In the latest announcement, Western Coach Station Company (code WCS) has postponed the deadline for the list of shareholders eligible for 2023 interim dividend payment from 15/3 to 20/3/2024, which is after 3 trading sessions. Other details remain unchanged.

Accordingly, WCS plans to pay interim dividends in cash at a rate of 144%, equivalent to 14,400 VND per share. The company will make the payment to shareholders on 28/3. With 2.5 million shares in circulation, it is estimated that Western Coach Station Company will spend 36 billion VND to pay interim dividends to shareholders.

Despite having modest charter capital of 25 billion VND, equivalent to 2.5 million shares traded on the stock market, WCS is known as “small but mighty” with annual profits of tens of billion VND, top EPS index in the market and high and regular dividend policy over the years.

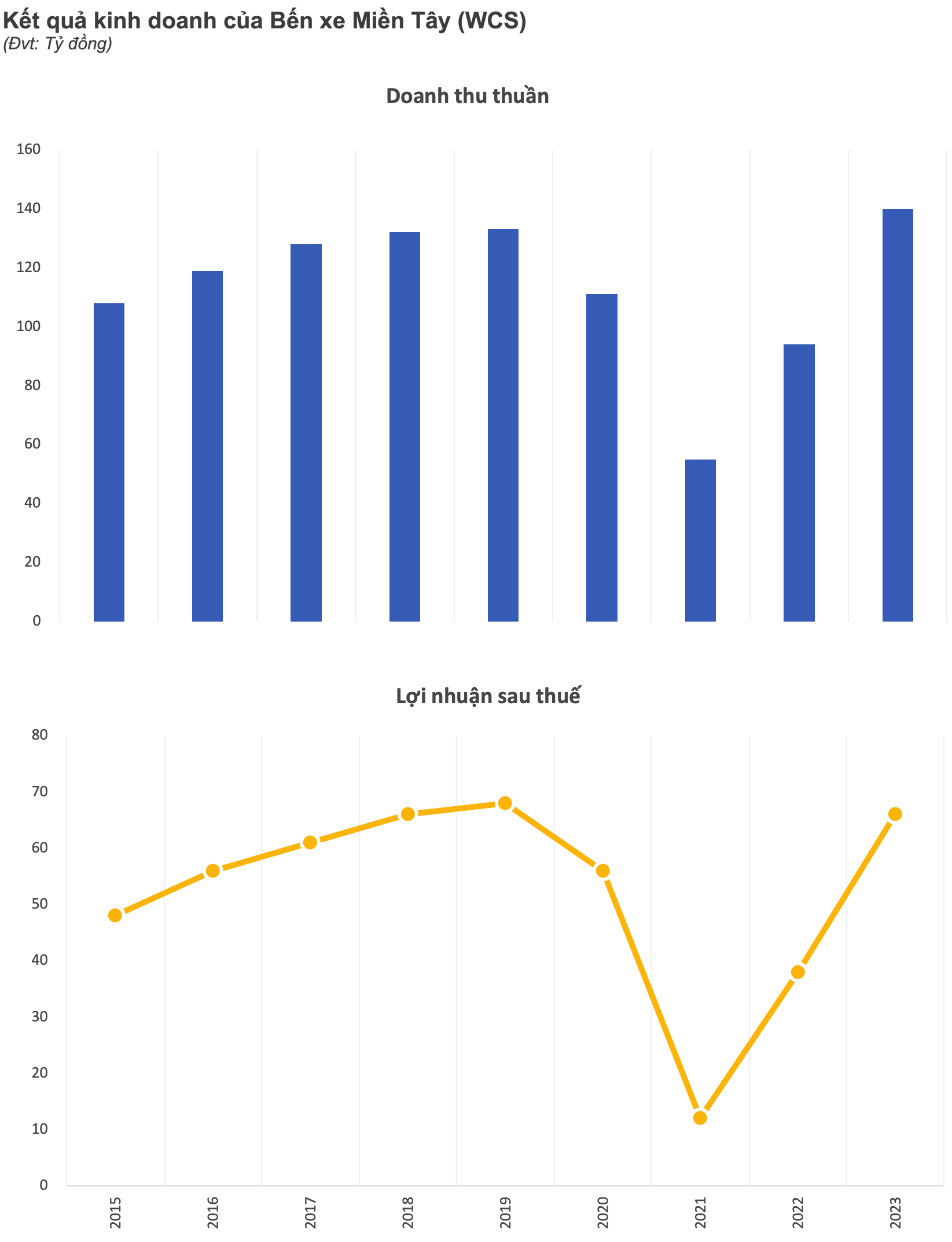

After 3 years of fluctuations due to the impact of the pandemic, in 2023, WCS’s net revenue reached a record of over 140 billion VND, an increase of 49% compared to the previous year, exceeding the revenue target by 17%. Profit after tax increased significantly by 73% to nearly 67 billion VND – the highest profit level of the company in the past 4 years and nearly 50% higher than the full-year profit plan.

The company said its revenue improved thanks to the ban on sleeper buses in the inner city area since the beginning of the year, which led transport companies to bring buses into the station. The company applies the fee for the service of taking and releasing buses into the station according to the approved schedule by the management authority.

With record profits, WCS immediately pushes ahead with dividend payment to shareholders. The dividend rate of 144% for 2023 has far exceeded the “not less than 20%” dividend plan passed at the beginning of the year. This is also the highest dividend rate of the company in the past 3 years. In the period of 2018 and 2019, the coach station company even paid an incredibly high dividend rate of 400% and 516%, respectively.

However, most of the dividend money will flow into the pockets of major shareholders as WCS’s shareholder structure is relatively concentrated. Currently, Saigon Mechanical Transport Corporation holds 51% of the capital, followed by America LLC with 23.08% of the capital and Thai Binh Investment Corporation with 10% of the capital.

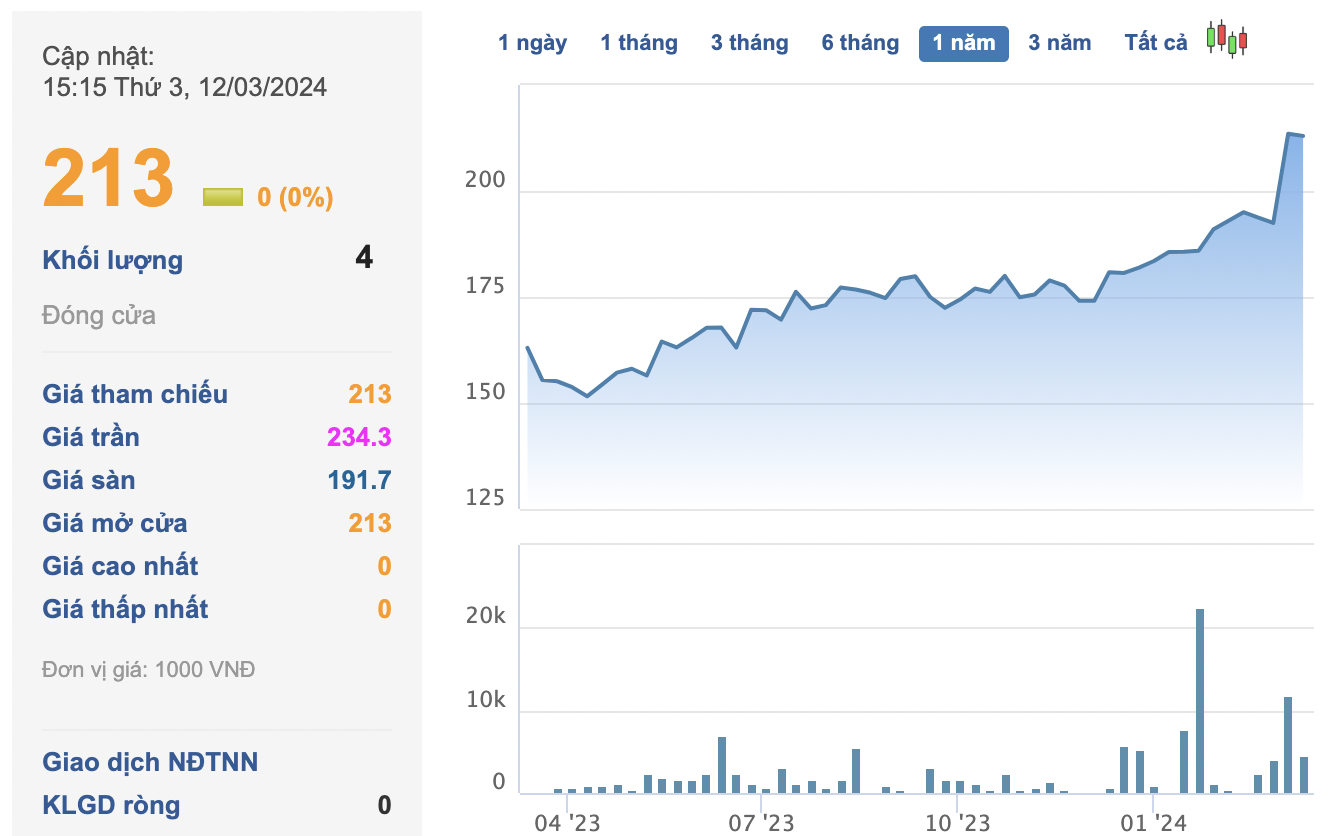

On the exchange, WCS shares have been relatively sluggish due to low floating shares. At the end of the 13/3 session, WCS’s price stood still at 213,000 VND/share, an increase of nearly 15% since the beginning of the year. With the current price, WCS has become the second most expensive stock on the HNX and HOSE exchanges.