After a long battle with the COVID-19 pandemic, the global economy has become weakened by political instability, pushing up production costs and causing a global economic slowdown.

Vietnam is no exception, as import-export activities have been affected and economic growth has slowed down in the past year. People have tightened their spending due to concerns about declining incomes, leading to a lack of increased spending on insurance products.

According to data from the General Statistics Office, the total insurance premium revenue for the entire market is estimated at 227.1 trillion dong in 2023, a decrease of 8.33% compared to the previous year. Of this, life insurance premium revenue is estimated to reach nearly 156 trillion dong, a decrease of 12.5%, and non-life insurance premium revenue is estimated at 71.1 trillion dong, an increase of 2.4%.

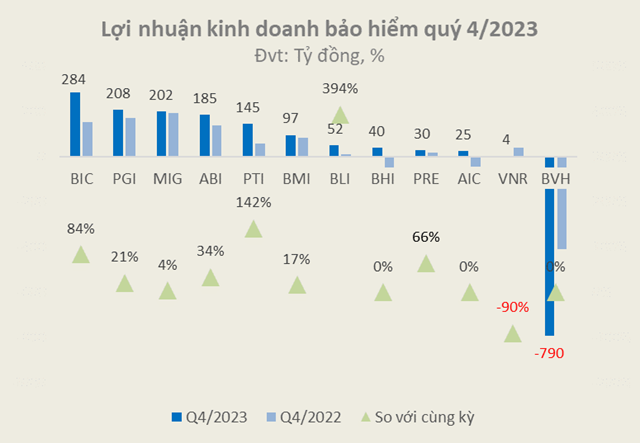

Profitable Insurance Business in Q4 2023

Source: VietstockFinance

|

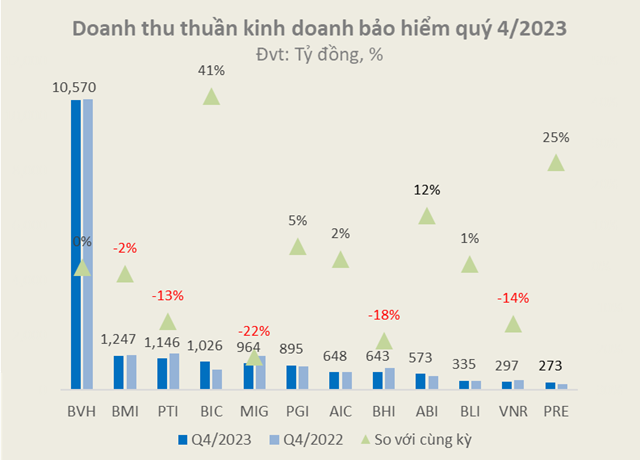

In Q4 2023, data from VietstockFinance shows that the net revenue from insurance business operations of 11 non-life insurance companies listed on HOSE, HNX, and UPCoM reached 18,617 billion dong, a slight decrease of 1% compared to the same period last year.

Source: VietstockFinance

|

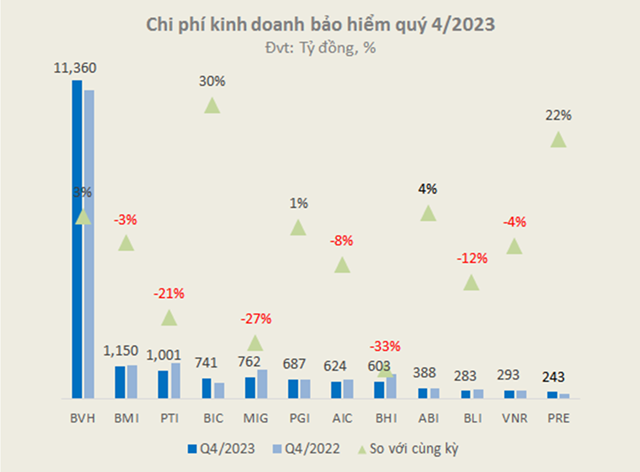

Meanwhile, the operating expenses of insurance companies (claims expenses and other expenses) decreased by 2% to 18,136 billion dong. With expenses decreasing faster than revenue, the total gross operating profit of insurance business increased by 58% to over 482 billion dong.

Source: VietstockFinance

|

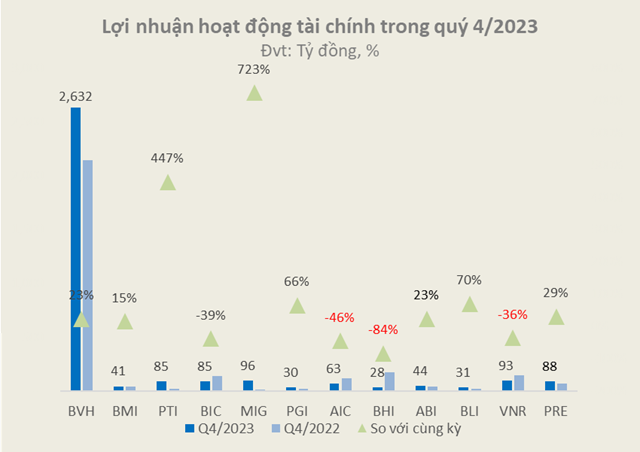

In addition, the gross financial operating profit increased by 14% to 3,317 billion dong, helping the total net profit of non-life insurance companies increase by 25% to nearly 1,061 billion dong.

Source: VietstockFinance

|

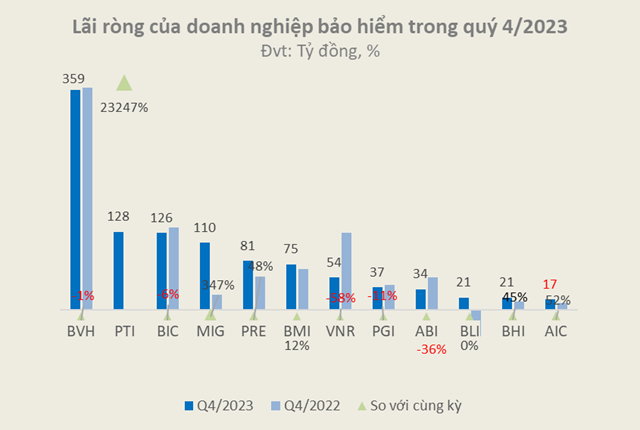

Among them, 6 out of 11 non-life insurance companies had an increased net profit and 1 company turned its loss into profit.

Source: VietstockFinance

|

With a net profit of 128 billion dong, 233.5 times higher than the same period last year, Vietnam Posts and Telecommunications Insurance Joint Stock Corporation (PTI) led the profit growth in Q4 2023. This result was achieved thanks to an increase in insurance business profit and financial investment profit compared to the low level of the same period, in addition to a significant reduction in insurance business operating expenses.

Bao Long Insurance Corporation (BLI) turned its loss into profit in Q4 2023 due to a sharp decrease in reinsurance expenses and compensation expenses compared to the same period.

On the other hand, Vietnam National Reinsurance Corporation (VNR) had the biggest decline in net profit, down 58% to 54 billion dong. The reason is that the operating profit of insurance business decreased by 90% and the profit from financial activities decreased by 36%.

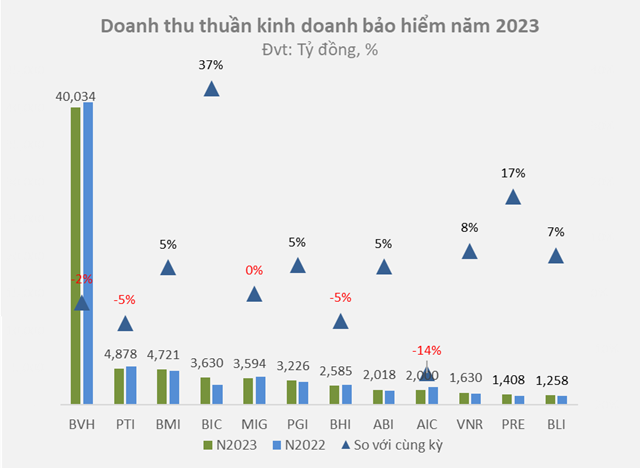

Caught between two forces, the overall profitability of insurance business throughout the year is not impressive.

Narrowing insurance demand has affected insurance premium revenue, while compensation expenses tend to increase back to pre-pandemic levels, making insurance business activities challenging for most of the year 2023.

Source: VietstockFinance

|

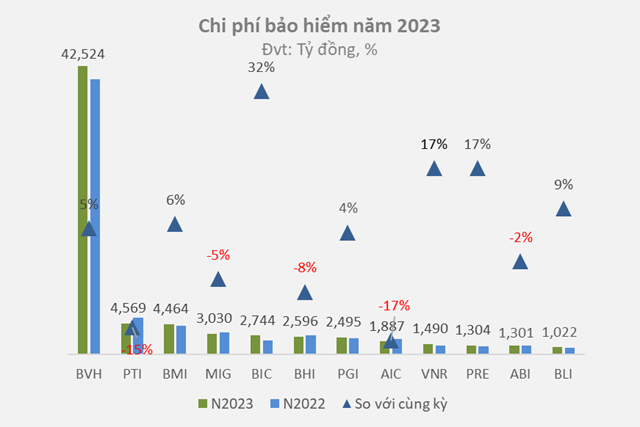

According to data from VietstockFinance, the net revenue from insurance business operations of 11 non-life insurance companies reached 70,983 billion dong, almost unchanged compared to the previous year.

Source: VietstockFinance

|

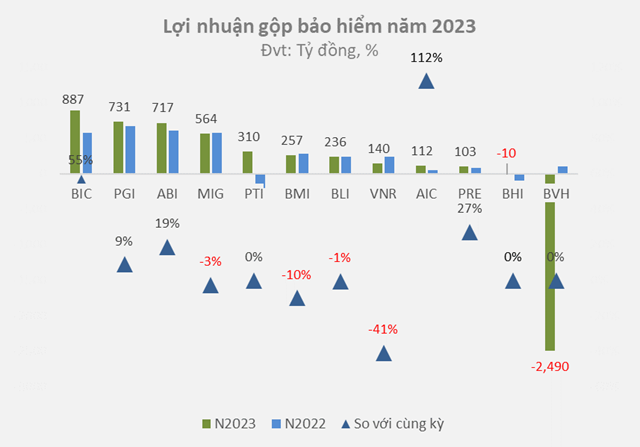

Meanwhile, the operating expenses of insurance companies (mainly claims expenses and other expenses) increased faster than revenue (2% increase to 69,427 billion dong), resulting in a decrease of over half in the total gross operating profit of insurance business compared to the previous year, reaching 1,556 billion dong.

Source: VietstockFinance

|

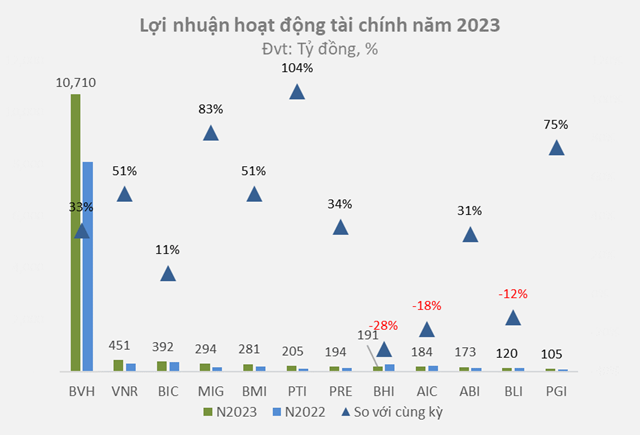

However, high interest rates are considered a lifeline for the profit growth of non-life insurance companies in 2023.

Due to the short-term nature of the insurance products they sell, the investment portfolios of non-life insurance companies are mainly focused on deposits and bonds, accounting for over 80%; the rest is invested in stocks, real estate, etc.

According to SSI Research, the deposit interest rates increased by 400-500 basis points compared to the beginning of the year, and the 10-year Government bond yields increased by 257 basis points compared to the beginning of the year. Therefore, the business results of insurance companies in 2023 will fully reflect the deposit interest rate movements that took place in 2022.

As expected, the profit from financial activities can have a strong impact on the after-tax profits of insurance companies because these companies hold a significant amount of cash. Adjustments in interest rates by the central bank directly affect the profitability of insurance companies’ total assets. With the advantage of a large amount of net cash, the insurance sector benefits directly from high deposit interest rates.

Source: VietstockFinance

|

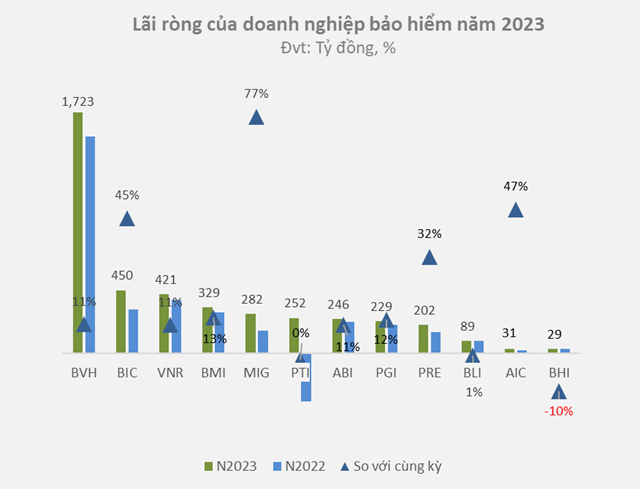

Statistics show that 11 non-life insurance companies earned a profit of 13,301 billion dong from financial activities, an increase of 31% compared to the previous year, offsetting the decline in profits from insurance business activities and resulting in a total net profit of 4,283 billion dong, an increase of 40%.

Source: VietstockFinance

|

Leading the net profit growth in the year is Military Insurance Corporation (MIG) with an increase of 77% to 282 billion dong. This positive result is due to an 83% increase in financial operating profit to 294 billion dong.

Only one company experienced a decrease in profit, which is Saigon-Hanoi Insurance Corporation (BHI) with a loss of 29 billion dong due to a gross loss from insurance business of 10 billion dong and a 28% decrease in profit from financial activities to 191 billion dong.

Notably, PTI achieved a net profit of 252 billion dong after a record loss of 347 billion dong. The recovery of PTI was mainly due to a financial operating profit of 205 billion dong, more than double the previous year.

Racing to exceed the plan

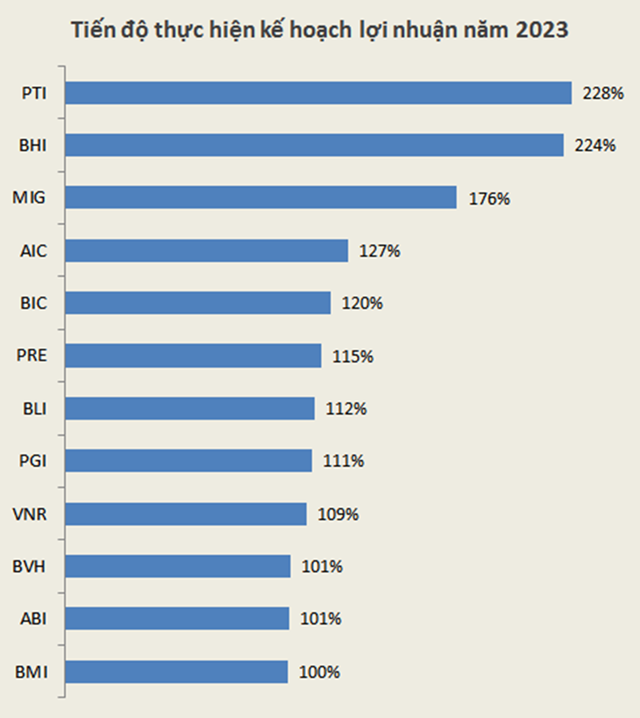

With conservative profit targets in anticipation of challenges and difficulties, most non-life insurance companies not only achieved their goals but also exceeded expectations.

Source: VietstockFinance

|

PTI and BHI achieved more than three times the annual profit target. Meanwhile, MIG, AIC, BIC, PRE, BLI, and PGI exceeded the target by over two digits.

Non-life insurance industry still faces challenges

According to a report by Swiss Re, global economic growth is slowing down and political instability is increasing, which will reduce the prospects for the insurance industry in the 2024-2025 period.

The Swiss Re analysis team also predicts that the average global insurance premium growth rate will be 2.2% per year in the next two years (2024-2025), lower than the pre-pandemic level (2018-2019: 2.8%), but higher than the average for the past 5 years (2018-2022: 1.6%).

“Although profitability will continue to improve, mainly due to improved risk-adjusted pricing and higher investment returns, it is expected that the industry will not be able to offset the cost of capital in 2024 or 2025 in most markets. Events such as the Middle East war will increase inflation and create market volatility, which will damage the capital of insurance companies,” Swiss Re’s report stated.

Swiss Re also pointed out that non-life insurance faces significant compensation pressure, with insurance-paid losses exceeding $100 billion in 2023. Market conditions are predicted to be even more challenging, at least in 2024. In particular, the property and casualty insurance segment is estimated to have a real premium growth rate of 3.4% worldwide in 2023, then decreasing to 2.6% for 2024-2025.