On March 14, in Hanoi, Prime Minister Pham Minh Chinh will preside over a conference to implement the monetary policy tasks for 2024, focusing on resolving difficulties for production and business, promoting macroeconomic growth and stability.

The conference will be attended by leaders of ministries, sectors, and leaders of large businesses to openly exchange and discuss solutions to remove obstacles for production, business, and contribute to economic growth.

The headquarters of the State Bank of Vietnam in Hanoi

|

Multiple challenges

Leading up to the conference, the monetary policy body, the State Bank of Vietnam (SBV), shared information about its flexible credit management activities aimed at resolving difficulties for production and business, and promoting economic growth.

The SBV representative stated that in 2024, the global economic outlook is expected to continue to be complex, with economic growth projected to remain low, inflation showing signs of slowing down but still high, and many central banks beginning to consider interest rate cuts. However, there are increasing risks of financial instability, high exchange rate pressures, and unpredictable fluctuations in global commodity prices.

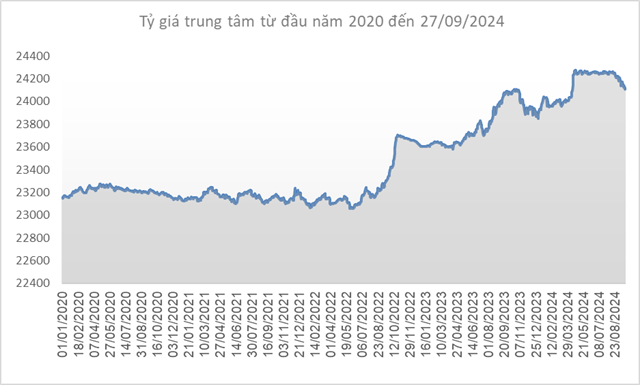

Domestically, the economy is showing signs of recovery but still faces challenges. In this context, closely following the resolutions and directives of the Government, the Prime Minister, the SBV has resolutely implemented key measures and tasks. Specifically, flexibly managing monetary policy tools to ensure abundant liquidity for the credit system of financial organizations to meet the credit needs of the economy; rational management of interest rates and exchange rates in line with market conditions, macroeconomic developments, and monetary policy goals.

The SBV maintains its current interest rate levels, flexibly manages exchange rates to absorb shocks, and limits large short-term exchange rate fluctuations. It instructs financial organizations to reduce costs, simplify lending procedures, and continue to strive to lower lending interest rates. It requires financial organizations to report and publicly disclose lending interest rates; many financial organizations have already publicly disclosed lending rates on their official websites.

The average lending interest rate has decreased by more than 2.5% in 2023 and continues to decrease in the first month of 2024. Currently, the average deposit and lending interest rates for new transactions have decreased by about 0.2% per year and 0.7% per year compared to the end of 2023. The foreign exchange market operates smoothly, and legal foreign exchange demands are fully and timely met.

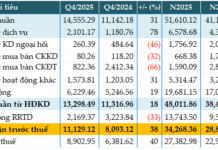

Based on the economic growth and inflation targets set by the National Assembly and the government, the SBV aims for a credit growth rate of about 15% for the entire system in 2024, adjusted to be in line with developments, actual situations, and by December 31, 2023, the SBV has allocated all credit growth targets for 2024 to the financial organizations and publicly announced principles for determining credit growth, allowing financial organizations to proactively implement credit growth.

The SBV continues to actively implement credit programs and policies for priority areas, growth drivers, and essential sectors of the economy, such as the VND 120 trillion housing loans. (USD 5.2 billion) for social housing, worker housing, and the renovation and reconstruction of apartment buildings; expanding the scale/registration of participation in the VND 15 trillion (USD 647 million) credit program to become the VND 30 trillion (USD 1.3 billion) package for the forestry and fisheries sectors; continuing to implement policies to restructure debt repayment terms and maintain the debt category according to Circular No. 02/2023/TT-NHNN…

In addition, the SBV urgently coordinates with relevant ministries and agencies to review and amend existing documents on credit activities to comply with the Law on Financial Institutions in 2024, thereby improving the ability to access bank credit.

By the end of 2023, credit to the economy had increased by 13.78% compared to the end of 2022. However, as of February 29, 2024, due to the seasonal factor of the Lunar New Year and the relatively low capital absorption capacity of the economy, credit to the economy decreased by 0.72% compared to the end of 2023. However, the rate of decline in February slowed down (-0.05%) compared to January (-0.6%). Credit was concentrated in the production and business sectors, prioritized sectors, and controlled credit in potentially risky sectors.

Based on the economic growth and inflation targets set by the National Assembly and the government, the SBV aims for a credit growth rate of about 15% for the entire system in 2024, adjusted to be in line with developments, actual situations, and by December 31, 2023, the SBV has allocated all credit growth targets for 2024 to the financial organizations and publicly announced principles for determining credit growth, allowing financial organizations to proactively implement credit growth.

The SBV has issued guidelines and organized online conferences for the entire banking sector to promote bank credit to support businesses and stimulate economic growth in 2024. It directs financial organizations to continue to implement resolute solutions to increase credit growth from the beginning of the year, remove difficulties for businesses and people, and thereby support economic growth.

Urgently removing obstacles, improving coordination between banks and businesses

The SBV representative affirmed that with the abundant liquidity of the financial system as its deposit balance is larger than its credit balance, and there is still plenty of room for credit growth, the current favorable conditions allow financial organizations to supply capital for the economy.

However, the representative of the SBV noted that credit growth in the first two months of the year is still not high due to both objective and subjective reasons.

The representative of the SBV stated that in recent times, the banking industry has been making efforts to implement many solutions to resolve difficulties for production and business. However, the key issue at present is to promote credit demand from the economy amidst the global economic downturn.

Therefore, in addition to the solutions from the banking industry, there is a need for coordinated efforts from other policies to remove difficulties for production and business in accordance with the resolutions and directives of the National Assembly, the Government, such as increasing the effectiveness of the Credit Guarantee Fund for Small and Medium-sized Enterprises, the Development Fund for Small and Medium-sized Enterprises; businesses actively implementing measures to restructure operations, improve management and financial capacities to provide a basis for financial organizations to assess and make lending decisions and increase access to capital from other fundraising channels (such as issuing shares, bonds, etc.)

In the coming time, the SBV will continue to proactively manage credit growth to contribute to controlling inflation, supporting economic growth, directing financial organizations to ensure safe and effective credit growth that is in line with targets, meets the timely capital needs of the economy, and focuses on credit in the production and business sectors, prioritized sectors, and growth drivers.

Continue to review and simplify loan procedures and documents, apply flexible collateral forms, and comply with the regulations of the law to create favorable conditions for customers to borrow capital. At the same time, continue to vigorously implement credit programs and policies in accordance with the directions of the Government, the Prime Minister, and closely coordinate with ministries to promptly remove obstacles in the implementation process.