Originating from a company producing and trading veterinary drugs, chemicals, animal feed, and pharmaceutical ingredients in the early 1990s, in 2007, when Vietnam officially joined the WTO, welcoming a wave of large-scale investment, a large surplus capital shifted from the stock market to the real estate market. This was also the time when Thanh Nhon Trading Co., Ltd. transformed into Novaland Group, expanding into real estate business. Since then, the ups and downs of the real estate market have also been the ups and downs of this leading giant in the Southern region.

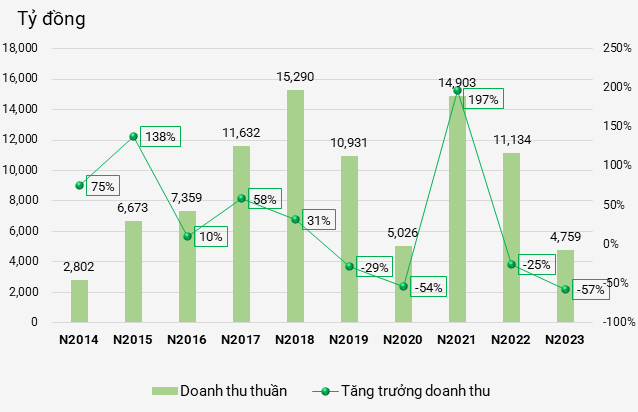

Examining the past 10 years from 2014 to 2023, the business activities of NVL have occurred in two cycles parallel to the real estate market: Prosperity and Loss.

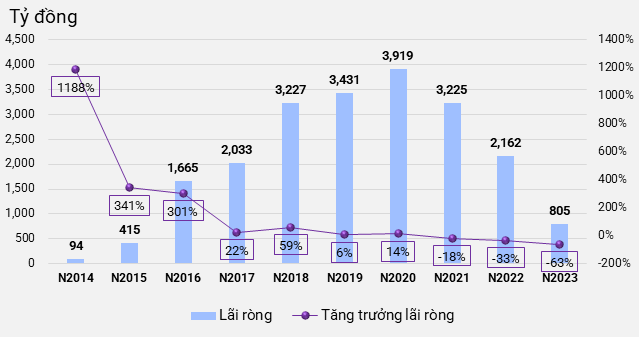

The business indicators in terms of revenue and profit of NVL have grown by 2, and even 3 digits every year in the period from 2014 to 2020, before plummeting rapidly. The years 2018 – 2020 were the peak period of NVL. This was also the time when the real estate market was overheated everywhere. NVL’s revenue exceeded 15 trillion VND, and net profit remained above 3 trillion VND every year.

|

Revenue and 10-year revenue growth of NVL

Source: VietstockFinance

|

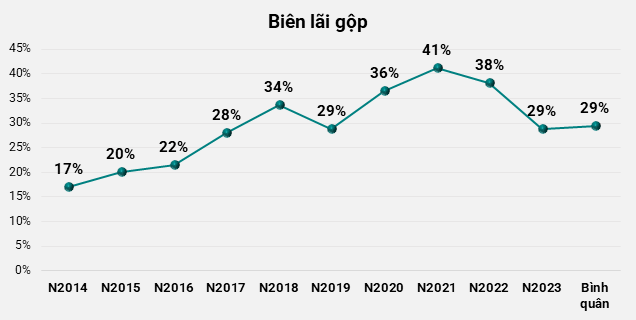

Accompanying the double-digit profit growth rate, the average gross profit margin over 10 years is 29% per year – a “dreamy” figure for many businesses.

|

10-year gross profit margin of NVL

Source: VietstockFinance

|

|

Net profit and 10-year net profit growth of NVL

Source: VietstockFinance

|

However, in the period of 2021 – 2023, the business activities of NVL plummeted uncontrollably due to the unforeseen impact of the corporate bond fever.

Quagmire of bonds

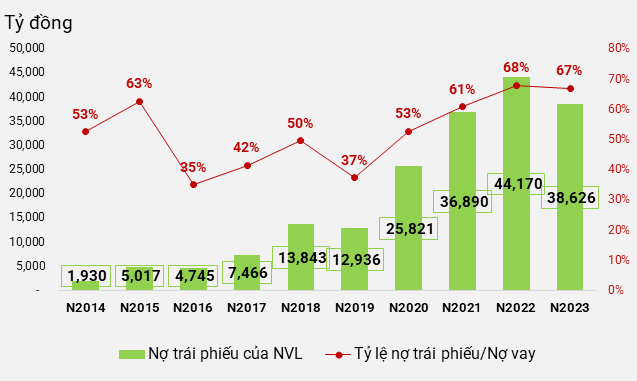

Along with the rapid growth in recent years, NVL is the listed company that actively issues bonds on the market. For many consecutive years, NVL’s bond debt in the following year has more than doubled the previous year. Bond debt as a percentage of NVL’s total borrowings over the past 10 years averages 53%, meaning that more than half of the borrowings come from bonds. Moreover, the public bondholders of NVL are all credit and financial institutions.

An NVL project – Photo: TM

|

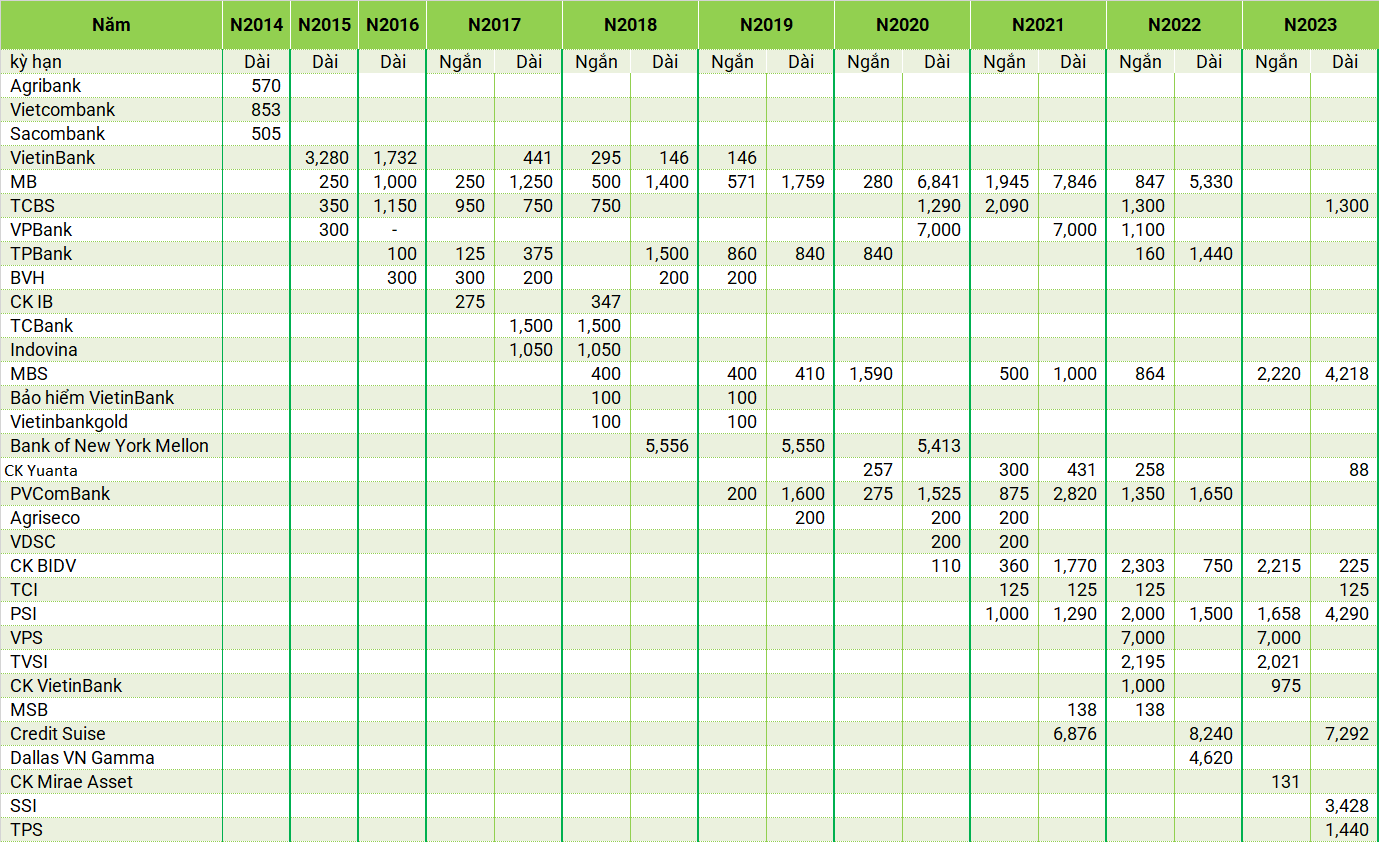

According to statistics from VietstockFinance, in 2014 alone, NVL did not have any short-term bond debt, all were long-term bonds held by two state-owned banks including Agribank, Vietcombank and private bank Sacombank. Since then, these banks no longer appear in NVL’s bondholder list.

In the period from 2014 to 2017, NVL’s bond debt remained below 10 trillion VND. By 2018, during the real estate fever, bond debt started to soar to nearly 13.8 trillion VND, nearly double the previous year. The period from 2019 to 2022 witnessed the explosion of NVL’s bonds, with continuous increase in issuance volume every year. This was also the period when the financial market witnessed a strong flow of capital into the bond channel, especially individual corporate bonds, due to attractive interest rates and lenient issuance conditions.

In 2022, NVL’s bonds exceeded 44 trillion VND, accounting for 68% of the company’s total borrowings. The company’s debt repayment for this year reached nearly 213 trillion VND (accounting for nearly 83% of total capital) – a figure that startled many people.

|

NVL’s bond debt over the past 10 years

Source: VietstockFinance

|

|

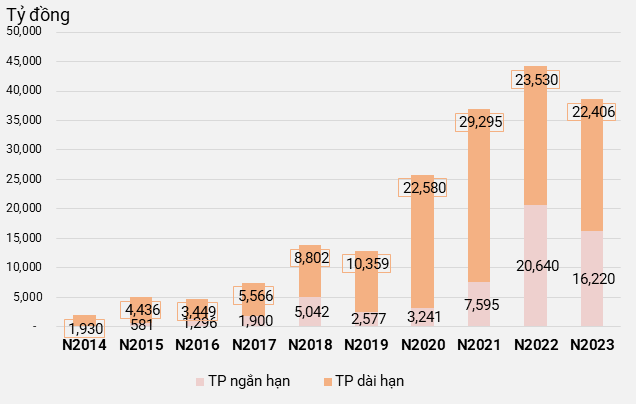

NVL’s short-term and long-term bonds over the past 10 years

Source: VietstockFinance

|

After the bond boom in 2022, the incidents related to TCM and VTP have caused turmoil in both the real estate and bond markets. Moreover, the global economic crisis after the COVID-19 pandemic has affected the domestic economy. NVL is perhaps one of the giants hit hardest by the severe crisis of confidence.

The list of public bondholders in recent years includes over 30 financial institutions inside and outside the country. Among them, private banks hold the most bonds.

NVL’s bondholders over the past 10 years

Source: Compilation. 2023: Financial statements marked as consulting firms/issuing agents

|

In the “thousand-hair” situation, this company constantly sought help from local authorities to the central government, the Government to expedite legal procedures, quickly turn around capital flow to pay off debts. The market was buzzing every day with news that NVL had no money, NVL’s money was frozen by the bank, no matter how much money returned, it was sealed to pay off debts…

During this crisis, NVL held numerous conferences with dozens of subsidiaries, affiliated companies with bondholders to find solutions such as debt rescheduling, debt extension, debt-to-equity conversion, even selling assets, replacing real estate products with bonds…

“It’s extremely difficult”, Chairman Bui Thanh Nhon, in the 2023 annual shareholders’ meeting, had to apologize to investors, partners, contractors, suppliers, laid-off employees… and all stakeholders who were affected by the Group’s incident.

Nhon admitted that in the crisis, with no working capital, no capital and tight bank financing: “We accept all losses”.

Thu Minh