After a strong decline, the stock market started the trading session on Monday (March 11) relatively optimistic with green dominating in many sectors. However, unwillingness to pay high prices has made the market difficult to rise strongly. The tug-of-war took place for most of the time before selling pressure increased sharply towards the end of the session.

VN-Index closed down 11.86 points (-0.95%) to 1,235.49 points with high liquidity. The matching value on HoSE reached over VND 22,500 billion. Foreign investors were quite active when they net bought VND 69 billion in the whole market, of which net buying value on HoSE amounted to nearly VND 249 billion.

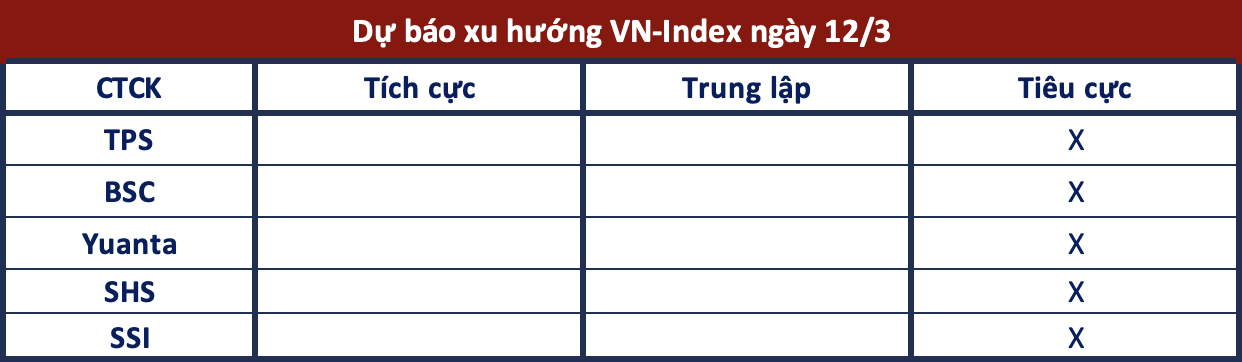

About the market outlook in the coming sessions, most securities companies have given cautious opinions:

Continued downward momentum

TPS Securities: After the correction phase in today’s session, VN-Index broke the support level at 1,240 – 1,250 points and fell to the 1,235 point area. Therefore, in tomorrow’s session, the index may continue to have downward momentum to test the 1,230 point area. Buying force is expected to increase at the low price range to balance selling pressure and VN-Index may recover around the 1,245 point area. In the negative scenario if the 1,235 point level is broken, VN-Index may retreat to the 1,220 – 1,225 point range.

Not ruling out the possibility of further weakness

BSC Securities: Caution prevailed over the market in the morning session on March 11 when VN-Index fluctuated around the reference level. Afternoon session saw selling pressure appear, causing the index to decline sharply as the market received information that NHNN issued promissory notes. The market’s decline is not significant and the index may bounce back after touching SMA20. However, BSC does not rule out the possibility of the market continuing to weaken, forming a short-term bottom range at 1,210 – 1,220 points in the coming sessions.

May continue the downward trend

Yuanta Securities: VN-Index may continue the downward trend and retest the support zone of 1,225 – 1,230 points, but the market may close higher in the next session. At the same time, the market is in a short-term accumulation phase, so Yuanta assesses that stock groups will have differentiated movements in the next trading sessions, especially Midcaps stocks.

The market’s upward momentum is weakening

SHS Securities: From a short-term perspective, the market’s upward momentum is weakening and the correction session today increases the possibility of ending the short-term uptrend of VN-Index. SHS believes that the signal VN-Index enters a clear short-term downtrend and does not highly assess the possibility of the index forming a strong uptrend although there may be recovery sessions in the near future.

The downtrend is still maintained

SSI Securities: VN-Index continued its decline after the reversal in the previous session. Technical indicators RSI and ADX are moving to adjust towards the neutral zone, indicating that the downtrend is still maintained. However, there might be a positive reaction at the short-term support zone of 1,224 – 1,225 points.