World gold price rose in Wednesday’s trading session, recovering some of the losses from the previous steep decline, thanks to the weakening of the US dollar as the market maintains its expectations that the Federal Reserve will begin cutting interest rates in June. Gold prices in the country rebounded this morning (March 14), with the price of gold rings returning to 70 million dong/tael and SJC gold reaching 81 million dong/tael.

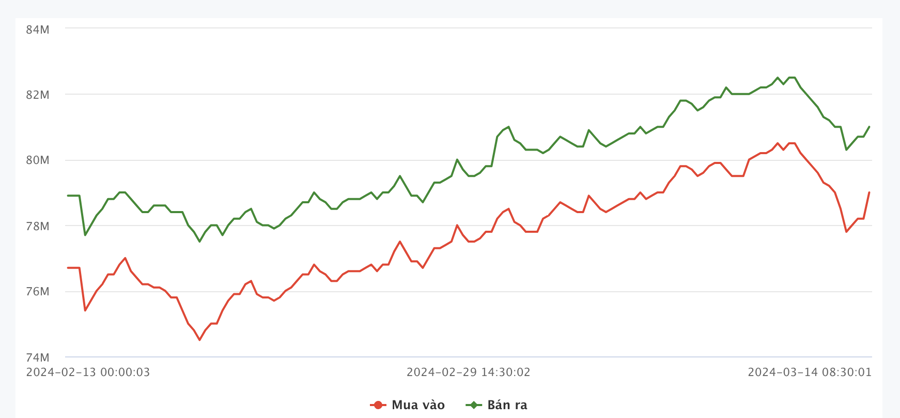

At around 10 am today, Phu Quy Group quoted the price of SJC gold bar for the Hanoi market at 78.8 million dong/tael (buying) and 80.9 million dong/tael (selling). Compared to yesterday afternoon, the price of SJC gold bars at this company has increased by 800,000 dong/tael for buying and 400,000 dong/tael for selling.

However, compared to yesterday morning, the price of SJC gold bars at Phu Quy is still down 1.1 million dong/tael for buying and 1 million dong/tael for selling.

Phu Quy’s smooth round 999.9 gold ring is priced at 68.1 million dong/tael and 69.7 million dong/tael, respectively, for buying and selling, increasing 900,000 dong/tael at each end of the price compared to yesterday afternoon, but still lower by 400,000 dong/tael for buying and 200,000 dong/tael for selling compared to yesterday morning.

Bao Tin Minh Chau Company quotes the price of the round 999.9 smooth gold ring of Rong Thang Long at 68.58 million dong/tael and 70.08 million dong/tael.

In Ho Chi Minh City market, SJC Company quoted the price of gold bars of the same brand at 79 million dong/tael and 81 million dong/tael, still lower by 800,000 dong/tael at each end of the price compared to the same time yesterday morning, although it has recovered by about half a million dong/tael compared to the closing price yesterday.

SJC round rings are priced at 67.6 million dong/tael (buying) and 68.9-69 million dong/tael (selling) depending on the weight of the product.

Yesterday, gold prices in Vietnam experienced continuous declines due to the impact from the sharp drop in international gold prices on Tuesday. The downward pressure on domestic gold prices also came from increasing sales as many people who hold gold are concerned that gold prices are entering an adjustment phase after continuously reaching record highs recently, according to gold traders. At the bottom of yesterday, the price of gold bars dropped by about 1.8 million dong/tael compared to the day before, and gold ring prices dropped by 2.5 million dong/tael.

Although it recovered this morning, the price of gold bars is still lower than the record level by more than 1 million dong/tael. The record for world gold prices was set on Tuesday this week, when the price of gold bars exceeded 82 million dong/tael and the price of gold rings exceeded 71 million dong/tael.

In the overnight trading session in New York, spot gold prices closed at 2,174.5 USD/oz, up 15.9 USD/oz, equivalent to an increase of over 0.7% compared to the previous closing session, according to data from Kitco.

In Tuesday’s session, spot gold prices fell more than 1.1%, retreating from the nearly 2,200 USD/oz level set earlier this week.

Spot gold prices in the Asian market at more than 9 am this morning in Vietnam stood at 2,175.1 USD/oz, up 0.6 USD/oz compared to the closing price of Wednesday’s trading session in New York, according to data from Kitco.

This price level is equivalent to about 65.1 million dong/tael if converted according to the USD selling rate at Vietcombank, an increase of 600,000 dong/tael compared to yesterday morning.

Compared to the converted world gold price, the retail price of SJC gold bars is currently higher by 15.9 million dong/tael, down from 17.4 million dong/tael yesterday morning. The price of gold rings is higher than the world price by nearly 5 million dong/tael, down from 5.9 million dong/tael yesterday morning.

The narrowing price difference between domestic gold and the world price reflects the fact that domestic gold prices have decreased more than the international price in Tuesday’s trading session, and have not fully recovered this morning.

World gold prices rebounded as the US dollar weakened due to investors – after a selloff session due to pressure from hotter-than-expected US inflation data – gradually regaining confidence that the Fed will begin loosening monetary policy from June this year. The Dollar Index closed the session with a 0.2% decrease, staying at nearly 102.8 points.

In the past month, this index has decreased by more than 1.4% – according to data from MarketWatch.

The weakening of the USD and expectations of the Fed lowering interest rates are important factors supporting gold prices. In addition, this precious metal’s price is pushed up by geopolitical tensions. Alongside the ongoing Israel-Hamas war in the Gaza Strip, the conflict between Russia and Ukraine has escalated in recent days as Ukraine continues to attack Russian oil refineries.

“Gold speculators are in a favorable environment. If the Fed lowers interest rates, the price of gold will soar. But if the Fed does not lower interest rates, concerns about inflation can also push the price of gold higher,” said Bob Haberkorn, a strategist at RJO Futures, emphasizing that this increase session shows investors’ buying pressure.

According to data from the FedWatch Tool of the CME exchange, the market is betting on a 65% chance that the Fed will cut interest rates in June, down from 72% before the release of the US inflation report on Tuesday.

“If the Russia-Ukraine war escalates, Western countries will inject more money into Ukraine. Currently, the price of gold is fundamentally driven by political factors and shifted to concerns about higher-than-expected US inflation,” Haberkorn added.