CTCP Thương mại Đầu tư Dầu khí Nam Sông Hậu (HOSE: PSH) has announced that the delay in payment of the 7th accrued interest to bondholders is due to the company’s inability to fully arrange the necessary funds.

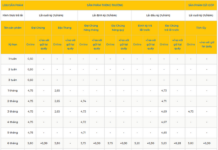

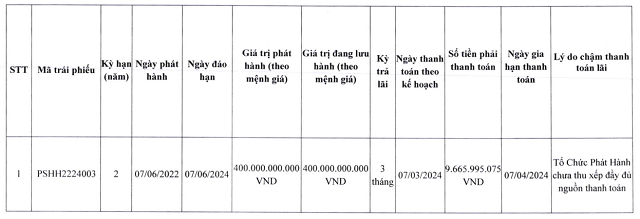

The bond series PSHH2224003, with a value of 400 billion VND at face value, was issued by PSH in June 2022 and is scheduled to mature in June this year. Bondholders receive quarterly interest payments at an annual interest rate of 10%.

PSH has announced the extension of the payment deadline for the 7th accrued interest along with the reason. Source: PSH

|

This is not the first time that PSH has delayed interest payments. According to the company’s disclosure, PSH has paid a total of 4 early interest payments to bondholders, amounting to nearly 3.7 billion VND. The 4th interest payment was delayed by 6 days compared to the original plan, also due to the incomplete arrangement of payment sources.

Similar delays were observed in the 5th and 6th interest payments. Specifically, in the 5th interest payment, the company extended the deadline to September 16, 2023, 9 days late. In the 6th payment, the full interest amount was not paid until January 29, 2024, nearly 2 months behind the original schedule.

In addition to the aforementioned bond series, PSH has 2 other bond series with a total value of 600 billion VND, including one 400 billion VND bond with the code PSHH2224002 issued in April 2022, with an interest rate of 11.5%, and it is scheduled to mature on April 4, 2024, just over 2 weeks from now.

Similarly, PSH has also been late in paying interest by 10 days in the 6th payment period in October 2023, and had to extend it twice in the 7th interest payment period, until February 29, 2024, with the same reason of incomplete arrangement of payment sources. By the end of 2023, PSH had repurchased this bond series before maturity for over 4.1 billion VND and still had 35.8 billion VND in circulation.

The remaining bond series with the code PSHH2224001 has a value of 200 billion VND, issued in March 2022, with a maturity of 2 years, and recently matured on March 1, 2024, according to the plan. The bond series was raised with an interest rate of 11% per annum and has been fully settled by PSH from March 01 to September 05, 2023.

In 2023, PSH recorded a net profit of 600 million VND, accounting for only 1% of its revenue. Despite this, the result is still positive compared to the loss of 23.6 billion VND in 2022.

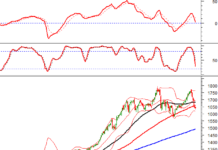

However, PSH’s cash flow was negative by nearly 2 trillion VND in the past year due to large receivables and payables, reaching the lowest level since 2017, which significantly affects the ability to pay interest to bondholders.

Recently, on February 27, PSH signed a cooperation agreement with Acuity Funding (Australia), agreeing to provide 720 million USD in credit to invest in a series of projects, while aiming to become a strategic shareholder of PSH.

| PSH’s cash flow from operating activities from 2017 |

PSH signs cooperation agreement, receives 720 million USD funding from Australian “giant”

Tử Kính