The market unexpectedly “gives gifts” to bottom-fishing investors with a explosive increase yesterday. Short-term selling pressure surged in this session, pushing the liquidity of both exchanges to over 30.2k billion, not to mention off-market transactions. Many stocks turned red or faced price pressure at high levels.

Today’s trading is actually not bad, stocks are still stronger than the index and money flow is divergent. One group experienced heavy selling, typical of banks, and prices dropped sharply. On the other hand, other stocks had high liquidity and prices continued to rise well. Only the blue-chip group, in general, was weak, dragging the indices back to the previous highs.

From the perspective of the VNI or VN30, the situation of whether or not to break through to new highs is not clear. VNI increased first, then decreased without breaking out of the range of the previous high, while VN30 even created a lower high. The lack of strength from the banking sector and many other pillars, and the efforts of VIC and GAS to support, made the indices difficult to break through. It is also important to note that although the market performed well yesterday, most blue-chips only had normal price rebounds after reaching new highs.

The small and mid-cap group performed better but not evenly. The important thing is whether the money flow tends to shift to these groups and stocks that receive strong buying force still have effective price increases. Therefore, perhaps it is not necessary to pay much attention to the indices, at this time, it is necessary to see how the stocks in your portfolio are being sold and how the money is coming in or going out. However, it is also important to note that if the indices are forced too strongly, the general psychology will deteriorate and small speculative stocks are very prone to sudden reversals.

The differentiation and stocks performing better than the indices at this time are similar to the period in August and September last year. Similarly, the forcing of blue-chips caused the indices to fall, the bottom-fishing liquidity exploded, and the market rebounded again, but then money was stuck too much and finally weakened. Generally speaking, there is no stage in which the market repeats exactly the same, but as long as the liquidity is as large as this and does not create corresponding price increases, caution should be exercised. No matter how big the amount of money is, it is not worth as much as the volume of stocks.

Today, the SBV injected an additional 15k billion, making it the fourth consecutive session at this scale. The number of banks participating has decreased quite rapidly, from 18 in the first day to 11 today. Last time, the SBV also injected for 3 consecutive days at a rate of 10k billion, but the exchange rate did not decrease, so it surged to 20k billion later. Today, the free exchange rate showed a signal of decrease but the exchange rate at banks is still increasing, VCB sold at 24,870, up 50 dong compared to yesterday, and the opening of the week was 24,790. In general, the psychological impact of this money withdrawal is not as strong as last time, but the current situation is not favorable after a prolonged increase. It is just that the money flowing into the market is still strong so supply and demand are still grappling in each session.

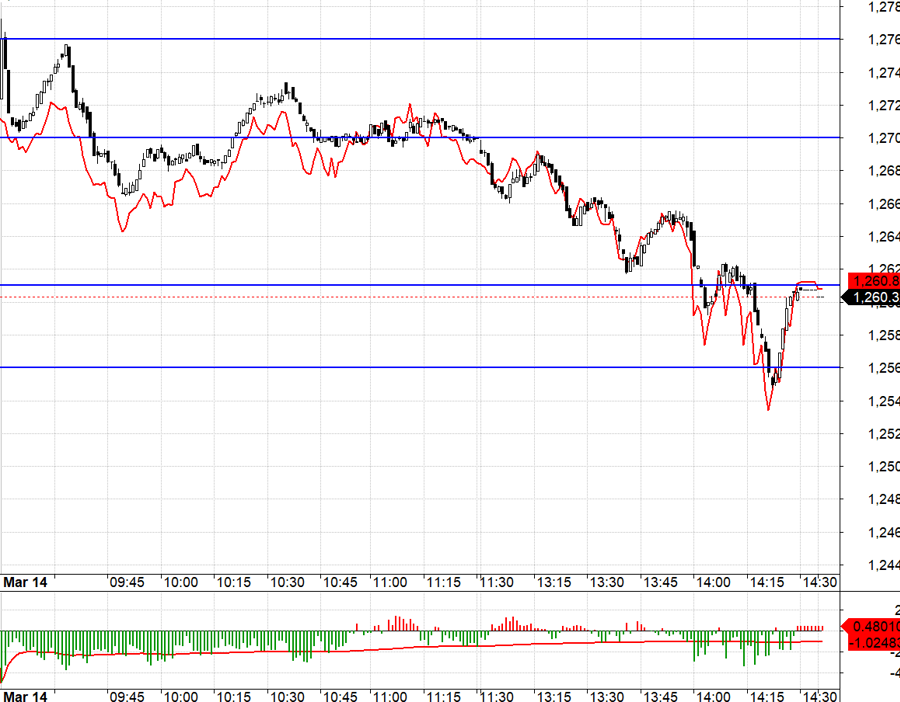

The derivative market today had a narrow range in the morning because VN30 was clearly restrained by certain pillars, only VHM, VIC, GAS stood out to provide support. In the afternoon, blue-chips fell significantly. VN30 has a range of amplitude from 1270.xx down to 1261.xx. That is the safest Short section. It can be seen that when it was nearly 1:30 p.m. and VN30 had not yet broken through 1270.xx, F1 had already turned negative in basis before.

Liquidity today returned to a high level, but stocks reversed or were heavily forced. This is a signal for T+ profit-taking after two previous sessions of good increases. Recently, the market has had a habit of trapping stocks overnight but selling off on T3. It is currently unclear whether the market has enough strength to continue rising, there are still many good stocks, but VN30 is difficult. The strategy is to look for Short opportunities.

VN30 closed today at 1260.32. The nearest resistance levels for tomorrow’s session are 1261; 1269; 1276; 1283; 1291. Support levels are 1256; 1250; 1242; 1234; 1225.

“Stock market blog” is personal and does not represent the views of VnEconomy. The opinions and evaluations are those of individual investors and VnEconomy respects the views and writing style of the author. VnEconomy and the author are not responsible for any issues arising from the published evaluations and investment perspectives.