All expenses with VIB credit cards can be paid in installments with an interest rate starting from 0%

Installment payment with credit cards: 0% interest rate, splitting expenses

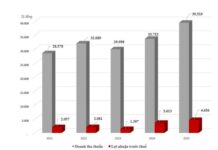

Instead of paying the full amount at the time of purchase, over 360 million consumers worldwide have chosen installment payment in 2022, according to Juniper Research[TNTT(1]. It is expected that in the following years, this payment method will reach a user base of 1 billion.

In Vietnam, the demand for installment payment is increasing. The “Installment Forms and User Trends” study by Visa revealed that 87% of the surveyed individuals have used installment payment plans, with an average of 20 installments per person per year.

Similarly, the “2022 New Payments Index” report by Mastercard also stated that 95% of Vietnamese consumers are aware of installment payment methods. The top three reasons for choosing this method are: low or 0% interest rates (57%), saving money to make purchases without waiting (55%), and the convenience of shopping at suitable times (55%).

Installment payment with credit cards is favored by many people due to the numerous benefits it brings. Users can easily split their shopping expenses into multiple installments, spreading out their expenditure over time to reduce financial pressure.

Tú Châu (32 years old, residing in Hanoi) revealed that she has the ability to buy necessary items, but never accumulates a large amount of cash to make a one-time payment. “Instead, I choose to pay in monthly installments and save the cash to invest in profitable assets such as gold and stocks. Some banks offer 0% installment interest rates, which is very convenient for cardholders like me,” shared Châu.

How to effectively use installment payments with credit cards?

There are currently two popular forms of installment payments: 0% interest rate installments and preferential interest rate installments. To optimize your shopping experience, consumers should prioritize choosing stores affiliated with their credit card provider that offer 0% interest rate programs.

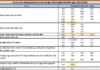

For example, with VIB credit cards, users can purchase their favorite products and pay in 0% installments with a term of up to 12 months at over 100 partner stores in various fields such as technology (FPTShop, Nguyễn Kim, CellphoneS, Daikin, Samsung…), education (ILA, British Council, Apollo English…), and healthcare (Gene Solutions, Otis Dental, Southeast Dental, Peace Dentistry, Saigon Maxillofacial Hospital, California Fitness…).

Furthermore, all educational expenses can be paid in 0% interest installments with the VIB Family Link card – a credit card designed exclusively for parents with their first child in the Vietnamese market.

For other retail stores, VIB offers competitive interest rates starting from 0.6% – 1.8% per month. This program applies to any transaction or purchase totaling 3 million VND or more with installment terms of 3, 6, 9, or 12 months. In return, the benefits of VIB’s credit cards, which are well-known for their high rewards through features such as point accumulation and cashback, will quickly compensate for the interest incurred by cardholders. VIB’s installment transactions can be combined with point accumulation, cashback, and other benefits specific to each credit card.

The most popular VIB credit cards for shopping include: Online Plus 2in1 (up to 6% cashback), Cash Back (up to 10% cashback), Super Card (up to 15% cashback), LazCard (up to 50% cashback)… Additionally, VIB cardholders can enjoy attractive rewards such as Rewards Unlimited, Family Link, or accumulate miles with Vietnam Airlines through Premier Boundless and Travel Élite.

Convenient and fast transactions anytime, anywhere

The registration process for installment payment with credit cards is simple and fast, without the need for documents or income verification. Cardholders have three options to choose from: Register directly at retail stores that accept installment payments with cards; Access the website or mobile app of an online store to choose installment payment with a credit card; Pay with a credit card first and convert it into installments later on MyVIB digital banking or through VIB’s AI Bot hotline – 18008195 (toll-free).

When registering, users should consider selecting installment terms that are suitable for their ability to make regular repayments in the future. A small tip is for cardholders to use installment payment calculation tools to determine the specific monthly payment amount. At the end of each billing cycle, the bank will also send notifications via email/sms to ensure cardholders make timely payments.

Additionally, users can set up automatic payments to avoid late payment fees on their entire credit card balance.

Open a VIB credit card, experience 0% installment payments, and enjoy countless benefits here.