decline, with the VN-Index only seeing a slight increase of 0.37%, which is far less than the 1.66% decrease in the previous session.

Only 2 stocks in the Top 10 market capitalization recorded significant increases, with BID up 1.57% and VNM up 1.71%. The rest of the VN-Index relies on medium-sized stocks for support, such as FPT up 1.82%, GVR up 3.28%, and MSN up 1.91%. Apart from these, the other stocks in the Top 30 market capitalization only saw a few small increases.

Currently, the blue-chip group is not strong but still remains the main support. Even in the best rebound in the first half of the morning session, with the VN-Index reaching a peak of nearly 6.7 points at 10 am, the market breadth was still balanced with 185 stocks up and 186 stocks down. For most of the session, the decline completely dominated. At the end of this morning’s session, the VN-Index recorded 182 stocks up and 253 stocks down, despite the index still rising 4.58 points, not much different from the peak at 10 am.

The above-mentioned changes in breadth and points indicate two things: First, the VN-Index is being gradually lifted by some large-cap stocks towards the end of the session. Second, many stocks experienced a half-session recovery, followed by a drop back into the red zone. The VN30-Index closed the morning session up 0.22% with 13 stocks up and 14 stocks down, including pillars such as VCB, VIC, VHM, HPG, and CTG, but the points are too few, meaning that most increases are slight.

However, it should also be noted that after a heavy sell-off session, the market is likely to recover. The selling pressure usually comes from the most fearful investors trying to exit yesterday, so the selling demand decreases. The important thing is that the buyers will also decrease because a large amount of money has already entered at the bottom of the previous session, while those who have withdrawn money will sit outside and observe the situation. This morning, the total trading value of the two exchanges decreased by 45% compared to last Friday morning, reaching only VND 9,803 billion, the lowest level in 10 sessions. HoSE also decreased 45%, to a little over VND 9,085 billion. Last week, this exchange averaged VND 13,537 billion in the morning sessions, which means that this morning’s amount has decreased by one-third.

The decrease in liquidity is not a cause for concern, at least when the price decline is still low. Weak demand can still balance the price if the supply is also low. However, the number of stocks continuously losing after being affected by the large price drop on March 8 will create additional pressure. At that time, more money will be needed to maintain the price.