VIX Securities JSC is the latest entity to announce a share issue to increase its shareholder capital. Accordingly, VIX Securities will pay dividends for the year 2023 in the form of shares at a rate of 10%, while also issuing bonus shares to increase shareholder equity by 10%. The total proportion of shares received by shareholders will be 20%.

ABUNDANT CAPITAL INCREASE PLAN

Prior to that, a series of securities companies announced share issuances to increase capital. According to recently released documents from the Vietcap Securities Corporation’s Annual General Meeting of Shareholders (VCI), the company plans to issue 4.4 million ESOP shares (equivalent to 1% of the charter capital) at a issuance price of VND 12,000 per share. The total proceeds from the ESOP issuance are expected to be used to supplement the company’s working capital and reduce debt.

After the ESOP issuance, the charter capital is expected to be VND 4,419 billion. The company will then proceed to issue an additional 132.57 million shares to increase its share capital from owner’s equity at a rate of 30%. After the issuance, the expected charter capital will be VND 5,744.7 billion.

The company plans to offer 143.63 million shares for sale to professional/strategic investors at a price not lower than the book value of the company as of December 31, 2023, which is VND 16,849 per share (based on the 2023 audited financial statements). Authorization is granted to the Board of Directors to decide on the above-mentioned offering price. Shares are subject to a minimum one-year restriction on transferability from the completion date of the offering.

If successful, the total outstanding shares of VCI will be 718.1 million shares, and the charter capital will be VND 7,181 billion.

Based on the book value as of December 31, 2023, the book value of the company is VND 16,849 per share, and the expected total proceeds from the private placement offering is at least VND 2,420 billion. It is expected to disburse VND 2,120 billion for margin lending activities and VND 300 billion for proprietary trading activities. The implementation period is expected to be in 2024 and the first quarter of 2025.

In 2024, VCI plans to achieve operating revenue of VND 2,511 billion and pre-tax profit of VND 700 billion. Dividends will be 5-10%.

Similarly, the Board of Directors of First Securities Corporation (VFS) has approved a plan to issue an additional 120 million shares to existing shareholders. This plan is expected to be implemented in 2024, immediately after receiving approval from the State Securities Commission (SSC).

With an expected capital of VND 1,200 billion, VFS will use VND 600 billion to supplement capital for proprietary trading activities and the remaining VND 600 billion to supplement margin lending activities. The charter capital of VFS after the issuance may increase from VND 1,200 billion to VND 2,400 billion.

FPT Securities Corporation (FPTS) also has a plan to issue shares to increase its charter capital for existing shareholders. The expected number of shares to be issued is 85.8 million shares, equivalent to over VND 858 billion based on face value. The capital will be realized from undistributed after-tax profits of the company. If successful, the charter capital of the company will increase from over VND 2,145 billion to VND 3,059 billion.

ACB Securities LLC (ACBS) has received approval from the State Securities Commission and the Ministry of Finance to increase its charter capital by an additional VND 3,000 billion, to VND 7,000 billion.

ARE THE BANK LEVERAGE RATIOS TOO HIGH?

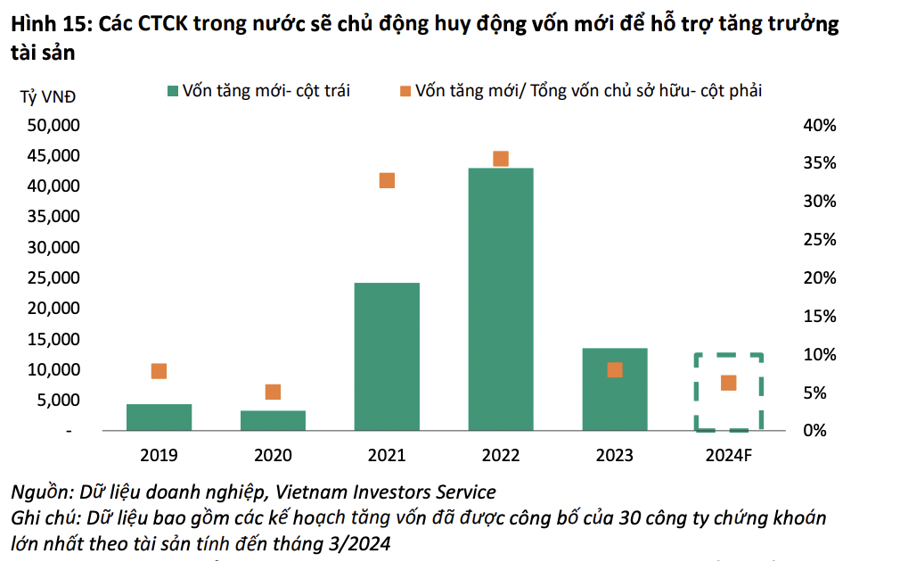

According to statistics from VisRating, the total amount of new capital raised by the 30 largest securities companies in terms of assets as of March 2024 is approximately VND 15,000 billion.

Securities companies are increasing capital issuance amid a stock market evaluated as an attractive investment channel, attracting domestic investor capital and expanding margin trading scope.

Meanwhile, the leverage ratio of large securities companies has shown signs of increase during the 2023 period. Typically, capital for lending from securities companies will be mobilized from commercial banks. When securities companies expand investment and margin lending activities, leverage ratios and dependence on short-term bank borrowing will gradually increase. Therefore, to minimize risks, securities companies have raised capital through share offerings.

The growth in brokering profit of securities companies is limited by fierce competition in fees, especially for foreign securities companies due to lower profit margins. Therefore, increasing margin lending activities is also an effective profit-generating channel for securities companies.

“The State Securities Commission has now banned securities companies from raising funds from customers, so some securities companies will need to seek funding from the market to support their business operations, especially those companies that do not have close links with banks. Securities companies distributing bonds with many buyback commitments will be more vulnerable when liquidity tightens,” VisRating commented.

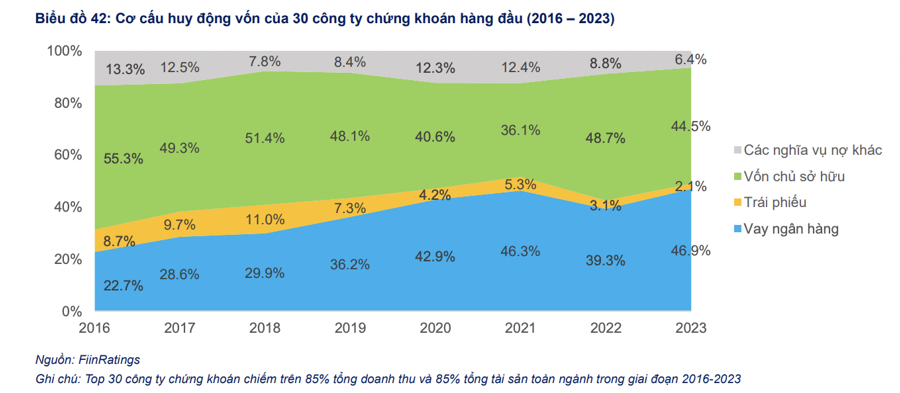

According to FiinGroup’s analysts, in terms of the capital structure of securities companies, in 2023, bank lending capital has shown an increase compared to 2021 due to the capital needs of securities companies to finance margin lending activities, which has increased after interest rate cuts.

Although this contributes to increasing the financial leverage of the industry, FiinRatings believes it will not necessarily have negative impacts on the credit quality of securities companies. On the contrary, in the context of relatively low interest rates and market expectations for economic recovery in 2024, increasing margin lending activities may have positive effects on market liquidity, which will help securities companies consolidate their revenue and profit margins.

In terms of the profit potential of securities companies, FiinRatings expects that 2024 will be a year of significant differentiation due to the differences in business models, as reflected in the revenue structure of securities companies. However, fundamentally, it will be relatively positive, with the main drivers being proprietary trading activities and margin lending activities.

From FiinRatings’ perspective, the monitoring factor for the securities industry will continue to be activities related to margin lending and the corporate bond market; these will significantly affect the liquidity position of securities companies.