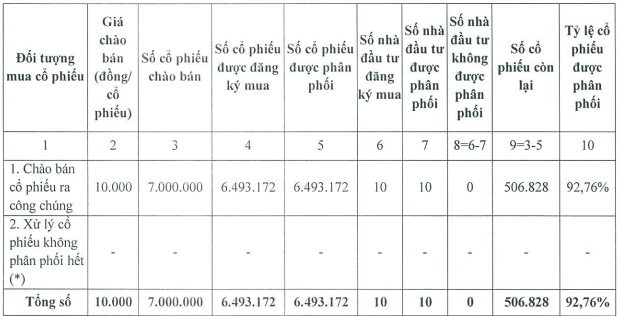

Specifically, the public offering of 7 million shares of PTT ended on February 20th, of which nearly 6.5 million shares were successfully sold, equivalent to a rate of 92.76%. The transfer is expected to take place in March 2024 and is not subject to transfer restrictions.

At a price of 10,000 dong/share (higher than the market price of 7,200 dong/share on March 10th), the company raised nearly 65 billion dong to supplement capital for the purchase of oil/chemical carriers with a load capacity of 10,000-25,000 DWT.

Regarding the purchase plan, PTT said that the estimated cost would not exceed 10.5 million USD (approximately 253 billion dong, including taxes and fees…). In addition to the proceeds from the stock offering, PTT will also use funds from other sources such as bank loans and shareholder equity.

PTT will directly purchase used vessels of Japanese or Korean origin. The vessels will be registered under foreign flags and will not be imported to Vietnam. The main operating markets are the routes near the ship receiving/discharging areas or routes in the Gulf, Southeast Asia, the Middle East, the Red Sea, and Europe. The vessels will be operated flexibly, prioritizing international chartering or participating in POOL (a cooperative arrangement among shipping companies) to ensure stable business activities. PTT stated that the goal of purchasing vessels is to increase revenue, profit, and capital utilization efficiency. The deal is expected to be completed in the first or second quarter of 2024.

With a total of 794 existing shareholders (792 individuals and 2 organizations), PTT successfully offered shares to 10 domestic investors. There were nearly 507,000 shares that were not sold, equivalent to a rate of 7.24%. PTT stated that it will not continue to distribute these shares, although the initial plan mentioned continuing to offer them to interested investors at a price not lower than the offering price for existing shareholders and with a one-year transfer restriction.

|

Results of PTT’s public stock offering

Unit: Shares

Source: PTT

|

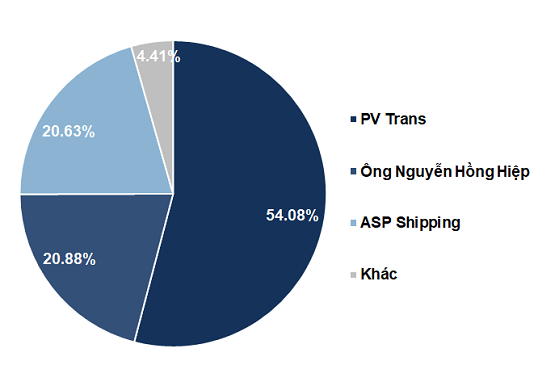

After the offering, PTT increased its charter capital from 100 billion dong to nearly 165 billion dong. The ownership structure consists of 3 major shareholders: Petrovietnam Transportation Corporation (HOSE: PVT) holds 54.08%, Asia Pacific Thai Binh Duong Shipping Co., Ltd. (ASP Shipping) holds 20.63%, and an individual named Nguyen Hong Hiep holds 20.88%. Overall, PTT’s shareholder structure is highly concentrated, with the 3 major shareholders owning 95.59% of the capital.

|

PTT’s shareholder structure after the offering

Source: VietstockFinance

|

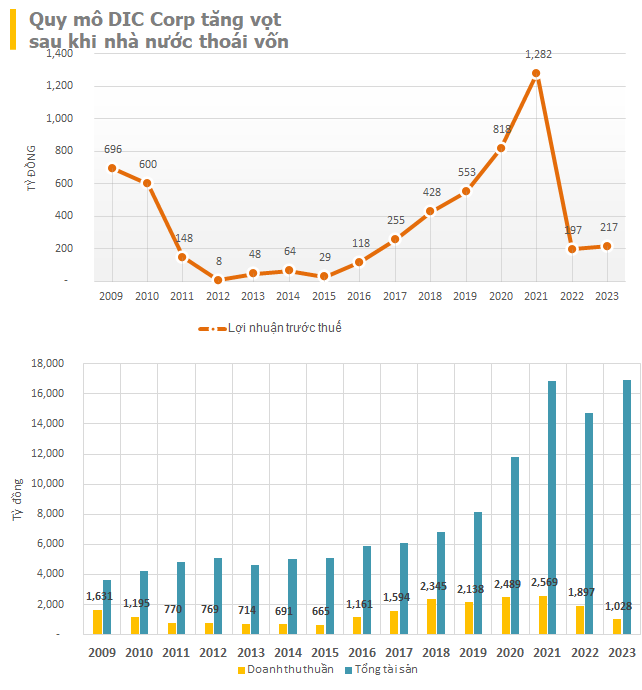

PTT is known as a provider of fuel, chemical, and logistics transportation services. In terms of business performance, in recent years, PTT has shown efforts to recover after hitting bottom in 2020.

By the end of 2023, PTT recorded net revenue of 259 billion dong and net profit of 11 billion dong, an increase of 7% and 120% respectively compared to the previous year (exceeding the 12% profit target for the year).

| PTT’s business results from 2019-2023 |