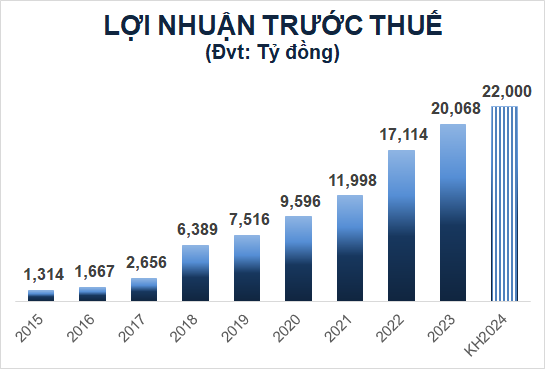

ACB’s pre-tax profit plan for 2024 is expected to reach VND 22,000 trillion, an increase of 10%.

With the expectation of the early recovery of business production in the enterprise sector and the demand for production and consumption in the household sector, ACB sets its orientation for 2024, with annual credit growth at the level assigned by the State Bank, improving the proportion of fee income on revenue, developing the customer portfolio towards enabling customers to conduct transactions in the digital environment, and increasing the number of transactions through digital channels.

ACB sets its plan for the end of 2024, with total assets reaching VND 805,050 trillion, an increase of 12% compared to the beginning of the year. Customer deposits and valuable papers reach VND 593,779 trillion, an increase of 11%; customer loans reach VND 555,866 trillion, an increase of 14%. ACB’s pre-tax profit plan for 2024 is VND 22,000 trillion, an increase of 10% compared to the result in 2023. Non-performing loan ratio is controlled below 2%.

Source: VietstockFinance

|

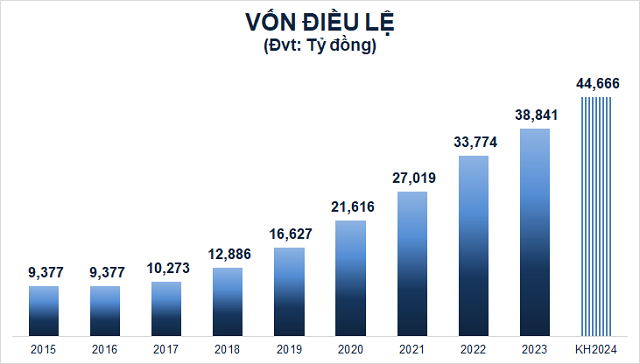

Capital increase, dividend distribution in cash and stock at a total rate of 25%

Regarding the profit distribution plan for 2023, ACB plans to distribute dividends at a total rate of 25%, of which 15% is in stock and 10% is in cash. The profit that can be used to distribute dividends in 2023 is VND 19,886 trillion. After using VND 9,710 trillion to distribute dividends in 2023, ACB’s remaining profit is VND 10,176 trillion.

Specifically, in terms of increasing charter capital through dividend distribution, ACB plans to issue more than 582.6 million shares to existing shareholders, at a rate of 15% (shareholders who own 100 shares will receive an additional 15 shares). After a successful issuance, ACB’s charter capital will increase from VND 38,840 trillion to VND 44,666 trillion.

The capital source for implementation is profit that can be used to distribute dividends after fully provisioning all funds and the remaining profit not yet distributed as of December 31, 2023, the amount of dividend in shares equivalent to VND 5,826 trillion.

Common shares issued for dividend payment to existing shareholders will be distributed according to the implementation of rights. The time for increasing charter capital is expected in the third quarter of 2024.

According to ACB, increasing charter capital is necessary to increase long-term capital sources for credit activities, investing in government bonds, adding capital to invest in infrastructure, strategic projects of the bank, and enhancing financial capacity.

The profit distribution plan for 2024 is also expected to be similar to 2023.

Source: VietstockFinance

|

The remuneration level for the Board of Directors and the Supervisory Board in 2023 is expected to be 0.6% of after-tax profit, equivalent to VND 80.99 billion. The remuneration for the Board of Directors and the Supervisory Board in 2024 is also expected to be 0.6% of after-tax profit.

ACB’s annual general meeting of shareholders in 2024 is scheduled to take place on April 4 in Ho Chi Minh City.

On the HOSE stock exchange, as of the closing session on March 14, 2024, ACB’s stock price stood at VND 27,250 per share, an increase of 14% compared to the beginning of the year. Average trading volume is nearly 12 million shares per day.

| ACB’s stock price movement from the beginning of the year until now |