On 11th and 12th March 2024, the State Bank of Vietnam (SBV) reissued bonds after a 4-month hiatus, totaling 30,000 billion VND with a term of 28 days and an interest rate of 1.4%. The stock market plummeted upon this news, but later recovered.

Dragon Capital assessed: “This bond issuance is seen as a necessary operational move to cool down the exchange rate, rather than a change in monetary policy.”

Why did the exchange rate increase sharply?

From the beginning of the year until now, the VND exchange rate has fallen by 1.6%, which is not too bad compared to other currencies in the region such as JPY (-4.3%), THB (-3.3%), KRW (-2.2%), or TWD (-2.8%). Factors such as remittances, disbursement of FDI, and trade surplus continue to support the VND.

However, in recent weeks, the exchange rate in the black market has continuously fluctuated, reaching 25,750 VND/USD, in addition to the price of gold reaching over 82 million VND/tael and the Bitcoin cryptocurrency continuously reaching new highs.

“These factors have increased the demand for USD in the black market and created a nearly 4% difference between the exchange rate in the black market and the interbank market,” according to the billion-dollar investment fund.

In the face of this situation, the official VND exchange rate is expected to increase as money flows out, especially when import-export activities show positive signs of recovery (demand for imported goods for export). Therefore, the purpose of the bond issuance is to absorb excess liquidity and reduce short-term exchange rate speculation pressure, said Dragon Capital.

According to the investment fund, in the long term, Vietnam’s monetary policy still tends to be loose, with a priority to reduce lending rates for businesses to stimulate economic recovery. Even after the bond issuance last year, interest rates continued to decline and bank system liquidity remains abundant.

On the global market, the Fed is expected to be very close to the decision to cut interest rates in the second half of this year, and the tightening trend of Japanese monetary policy after many years can weaken the USD. This will remove pressure on the VND exchange rate and allow Vietnam to continue its loose monetary policy.

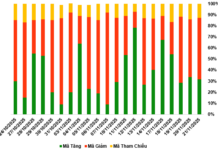

Be cautious of profit-taking pressure and defensive sentiment after rapid increases

Regarding the stock market, Dragon Capital expects the average earnings growth of the top 80 listed companies to reach 15-18% this year, and they are still being positively supported by the macro environment.

In the short term, the VN-Index may experience fluctuations due to profit-taking pressure or defensive sentiment from investors after a rapid rise since the beginning of the year.

“However, we maintain a positive outlook on the stock market in the long term,” Dragon Capital affirmed.