Mr. Do Quang Vinh – Chairman of the Board of Directors of Saigon – Hanoi Securities Joint Stock Company (stock code: SHS) shared his plans for a company that is both a securities company and a listed organization.

How do you assess the stock market in 2023, prospects for 2024, and could you share some achievements of SHS in the past year?

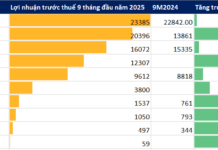

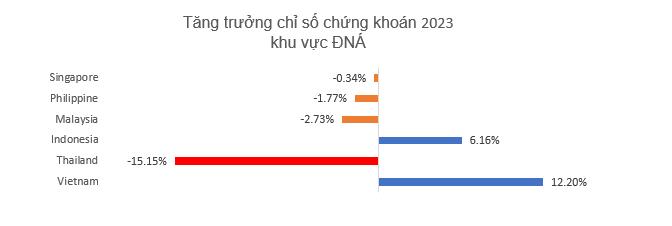

The Vietnam stock market in 2023, in my opinion, is quite positive. After a sharp decline in 2022, all key indices have shown growth, with VN-Index increasing by 12.2%, which is quite high compared to other Southeast Asian markets. This is significant considering the global uncertainties, Vietnam’s declining economic growth, and strong net foreign selling. In 2023, SHS recorded positive business results with a pre-tax profit of VND 684 billion, an increase of 247% compared to 2022, and ranked among the Top 10 securities companies with the highest profits in the market. We have also officially launched derivative securities services, providing our customers with risk hedging tools in the underlying market.

In 2024, Vietnam will continue to face challenges from external factors as the global economy is projected to “soft land,” with declining growth rates and ongoing political conflicts in some regions, increasing fragmented economic risks.

However, in my opinion, the economic outlook for Vietnam in 2024 is still positive, with higher growth rates compared to 2023, thanks to FDI inflows, relaxed fiscal policies, reduced external interest rates. These are important factors that provide a stable foundation for the stock market’s development and attract foreign capital back to emerging and frontier markets, including Vietnam.

Recently, you have registered to buy SHS shares, so what long-term development strategy does SHS have?

In the long term, specifically from now until 2030, the SHS Board of Directors aims to make SHS a flagship, early establishment of a leading financial investment conglomerate in Vietnam, in which SHS is the core. The financial conglomerate will include SHS and completely new subsidiary companies in the financial market. With the support of other specialized subsidiaries, SHS will have the momentum to soar in the securities sector. In the next 1 to 2 years, SHS has specific plans to submit to the General Meeting of Shareholders.

With a charter capital of VND 8,131 billion, assets of VND 11,457 billion, and a profit of VND 684 billion in 2023, SHS has the strength of being one of the listed securities companies with efficient capital utilization in the market. We will continue to enhance financial capacity and ensure safety measures to maximize capital utilization efficiency. Leveraging our strength in efficient capital usage, we will provide comprehensive investment advisory products and help customers optimize their asset management.

With this strategic plan, as an investor, I have also registered to invest an additional 5 million SHS shares to increase my ownership ratio. It is expected that after the successful transaction, my shareholding ratio will be 1.54% of SHS’s charter capital. This may not be a large percentage, but it reflects my trust in SHS’s development path in the future, commitment to accompany and aim for the highest benefits for shareholders.

We believe that with a passionate, dedicated, creative, and experienced team, along with a clear development strategy and financial advantages, SHS will continue to achieve success in the future and affirm its unique position.

Mr. Do Quang Vinh – Chairman of SHS Board of Directors

As the Chairman of the Board of Directors, can you tell us about SHS’s plans for 2024?

In the context of the aforementioned assessment and based on the achievements gained over the past 15 years, SHS will implement measures to strengthen internal strength, enhance competitiveness, and assert its position in 2024. SHS’s operating principle is customer-centric, dynamic innovation, and creativity in order to enhance the quality of products and services, best serve and meet all customer needs, with customer satisfaction and benefits as the driving force for all business activities of the company.

Firstly, we will innovate the organizational structure and upgrade business processes to create a more professional, systematic, and transparent organization, focusing on providing fast, efficient, and responsive services to adapt to market fluctuations. We can consider establishing a management body, from the Board of Directors, the Board of Supervisors, or the Executive Board with the participation of foreign resources, attracting a team of industry-leading experts to provide the best financial advisory products and help customers effectively manage assets. SHS plans to expand office space, create a dynamic, modern, convenient working environment, and fully tap into the creativity of employees. Although SHS’s current remuneration policy is relatively high in the labor market, we will continue to focus on attracting talents, commensurate with the scale and new development phase of SHS.

Secondly, in the era of strong digital transformation in all fields, especially in the financial and securities sectors, SHS will continue to invest in technology infrastructure and online services to optimize trading experience for customers. At the same time, SHS will focus on improving the information technology system promptly according to the guidance of state management agencies, upgrading to meet the requirements of transaction capacity, clearing and settlement, lending, etc., of FTSE Russell and MSCI.

Thirdly, we will restructure and diversify product services to meet customers’ needs with competitive costs. Ensuring that SHS always innovates and leads in the development trends of financial and securities products. For the IB sector, SHS will prioritize cooperation to enhance capital-raising capacity for large organizations and companies in key sectors of the economy. This includes not only providing investment banking services such as underwriting, consulting on equitization, divestment, public offering, stock listing, etc., but also committing to providing financial advice, investment consulting, and efficient capital mobilization strategies for clients. SHS will leverage its strong ecosystem, reputation, and relationships to become a trusted partner of large organizations and companies, accompanying them in their development and business expansion. SHS will provide comprehensive financial solutions tailored to the needs and conditions of each client, ensuring transparency, safety, and high efficiency. Improving the quality of goods in the listed market and affirming the basis of investor trust in businesses are also essential in promoting the market’s upgrading process.

Could you tell us about some of SHS’s activities in line with the Government’s direction for the stock market in recent times?

As I understand, the Government has recently issued guidelines on the Development Strategy for the stock market until 2030 in Decision No. 1726/QD-TTg dated December 29, 2023. To comply with this strategy, SHS will boost investment and issuance of Green Bonds, Social Bonds, and Sustainable Bonds… SHS commits to support businesses in mobilizing capital for projects that have positive impacts on the environment and society, as well as innovative financial solutions to support the Sustainable Development Goals, creating added value for shareholders and the investment community. Moreover, in addition to complying with domestic legal regulations, SHS will enhance cooperation with international financial organizations, adhering to the best standards, regulations, and enforcement measures of the international securities market, ensuring high transparency. From there, SHS’s credit rating will be elevated, creating more favorable conditions for regional and international negotiations and transactions. SHS will seize opportunities for cooperation, transactions, and attract FDI, stimulating indirect investment capital into the domestic stock market.

Regarding Retail Brokerage, in addition to the current product offerings to serve customers, which are highly appreciated by customers, we will bring a system of premium products to the high-end customer segment, accompanied by added values, with the main focus on optimizing financial investment efficiency. We are determined to regain a Top 10 market share in brokerage on both HSX and HNX.

Thank you!