On March 12, 2024, Guotai Junan Securities (Vietnam) (stock code: IVS) held its extraordinary general meeting of shareholders for the first time in 2024, officially approving the plan to issue additional shares to the public.

Accordingly, Guotai Junan Securities (Vietnam) will offer more than 69 million shares to existing shareholders at a ratio of 1:1, meaning that every shareholder will have the right to purchase 1 additional share for each share they own. The offering price will be determined specifically by the Board of Directors based on the actual conditions when the issuance procedures are carried out.

Regarding the use of funds raised from the offering, Guotai Junan Securities (Vietnam) plans to allocate 75% of the proceeds to supplement the capital for operating lending operations; 10%-15% will be used to expand the development of derivative products, and the remaining 10%-15% will be added to the capital to support investment banking operations. By completing 100% of the plan, IVS’s charter capital will increase to nearly 1,400 billion VND.

The most recent capital increase of this securities company was in 2019 through the issuance of shares to increase the charter capital from 340 billion VND to the current 693.5 billion VND.

Guotai Junan Securities (Vietnam) is a member of Guotai Junan International Group headquartered in Hong Kong, China. The company was originally established as Vietnam Securities in 2007. In 2011, the company changed its name to Vietnam Investment Securities JSC and then officially changed its name to Guotai Junan Securities JSC (Vietnam) in 2022. Currently, Guotai Junan Securities holds nearly 51% of IVS’s capital. With strong support from the parent group, Guotai Junan Securities (Vietnam) has the ability to compete in the race to reduce margin loan interest rates, with IVS’s current margin loan interest rate at 9.9% per year.

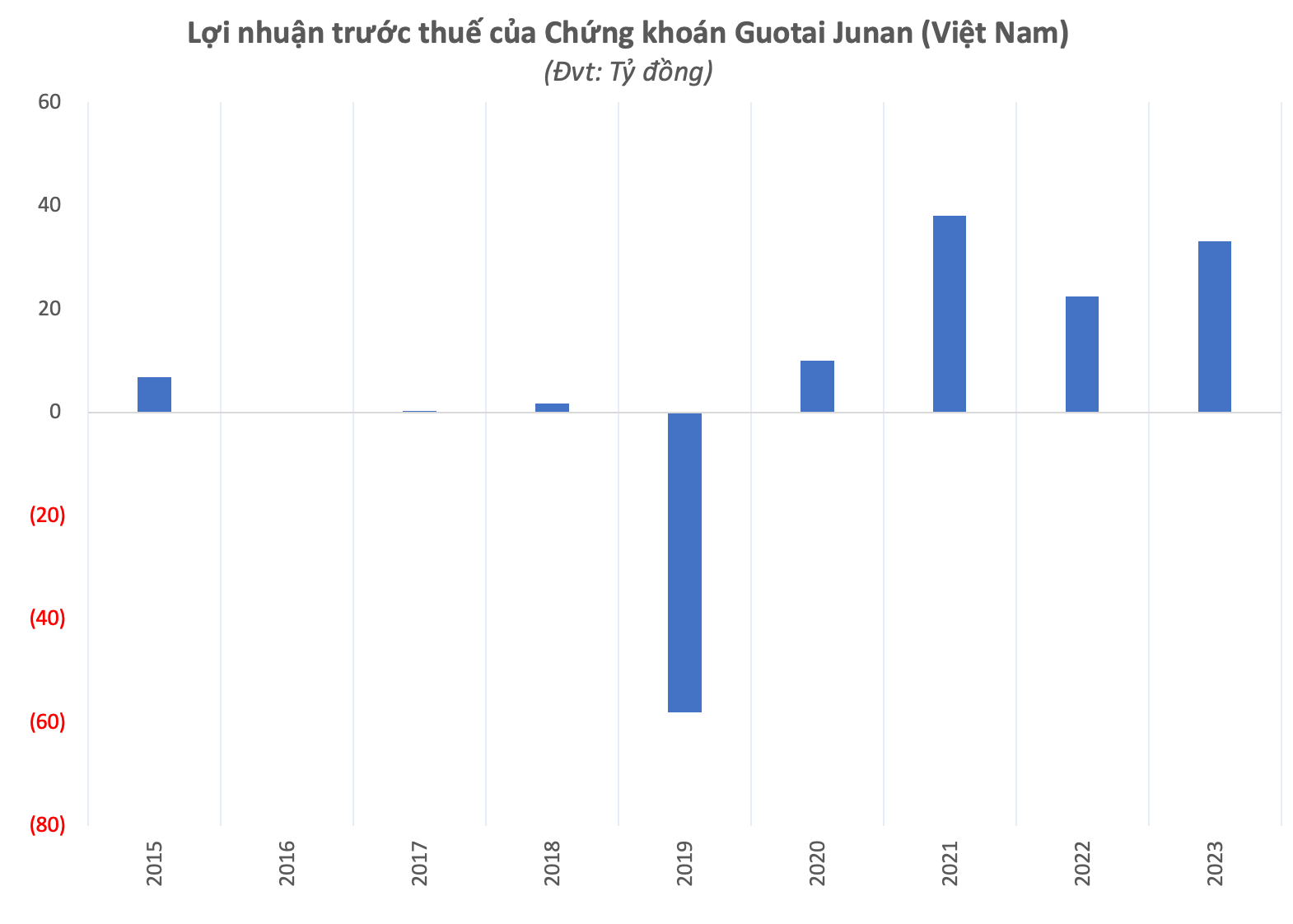

About business performance, in accumulated figures for the whole year of 2023, Guotai Junan Securities (Vietnam) recorded a revenue of 8,050 billion VND, completing 83% of the set plan. Pre-tax profit reached 3.3 billion VND, an increase of 47% compared to the previous year and exceeding the full-year plan by 28%.

As of December 31, 2023, total assets were approximately 766 billion VND, of which the value of lending and deposit claims was 336 billion VND; equity was at 755 billion VND.

IVS stock closed at 12,400 VND/share on March 12, an increase of 19% since the beginning of 2024.